Eye on electricity

The New Zealand gas market

- Generation

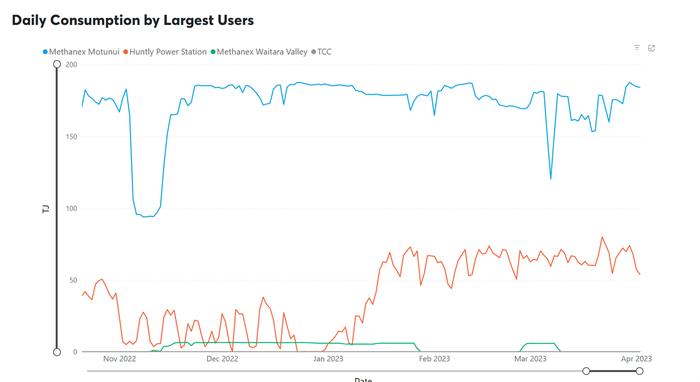

Fossil gas, or natural gas, in New Zealand is extracted from onshore and offshore fields in Taranaki. The first gas field, Kāpuni, was discovered in 1959 and gas extraction began in 1970. Annually, New Zealand produces 180 PJ1 of energy from gas. Figure 1 shows the daily gas consumption by New Zealand's largest users between November 2022 and April 2023.2 Currently, Māui is the largest producing gas field with a daily average of between 100-120 TJ extracted per day. This gas is utilised in many ways, from gas cooking and heating, industrial processes like steel production, petrochemical processes, and electricity production. The gas industry is currently self-regulated by an industry body called the Gas Industry Co.

The Electricity Authority monitors how much gas is being used to generate electricity and how the short run marginal cost (SRMC)3 of gas is changing each month, with comparisons to coal and diesel. This analysis can be found in our weekly trading conduct reports.

Each year roughly 45 per cent of New Zealand’s gas is used for petrochemical production, mainly refining it into Methanol. This is done by Methanex at their Motunui site. Another remaining 30 per cent of gas is used to make electricity.

E3P or Huntly 5 is the Huntly power station's largest and most efficient unit. It burns gas to convert water into superheated steam which spins a turbine, creating electricity. During colder months, Huntly 5 tends to run continuously using gas from Taranaki. Huntly 6 is a type of generator which typically runs during peak electricity demand times (a “peaker”) and it also uses gas. The three remaining units at Huntly, called Rankines, can be run using either gas or coal, or a mixture of both. Contact Energy also uses gas in their Taranaki Combined Cycle unit and in both of its peakers. Furthermore, two peakers operated by Nova Energy, Junction Road and McKee, also use gas.

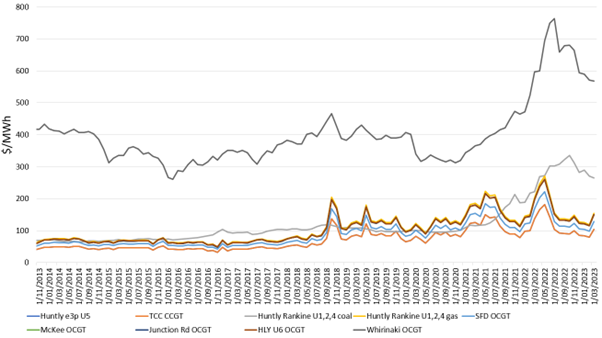

Since New Zealand does not import or export fossil gas4, the domestic gas market has been largely insulated from the Energy Crisis which has recently washed over Europe and raised the global prices for fuels like coal and diesel. Figure 2 shows the short run marginal cost, a measure of how expensive a fuel is to use to generate electricity, for coal, diesel and gas. The SRMC of diesel and coal has increased since 2021, with sharp rises in early 2022. The SRMC of gas, however, has fluctuated in line with domestic supply and demand conditions. After being quite flat for many years, it increased back in 2018 due to an unexpected outage at the Pohokura gas field. It has remained higher since then, with some ongoing uncertainty surrounding gas supply from the New Zealand fields.

Most gas in New Zealand is sold under long-term contracts. However, there is still a spot price for gas, like there is for wholesale electricity, which isn’t contracted to balance out supply and demand. Currently this is hovering between $5/GJ and $20/GJ5. In times of excess gas, the spot price normally falls. This happened last year when Methanex closed one of its methanol production plants for maintenance. During this time, electricity generators burned extra gas, in order to conserve water in their hydro storage lakes, and extra gas was purchased off the spot market and injected into a storage facility at Ahuroa.

At other times, such as in 2018 when the Pohokura gas field had an unexpected outage, a shortage of supply can increase the gas spot price. Even if electricity generators do not need to purchase more gas off the spot market in these times (due to contracted amounts remaining enough to generate), the opportunity cost of generating electricity increases, as they could sell their contracted gas in the spot market instead of generating electricity. This is what we are measuring in the SRMCs for the gas generators.

1. About the Industry - Gas Industry

2. Gas production and consumption - Gas Industry

3. Note, these values are estimated.

4. Refined gas products like Methanol are exported.

Related News

Centralised wind and solar forecaster contract awarded

The Electricity Authority has awarded a contract to provide centralised wind and solar forecasting services to DNV Services.

Battery energy storage systems roadmap released

We have published a draft two-year roadmap that sets out our work to support investment in battery energy storage systems (BESS). BESS will become increasingly…

Submissions published on frequency-related Code amendment proposals

We have published submissions on our proposal to amend Part 8 of the Code to address increased frequency variability in New Zealand’s power system.