Eye on electricity

Trading and open interest update

- Distribution

- Wholesale

As part of its monitoring activity and policy development process, the Authority periodically reviews the effectiveness of its policy interventions.

In early 2020, the Authority increased the volume of contracts market made and reduced the spread between market makers bids and offers. In the following two years, the electricity futures market has seen an increase in the level of trading activity and open interest. This indicates that the changes made in the long-term interest of consumers has been effective.

Electricity is bought and sold on the wholesale electricity market and one component of the market is the electricity futures market. The futures market, which is traded on the Australian Securities Exchange (ASX) platform, is one way that electricity market participants can insure against spot price volatility. Participants buy and sell financial instruments whose prices are based on expectations about the spot market and its underlying conditions.

Since New Zealand electricity futures were first listed on the ASX in 2009 the Authority has consistently worked to encourage the development of exchange-traded products. Recently, the Authority undertook a number of actions to enhance the development of the futures market, with specific attention given to market making on the ASX platform. Early in 2020, the Authority introduced an urgent Code amendment to place a mandatory backstop to the then voluntary market making activities by four integrated generator retailers, with enhanced levels of service by market makers (tighter spreads between bids and offers as well as increases in available volumes). This mandatory backstop was made permanent in April 2021.

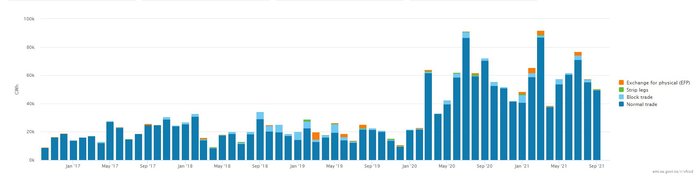

Trading activity in ASX futures products has, over the past two years, increased significantly. Trading in the period of late 2016 to 2019 was often in the range of 2,000 GWh per month. Now, in 2020 and 2021, futures trading has increased to a range between 4,000 GWh to over 8,000 GWh per month. For context, this is about twice as much electricity as is actually consumed each month in New Zealand.

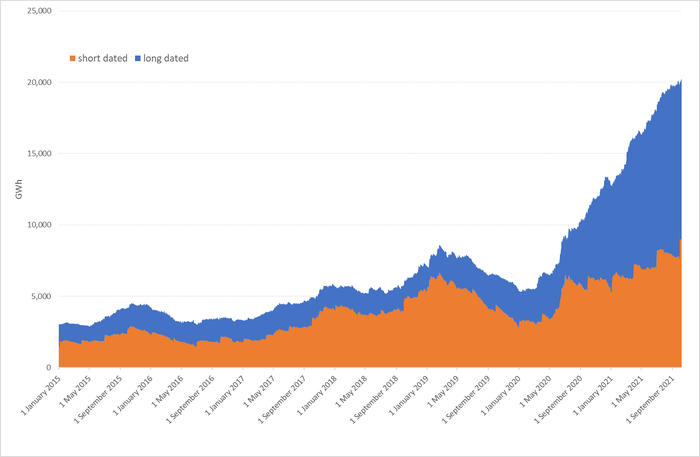

Associated with the increase in trading volumes is an increase in the open interest. Open interest is the total volume of contracts that can earn or owe money on the exchange at a given point in time. Some participants may buy and then sell contracts that cancel each other out, however these do not count towards the open interest measure. Over the same time period, October 2016 to September 2021, open interest has increased nearly 470 percent from 3,472 GWh to 19,809 GWh. For comparison, during the twelve months to September 2021, 39,894 GWh of electricity was used in New Zealand.

Most of the growth in open interest has been in the past two years, since the changes in service level by the market makers.

Growth in open interest has been predominately seen in long dated contracts (those with greater than twelve months until the contract is settled). Since January 2020, long dated future contracts open interest has grown from about 2,000 GWh to over 11,000 GWh. The growth in long dated contract open interest may indicate participants increased confidence in using ASX futures products to manage price risk further out in the future.

Generally, more volume, both through increased trading and increased open interest in the hedge market creates more opportunities for generators, retailers, and large consumers to effectively manage spot price risk. This reduces price shocks for all parties, including household consumers who benefit from retailers’ access to efficient risk management products.

The Authority continues to work on enhancing the futures market and in 2022 the Authority intends to appoint a commercial market maker as part of the enduring design for market making. The Authority will continue to monitor market outcomes in the ASX futures market to ensure the futures market is acting in the long-term benefit of consumers.

Related News

Strengthening the wholesale market: quarterly update

The Electricity Authority has published its first quarterly report on its delivery of recommendations to support resilient, affordable electricity for the futu…

Members of the Distribution Connection Pricing Technical Group appointed

The Electricity Authority Te Mana Hiko is pleased to announce the appointment of 11 members to its new Distribution Connection Pricing Technical Group. This gr…

UTS cross-submissions published

Submissions and cross-submissions on the Electricity Authority's preliminary decision on whether an undesirable trading situation occurred following 16 Febru…