Eye on electricity

Investment in new generation plants

- Generation

In July 2025 the Electricity Authority Te Mana Hiko published a dashboard showing planned generation projects in New Zealand. This generation investment dashboard shows details about where projects are located, their size, status and expected commissioning, and will improve transparency around the investment pipeline.

The dashboard is updated monthly with data collected by Transpower under the Authority’s investment pipeline clause 2.16 notice. It’s important that developers provide Transpower with regular updates on all projects to ensure that this information remains up-to-date.

This article shares key insights from the new data and dashboard and explores the implications for the electricity system.

Solar and wind projects make up most of the pipeline

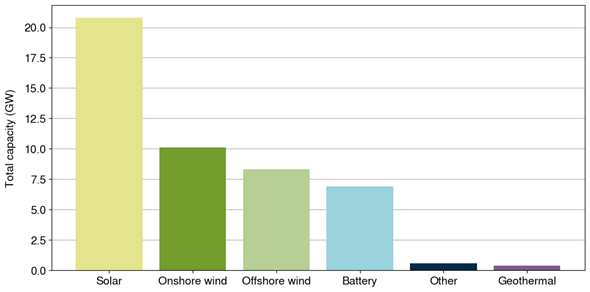

There are 312 new generation projects in the pipeline, with a combined total capacity of 47.1GW. This comes from nine different types of generation, grouped into two categories: intermittent like solar and wind, where power output changes depending on weather conditions, and firming such as batteries and geothermal generation, which can be generated at any time.

Currently, 83% of pipeline capacity comes from intermittent renewable projects. Increasing renewable generation is key to decarbonising New Zealand’s economy and can lower wholesale prices when wind and solar generation are high.

However, if the wind stops blowing or a cloud covers the sun, there must be enough firming generation to meet demand. Existing generation capacity, most of which is capable of firming, could provide this as well as new firming generation projects.

Thirty-one of 180 new solar projects are being built with batteries. These can be charged when the sun is shining and electricity demand is low, usually in the middle of the day. Then, when demand peaks, this stored power can be fed back into the grid.

Not everything in the pipeline will be built

With current national generation capacity of ~10.6GW and demand at ~41.5TWh in 2024, it would be uneconomical to build all 47.1GW of projects in the pipeline.

New generation plants are significant investments for developers and can take a long time to complete, due to the complexity of these projects. Early-stage projects sometimes drop out of the pipeline as more research into their viability is carried out.

We expect generation capacity to keep pace with demand

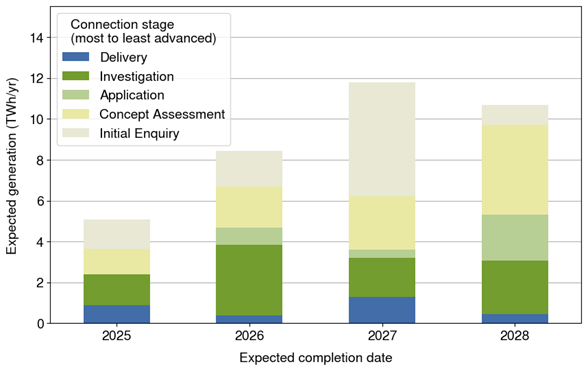

Figure 2 (below) shows the estimated annual generation of projects in the pipeline by expected completion year and connection queue stage (the process that projects go through to connect to the grid).

With more than 12TWh/yr of generation in the final two queue stages scheduled for completion before 2029, and demand expected to increase by ~1.3-2.7% each year, we expect enough new generation to be built to meet rising demand.

Offtake agreements can help finance new generation investment

Additionally, developers often enter power purchase agreements (PPAs) before committing to new projects. PPAs are long-term contracts for the purchase of power, providing price stability for both the buyer and generator. Buyers who are building new facilities with high electricity demand (such as data centres or industrial plants) are incentivised to enter PPAs for new generation. This ensures that when demand increases, generation capacity increases with it.

The Authority’s Energy Competition Task Force is currently investigating how PPA settings could be improved to enable new generation entry.

Most new generation is being developed by independent parties

Around 90% of existing national generation capacity is owned by integrated generators (those who own existing generation assets and also act as electricity retailers). This proportion is likely to decrease, according to pipeline data, with 77% of new capacity being built by independent developers.

However, a higher proportion of projects developed by independent parties are still in early development stages and may not be built. Independent developers are also more likely to build intermittent than firming generation, and we expect some projects may eventually be sold to integrated developers. As a result, the actual proportion of new generation provided by independent parties will likely be lower than 77%.

Despite this, even if only projects at an advanced stage of development were completed and 50% were sold to integrated parties, the proportion of independent generation capacity would still increase to 20% by 2030.

More new generation planned for the Waikato than any other region

Our new data includes the locations of projects, allowing us to see where investment in new generation is taking place. We currently know the locations of 142 projects and hope to see more developers provide Transpower with this information.

Of projects with known locations, 75% of planned capacity is in the North Island, with more in the Waikato (5GW) than any other region. The North Island is responsible for the majority of national electricity demand, but most generation capacity is in the South Island. A small amount of electricity is lost in transmission, and this amount increases the further it needs to travel, so it is more efficient to build generation close to where demand is highest.

New insights are available each month

The dashboard is updated with new data each month to provide the most up-to-date information available. New features will continue to be added as the data evolves, so watch this space.

Related News

Generation investment pipeline: updates and current insights

At launch, our generation investment pipeline dashboard included details about where projects were located, their size, status and expected commissioning as a …

Electricity hedge prices compared to new estimate of the LCOE

In an 'Eye on electricity' article in June, we compared the prices of long and short hedges to estimates of the levelised cost of electricity and short run mar…

Decision on causer of 26 July 2024 under-frequency event

Following consultation, we have determined that Transpower New Zealand Limited, as grid owner, is the causer of the 26 July 2024 under-frequency event.