Eye on electricity

Spot prices fall as hydro storage increases

- Generation

- Transmission

- Prices

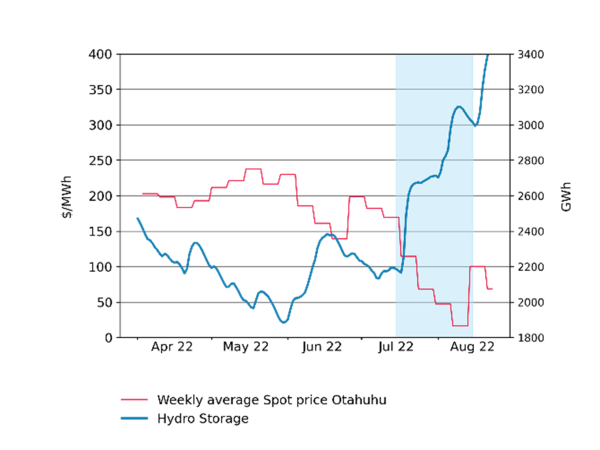

The heavy rain that has lashed the country in recent times may have caused flooding and numerous slips in parts of the country but there has been one upside – storage in New Zealand’s hydro schemes has risen rapidly.

As of August 25, hydro storage was sitting at 77 per cent of the theoretical maximum storage – at 3400GWh up 28 per cent on the same time last year.

As the lakes levels have risen, prices on the spot market have fallen because of the abundance of available hydro generation as seen in Figure 1.

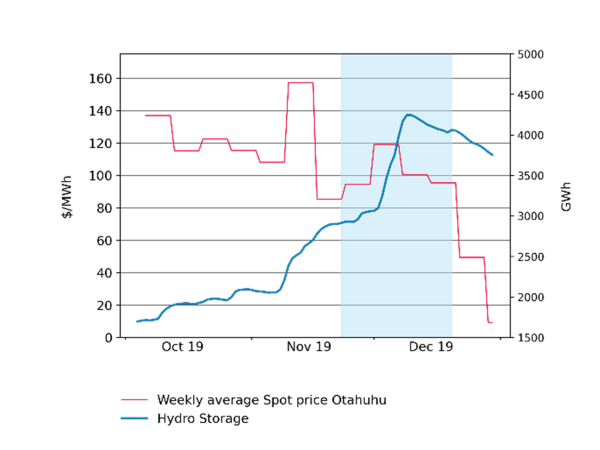

The decline in spot prices relative to the abundance of hydro storage contrasts with the events of December 2019 when spot prices remained elevated despite hydro storage increasing, as seen in Figure 2.

Following a year-long investigation after a claim made by seven claimants, the Authority decided there was an undesirable trading situation for the period between 3-27 December 2019 and reset prices for the period of the UTS to a level that was more consistent with the abundance of water available for generation.

The Authority introduced new trading conduct rules in June 2021 and is actively monitoring trading conduct behaviour.

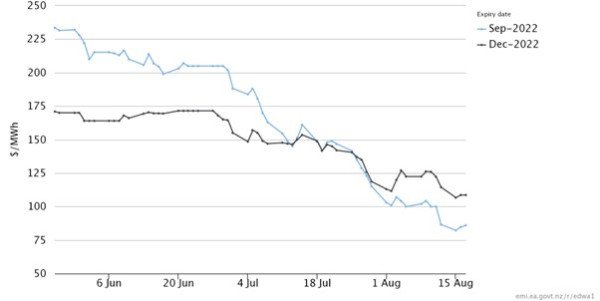

The recent high inflows into hydro lakes as also impacted on the futures market with Forward Electricity Market prices falling for the remainder of 2022 as seen in Figure 3.

Related News

Consultation open on common quality information requirements

We are seeking feedback on a Code amendment proposal that would ensure the system operator has timely access to accurate information for assets connecting or c…

Centralised wind and solar forecaster contract awarded

The Electricity Authority has awarded a contract to provide centralised wind and solar forecasting services to DNV Services.

Seeking feedback on 21 December 2024 under-frequency event

We are seeking feedback from generators, the grid owner and other market participants who may have been substantially affected by the under-frequency event of …