Eye on electricity

High hydro levels and wholesale prices

- Generation

- Wholesale

New Zealand produces over half of its electricity by hydro-electric dams. Upstream of these dams, lakes preserve water from rain and snow for later electricity generation.

Stored water has an intrinsic value. If storage is low due to recent low inflows, that water has a higher ‘value’ as it’s scarce. However, when the water level is high and rises above the full supply level, spilling out of the dam, the water has a value close to zero as it can’t be held onto for a better time. When dams are close to full or spilling, electricity generation from hydro is sold at very low prices into the wholesale market. So as more wind and solar capacity is installed in New Zealand, it is likely that energy will be spilled resulting in low prices more often. This may be from hydro-electric dams, but also from wind and solar when there is enough energy to meet demand.

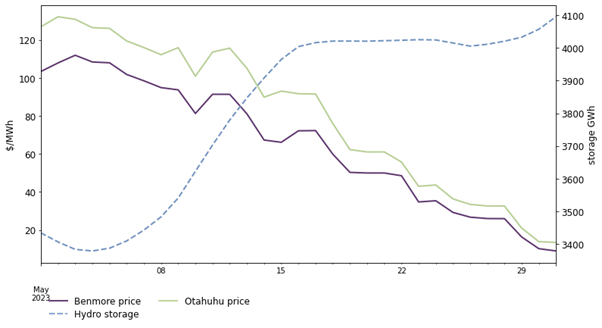

In May 2023, national hydro storage increased by 838 GWh1 – an increase of almost 20% in one month. Some lakes, like Te Anau and Manapōuri, went above consented levels and began to spill water. This resulted in low wholesale prices during periods of the day when demand could be met with a high proportion of hydro and other renewable generation (like wind). Figure 1 shows that as hydro storage levels passed and stayed above 90% of total hydro capacity, the rolling average of wholesale prices slid to very low levels.

In May 2023, the system operator indicated a lack of spare generation at some times, causing some short-term spikes in wholesale or spot prices. The Electricity Authority investigated the spot market price volatility in May 2023, but average spot prices continued to drop (as per Figure 1).

What does this mean for consumers’ electricity bills? In the short term, it will have little impact. In part, this is because household and other small consumers generally have fixed price agreements. Also, electricity retailers typically manage the cost of electricity they buy from the wholesale market by hedging. This is essentially making an estimate on future average wholesale prices and fixing supply at that price in advance. Hedging means that the costs of wholesale electricity in household power bills will not change much from month to month, as it protects households from wholesale market volatility.

In the long term, high hydro levels can help push down the forecast wholesale prices for a time. Depending on the retailer’s hedge position, this should ease the cost of the wholesale electricity portion of consumers’ bills and minimise bill increases in the near future.

1. Figure 1 does not show the full increase in storage, because it is a rolling average. The final value for 31 May was 4490GWh.

Related News

Better tools to manage price volatility and incentivise flexible demand

This is the Authority’s latest quarterly update on how we are implementing the Market Development Advisory Group’s final report. It covers April to June 20…

Contract extension for commercial market making services

The Electricity Authority Te Mana Hiko has extended by eight months the end of the current contract to provide commercial market making services.

Centralised wind and solar forecaster contract awarded

The Electricity Authority has awarded a contract to provide centralised wind and solar forecasting services to DNV Services.