Eye on electricity

Security of supply while two thermal generators are on outage

- Generation

The ability of electricity supply to meet demand over time is referred to as 'security of supply'. It's about the availability of enough generation capacity each day to meet peak electricity demand and enough fuel to generate electricity over the longer term. These are referred to as ‘capacity’ security of supply and ‘energy’ security of supply.

This article looks at how the electricity industry can provide appropriate generation capability to maintain normal supply to consumers when there are unplanned generation outages.

Capacity concerns are higher in colder months

In New Zealand the demand for electricity is lower during spring and summer than during winter – both in terms of how much total energy is used and how high peak demand gets. The demand for electricity is highest during cold winter spells, usually in the evenings when people are returning home from work, turning on heating and preparing dinner.

In summer, the evening electricity peak tends to be lower and spread over a longer period of time. People don’t need to heat their homes, tend to spend more time outside, have gas barbeques and later dinners. National demand is lowest during the last week of December and first week of January when many people go on holiday and businesses shut down for the Christmas break.

Electricity demand can increase in summer from:

- low rainfall – irrigation increases, which uses more electricity, especially in the eastern parts of New Zealand

- high temperatures – air conditioning demand increases.

Peak summer demand is more than 10% lower than peak winter demand. This means that Aotearoa is less likely to run into capacity issues over the summer months.

Capacity is reduced until February 2024 due to two outages

This year two important thermal generation units shut down due to faults. Genesis Energy’s Huntly unit 5 tripped on 30 June 2023 when one of its circuit breakers failed. This unit is on outage while a new circuit breaker is manufactured overseas.

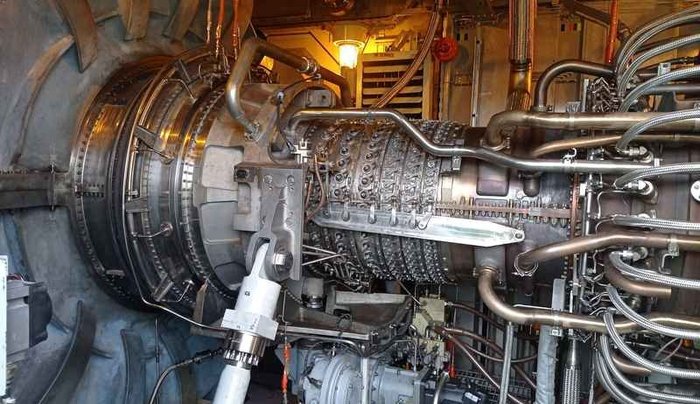

Huntly unit 5 is a combined cycle gas turbine with a capacity of 403MW, making it the largest thermal unit in New Zealand. It is large enough to supply around 400,000 households. Genesis has advised it will not be fixed until the end of January 2024.

One of two Stratford gas peakers also stopped working earlier this month. A blade in the engine came loose, causing major damage to the engine. This thermal generator has a capacity of 100MW and can be started quickly, so it can be used to meet peak demand. Contact Energy has advised it will not be fixed until February or March 2025.

With two thermal generation units on outage, this means 500MW less capacity until February 2024. This is a large proportion (21%) of the total thermal generation available in New Zealand. However, the security of supply risks are low, because demand is falling as we move into spring and summer with the warmer weather.

The availability of slow start thermal generators helps if hydro lakes are low

NIWA is predicting normal to above normal rainfall over summer in the west and south of New Zealand where some hydro catchments are located.

Hydro storage has been high this winter, but has declined since June and national storage is below average for this time of year. The expected rainfall over summer would reduce the likelihood of an energy shortage during 2024. But high amounts of hydro generation could reduce the amount of slow start thermal generation available to start up quickly. This is because – when hydro storage is high – slow start thermal generators are not needed as often to meet demand. This makes it inefficient for them to remain available in case they are needed. This could increase reliance on the remaining thermal peakers if there is suddenly low wind generation or high demand.

If hydro storage gets low, this means hydro generators have less fuel available to use, and they need to start conserving water instead of generating. If there are inflows similar to years that have had very strong El Nino patterns – that is, low inflows over spring – reliance on thermal fuels would increase. Slow start generators, such as Huntly 1, 2 and 4 and TCC, would be more likely to run and reduce the likelihood of capacity issues.

