Eye on electricity

The electricity system in December 2019 versus December 2022

- Generation

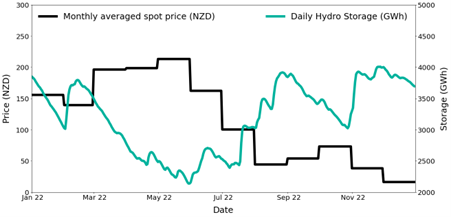

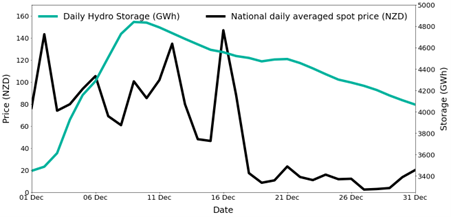

December 2022 was the end of an immense year in the electricity sector. A dry summer and autumn, which saw hydro lakes levels plummet over several months, was juxtaposed by a wet and windy winter and spring (see Figure 2). Rain and snow melt kept New Zealand’s hydro lakes high, with total controlled storage at 97% full on 1 December 2022. This, alongside high wind and geothermal generation, allowed the electricity system to operate at near 100% renewables during times in November and December. This renewable electricity kept spot prices low – with the average December 2022 price being $17/MWh across all nodes.

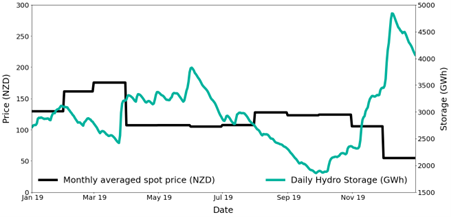

In December 2019 hydro storage reached even higher levels than in December 2022, but prices remained high (see Figure 2). Large rainfall events in November and December 2019 resulted in South Island reservoirs reaching maximum capacity and hydro generators spilling water. Spot prices were expected to fall to very low levels to avoid unnecessary spilling of water. However, spot prices rose as high as $618/MWh, while the average price for the month (at the time) was $54/MWh across all nodes (see Figure 4).

The increase of spot prices led to multiple industry participants alleging that an “undesirable trading situation” (UTS) had occurred, and that generators had breached the rules of the Electricity Industry Participation Code 2010 (Code). After further analysis and consultations, the Electricity Authority decided that the situation did indeed constitute a UTS, which spanned from 3-27 December 2019.

A UTS is a situation outside the normal operation of the electricity market that threatens, or may threaten, confidence in, or the integrity of, the wholesale market. The UTS provisions of the Code oblige the Authority to attempt to correct such situations and restore the normal operation of the market.

To rectify the situation, the Authority imposed a price cap of $13.70/MWh on the offers made in the South Island by nine different stations between 3-27 December 2022. The Authority then worked with the system operator (Transpower) and others to resettle the market, with some generators required to repay the excesses they had made during the UTS period.

Under the Code at the time, the allegation of a breach of the trading conduct rules by generators in respect of the events that led to the UTS was not upheld. This was because the safe harbour provisions in clause 13.5B of the Code applied.

In June 2021, the Authority amended the rules in the Code under which such a breach would be considered. These changes strengthen the requirements for generator offers to be “consistent with those made where no generator could exercise significant market power”, including by revoking the safe harbour provisions. The Authority also began weekly monitoring of generator offers under this rule.

The Authority also completed a post implementation review of the new trading conduct provisions in June 2022. Whilst nothing definitive could be proclaimed, the indicators examined found that the new provisions appear to be having the desired impact on generator offer behaviour.

Related News

Centralised wind and solar forecaster contract awarded

The Electricity Authority has awarded a contract to provide centralised wind and solar forecasting services to DNV Services.

Battery energy storage systems roadmap released

We have published a draft two-year roadmap that sets out our work to support investment in battery energy storage systems (BESS). BESS will become increasingly…

Submissions published on frequency-related Code amendment proposals

We have published submissions on our proposal to amend Part 8 of the Code to address increased frequency variability in New Zealand’s power system.