Eye on electricity

Hydro storage limits and why rain matters for electricity

- Generation

- Strategy

New Zealand has a highly renewable electricity system where hydro generation accounts for more than half of our total electricity generation. This article explains how hydro generation is priced as hydro storage changes and how this impacts wholesale electricity prices. It also explores the changing role hydro generation will play in a highly renewable electricity system.

Hydro power is king

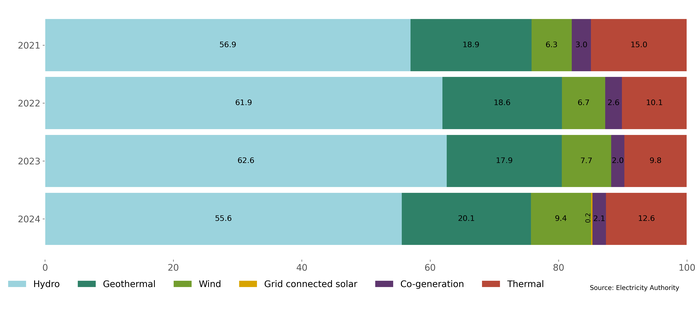

The large hydro schemes have storage lakes to capture rain and snowmelt to save water for future use. For example, Lake Pūkaki, in the South Island, stores water for the Waitaki scheme and water in Lake Taupō flows into the Waikato scheme. In recent years hydro generation has contributed over 50% of the total energy, with the remaining energy coming from geothermal, wind, solar, co-generation and thermal (Figure 1).

The total national hydro storage is equivalent to about 4,500GWh. This is enough to provide all electricity in New Zealand for around six weeks. As only around half of our generation is hydro powered, our full hydro storage could last about three months with no rain.

Hydro generation pricing increases as storage decreases

During dry periods hydro storage reduces, increasing the value of water as it becomes scarcer. Hydro generators price their electricity generation to reflect this water scarcity. When lakes are close to full, hydro generation is cheaper. If lakes are overfull, resulting in water being released without being used to generate electricity (called hydro spilling), then hydro generation should be priced as cheaply as possible.

When there is little rain and lake levels are low, hydro generation is priced more expensively. This is so more thermal generation is dispatched instead of hydro and water can be conserved for times of greater need.

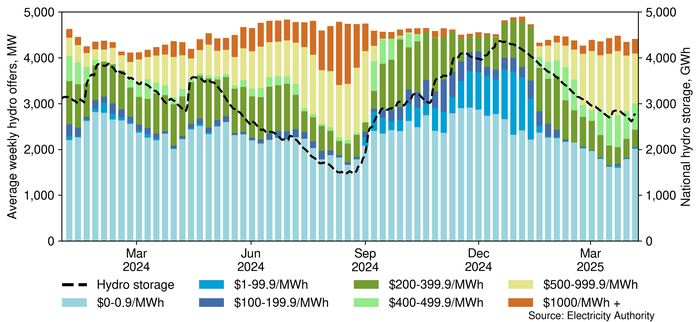

Figure 2 shows the average weekly volume of hydro offers and their prices since the start of 2024, alongside national hydro storage. In 2024, hydro storage declined from May until August. During this period, the volume of low-priced hydro generation (in blue) decreased, and the volume of high-priced hydro generation increased. Then, at the start of September 2024, heavy rainfall increased national hydro storage and the quantity of low-priced hydro offers increased significantly as the opportunity cost of water reduced.

Conserving water for winter

The time of year can also affect how hydro is priced. Electricity demand is always higher in winter due to colder temperatures and increased heating demand. This has been discussed in a previous Eye on electricity article.

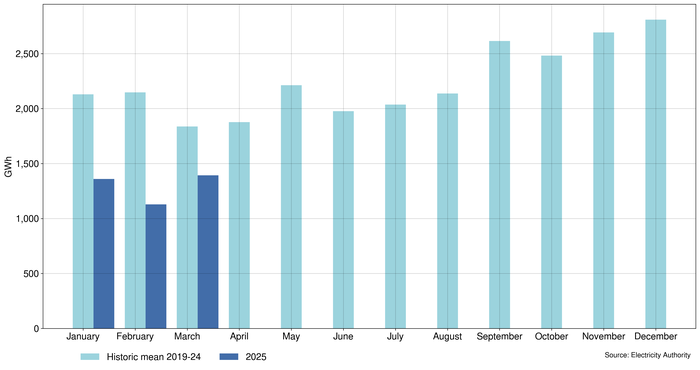

Sometimes hydro storage gets low early in the year with weather forecasts not indicating imminent rainfall in hydro catchment areas. When this happens, hydro generation is priced even higher compared to when storage is low later in the year. The higher pricing is because hydro generators are expecting to need more hydro generation in winter and want to conserve more water for the season. Typically, hydro inflows (water into the hydro storage lakes) are highest in spring and the beginning of summer due to snowmelt (Figure 3). In comparison, inflows leading up to and through winter are lower, making it even more critical to conserve water for the winter months.