New generation stations will add extra energy but not help so much with capacity concerns

Contact Energy is building a new geothermal station called Tauhara. Once completed later this year, it will have a capacity of 174MW. Geothermal units generate electricity continuously, so Tauhara will help with both energy and capacity security of supply concerns. Tauhara can’t be flexible, like the Stratford peaker, and turn on when wind gets low. But it will make up for a proportion of baseload usually provided by Huntly unit 5 whilst it is on outage.

Mercury’s new Kaiwera Downs Wind Farm is also beginning to generate electricity, and should be up to full output in October 2023 with a capacity of 43MW. Lodestone Energy is also building a new solar farm which is due for completion by the end of this year. This will supply 39MW at peak output. While these new intermittent renewable generation sources will help with energy security of supply, they can’t help to meet high demand if the wind is low or the sun isn’t shining.

We’re working to help security of supply

This year, the Electricity Authority worked on driving efficient solutions to promote consumer interests through winter 2023. We implemented the following four changes to improve information provision to participants and resource co-ordination in the wholesale market to better manage peak winter demand.

1. Better information on the headroom of supply over demand

We worked with the system operator to get the amount of forecasted “residual” generation published on the wholesale information and trading system (WITS) website. This shows the forecast amount of supply that is left after demand has been met. By publishing this information, participants are able to monitor for potential tight situations coming up, and change their consumption and generation decisions in a more coordinated manner.

2. Provision of forecast spot prices under different demand scenarios

We asked the system operator to publish forecast spot prices under different demand scenarios on WITS, so that participants can better assess the impact of demand uncertainty. For example, if forecast prices jump significantly under the higher demand scenario, it indicates that supply may be tight. Participants can mitigate their price exposure to such events by changing their generation offers or managing their flexible demand side resources.

3. Publication of an aggregate wind generation forecast and wind generation offers

The system operator uses a commercial wind generation forecast in its internal security assessment processes. We worked with the system operator to publicise wind generation forecasts when a tight supply situation is forecast.

This forecast allows participants to see whether wind generation offers submitted at the time are close to the wind forecast. It helps wind generators to review their offers and ensure they are the best estimate of their potential generation.

The confidence limits of wind forecasts are also published. This allows participants to see when there may be periods of high uncertainty in wind generation so they can plan their consumption and generation accordingly.

4. Clarification of the availability and use of discretionary demand

We made it mandatory for distributors to disclose how much discretionary demand they had available during a tight supply situation (when residuals get below 200MW). This means that both the system operator and participants have visibility of available resources and can better assess the need for action.

Previously, during a tight situation, the system operator could request distributors to reduce demand on their networks. For example, by switching off ripple-control hot water systems. The system operator only had an estimate of the quantity of load available to be reduced if it requested this information from distributors. This information was not included in any market forecasts, so participants could not gauge the impact on system security or market prices. This led to inaction by some as they were unsure if their actions were needed and they did not want to bear the cost of unnecessary commitment decisions.

We also worked with the system operator to release the final real-time pricing changes – the implementation of dispatch notification and enhancements to dispatchable demand. The dispatch notification product is intended to enable distributed energy resources1 and demand response to signal at what price they would reduce their demand. These bids and offers are then included in the price discovery process and will potentially displace more expensive generation.

Following a trial with solarZero, the Authority decided to further enhance dispatch notification by allowing smaller groups of resources to be aggregated. This should reduce barriers to entry as it is cheaper to submit a single bid for grouped resources.

What we’re doing next

The Authority is reviewing the above four solutions we’ve implemented to better manage peak winter electricity demand to identify and implement improvements.

We are also reviewing the need for a standby ancillary service to support the reliable operation of the electricity market. We will explore current market incentives for demand side flexibility and options for an interim ancillary service.

In addition, we are working on improving the accuracy and frequency of intermittent generation forecasts in the spot market. We are considering submissions received on our proposed options and will decide which option to progress by winter 2024.

1. For example, small-scale generation and flexible load, such as EV chargers, solar and battery installations or commercial buildings.

Related News

Unlocking the potential for batteries to contribute to security of supply

As New Zealand electrifies, more grid-scale batteries will maximise the benefits of renewable energy and provide extra resilience during times of tight electri…

The levelised cost of electricity

In New Zealand, more electricity generation is needed to meet future electricity demand and replace retiring thermal power plants. The initial build costs of n…

Uplift in new renewable electricity generation projects

A report commissioned by the Electricity Authority Te Mana Hiko shows the amount of new renewable electricity generation that has been committed has almost dou…