Eye on electricity

Electricity price volatility

An emerging feature in an increasingly renewable market

- Consumers

- Generation

- Retail

- Prices

What is spot pricing?

Electricity in New Zealand is sold in a wholesale market via auctions every 30 minutes. These 30-minute intervals are called ‘trading periods’. Generators (who produce electricity) offer a particular amount of electricity at a certain price to retailers (who purchase electricity on behalf of their customers).

The System Operator (Transpower) controls each auction and accepts all offers that combine to meet the expected demand. The cost of the final offer accepted sets the ‘spot price’. Every offer accepted is then paid the ‘spot price’ for their electricity.

What is spot price volatility?

Electricity spot prices change depending on the underlying market conditions. During times of high hydro and wind electricity generation and/or when demand is low, spot prices can fall as low as $0.01/MWh. If demand increases and/or intermittent generation from wind farms drops off, spot prices can suddenly spike. This rapid fluctuation is called ‘price volatility’.

What happened to spot electricity prices in September?

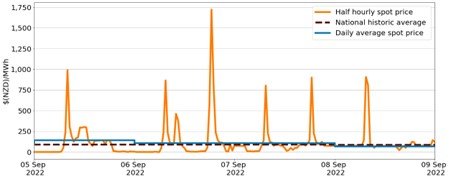

At the start of September spot prices were volatile. High amounts of hydro generation, combined with high wind and low demand meant that spot prices, at times, were as low as $0.02/MWh. This is shown in Figure 1 as the relatively flat half hourly spot price (orange line). A cold snap affected New Zealand between Monday 5 and Thursday 8 September 2022. The lower temperatures pushed up electricity demand as people used more electricity to keep warm.

Between the morning of Monday 5 September and the morning of Thursday 8 September, nationally averaged half hourly spot prices spiked at over $800/MWh. The highest spot price was over $1,600/MWh on Tuesday at 6:30pm, as shown in Figure 1.

What causes spot price volatility?

The offer curve shows all the electricity offers for a particular trading period. An offer curve is shown in Figure 2. The x-axis is the megawatt (MW) amount of electricity in each offer, while the y-axis is the cost of that electricity in $/MWh. Cheap electricity sits close to the $0/MWh, see the blue circle in Figure 2, while more expensive electricity sits further up, see the red circle in Figure 2. The steepness of the offer curve affects price volatility.

Currently the offer curve is steep. New Zealand has a large pool of renewable electricity generation which hovers around the bottom of the offer curve. When demand is relatively low, this generation can be dispatched to meet forecast demand. This leads to low prices, as one doesn’t need to ‘climb the offer curve’ to meet demand. More expensive thermal electricity generation sits further up the curve. When demand increases, and or intermittent generation decreases, the System Operator must start dispatching offers higher up the curve.

Figure 2 shows the offer curve for 6:30 pm on Tuesday 6 September 2022 when electricity demand was high. The dotted horizontal line in Figure 2 shows the spot price for that trading period, which was over $1600/MWh. This line is where electricity offers added up to expected demand.

A steep offer curve means that small changes in electricity demand or renewable generation can cause large swings in the spot prices, as more expensive thermal generators, which are further up the offer curve, set the ‘spot price’.

In the aggregate, however, the price swings seen at the start of September average out to roughly the same daily average as seen historically. See Figure 1, the black dashed (inflation adjusted historical average) and blue line (daily average spot price for 5-9 September 2022).

Increased price volatility is expected as the electricity grid becomes more renewable

Wholesale electricity price volatility is expected to become more common as New Zealand builds more intermittent electricity generation. Periods with abundant water, wind and sunshine will see extended periods of low electricity prices. Then when renewable sources of electricity aren’t enough, thermal sources will cover the difference, causing spot prices to spike.

Households and small businesses are protected from price volatility by paying a fixed cost for electricity. In an intermittent and sustainable future, it will be increasingly important for electricity industry participants to ‘hedge’ themselves against price volatility.

Related News

Centralised wind and solar forecaster contract awarded

The Electricity Authority has awarded a contract to provide centralised wind and solar forecasting services to DNV Services.

First compliance reports for retailers under Consumer Care Obligations due 30 September

The Electricity Authority is notifying electricity retailers that their 2024/25 compliance reports for the Consumer Care Obligations are now available to compl…

Electricity Authority appoints Daylight to deliver new comparison and switching service

The Electricity Authority has appointed innovative technology and creative studio Daylight to develop a new energy comparison and switching service.