Hydro inflows in 2025 are low

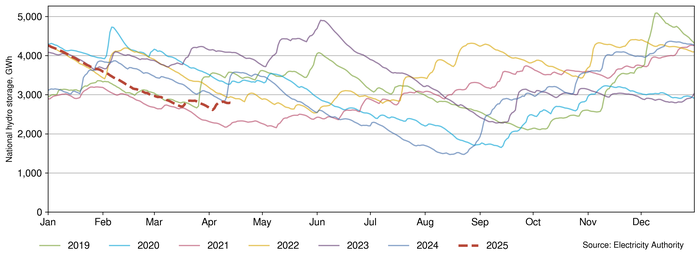

National hydro inflows in 2025 have been the lowest on record, and hence national hydro storage has steadily decreased since the start of the year (Figure 4). Low hydro storage has resulted in wholesale electricity prices increasing. This is similar to what happened in winter 2024 when hydro storage was also low and hydro generation prices increased, and in autumn 2021.

This year, hydro storage has dropped quicker than it did last year when hydro storage didn’t reach the current levels until the end of May. NIWA’s April-June 2025 seasonal climate outlook has indicated that it is unlikely there will be above average rainfall in the catchment areas over the next three months to make up for the low inflows at the start of the year.

Given the current low level of hydro storage, with winter still being just over a month away, and no significantly large inflows likely, hydro generators are pricing some of their hydro generation high (Figure 2), as storage needs to be conserved for winter.

In a highly renewable system hydro generation is used for firming

Many forms of renewable generation are highly volatile. In New Zealand, this is especially true for our wind and solar generation. New Zealand is reliant on its thermal and hydro generation to generate electricity when the sun is not shining, the wind is not blowing, and the rain is not falling.

As more and more renewable generation gets built, and thermal generation is retired, less and less hydro generation will be required on a day-to-day basis. This will free up hydro storage to be used to fill in the gaps when the weather is not being especially helpful and allow more thermal generation to retire. For more details on how hydro can firm wind and solar, check out this Eye on electricity article.

Working to ensure security of supply

The Electricity Authority has worked to encourage and monitor contingent contracting and New Zealand is in a better position than in 2024 even without the largest tranche of demand response being available from Tiwai.

In 2024 we observed how important contingency arrangements are for managing supply risks. The demand response agreement between New Zealand’s Aluminium Smelter (NZAS) and Meridian is a good example of a contingency arrangement and how it contributed to managing supply risks. It was employed early in the winter and benefited the market by reducing how much electricity the smelter used.

Also, during winter 2024 generators purchased gas from Methanex to use in generation.

This deal was only done after the prices had already reached over $800/MWh, but after it came into effect prices dropped. If this gas deal had been done before winter the increase in gas availability would likely have brought wholesale prices down.

More recently, the Authority has been encouraging investment in new generation with the Power Innovation Pathway, making it easier for innovators to learn what they need to know to make their plans a reality.

The trading conduct monitoring of the current participants in the energy market is carried out by the Authority to ensure that prices remain fair and competitive. You can learn more in our weekly trading conduct reports.

Related News

Quarterly report to the Minister for Energy, 1 October – 31 December 2025

The Electricity Authority Te Mana Hiko’s latest quarterly report to the Minister for Energy shows the mahi we have been delivering for consumers from 1 October…

Policy changes to strengthen dry year risk management

The Electricity Authority Te Mana Hiko has approved changes to the Security of Supply Forecasting and Information Policy (SOSFIP) to improve certainty and bett…

Electricity Authority launches new consultation on non-discrimination obligations

The Electricity Authority Te Mana Hiko (Authority) has launched a further consultation on certain aspects of the proposed non-discrimination obligations (NDOs)…