Eye on electricity

Futures prices respond to Tiwai announcement

- Distribution

- Retail

- Prices

The recently announced contract between the New Zealand Aluminium Smelter (NZAS) and electricity generators is an interesting example of how changes in information can affect participants’ understanding of future electricity prices, and the price of electricity contracts for those years.

In New Zealand four of the largest generator-retailers (Genesis, Mercury, Meridian and Contact) are obliged to buy and sell electricity futures contracts on the wholesale market. This enables other industry participants – notably retailers and large commercial consumers – to ‘hedge’ their future price of wholesale electricity. This risk management tool is an important way that market participants can manage their exposure to fluctuations of electricity prices in the spot market.

Buying and selling of electricity futures provides a ‘forward price curve’. This curve represents traders’ aggregate view of the price of wholesale electricity in the future.

Consumers benefit from the forward price curve. It allows their retailers to offer them deals that protect them from volatile spot prices. It also allows new retailers to manage their risk, which reduces barriers to new entry, increasing competition in the retail market. It also is one way that helps support decision-making around new investment to ensure that electricity supply keeps up with growing demand.

The recently announced contract between the New Zealand Aluminium Smelter (NZAS) and electricity generators is an interesting example of how changes in information can affect participants’ understanding of future electricity prices, and the price of electricity contracts for those years.

On Thursday 14 January 2021 Meridian Energy announced to the New Zealand stock exchange that NZAS had accepted contract terms from Meridian and Contact to continue its operation through to December 2024. The previously announced decision was that the smelter would shut down in August 2021. If the planned shutdown had gone ahead, New Zealand’s electricity demand would have fallen by 13 percent. The anticipated reduction in demand had already paused or halted several renewable energy developments.

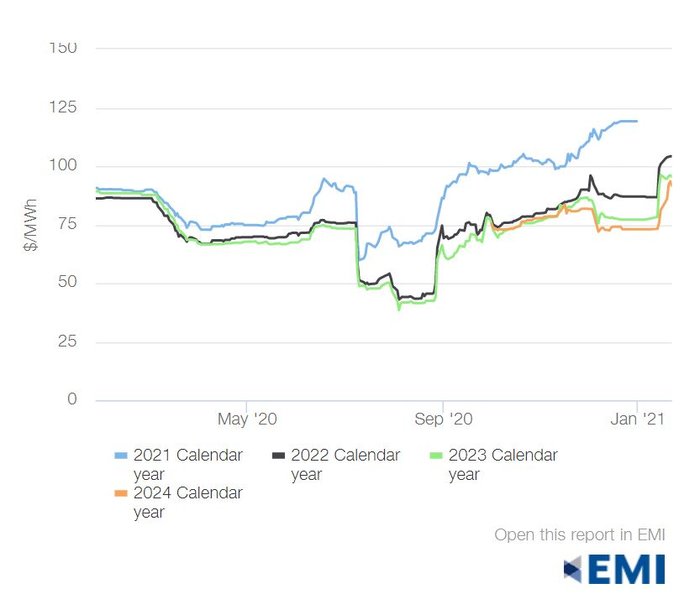

In the week after the announcement, contracts at Benmore for 2022 - 2024 increased approximately 20 percent. However, for contracts covering 2023 as at 22 January 2021 this was only three percent above their all-time high from before Tiwai’s exit announcement. While for contracts covering 2022, there was a more significant increase of roughly 14 percent, and 2021 saw an increase of nearly 40 percent. The increase in the first half of 2021 is predominantly due to low hydro inflows over December when the market was already anticipating tight supply due to uncertain gas availability. Similarly, increases in 2021/2022 also reflect notifications to the market on gas availability. These forward price movements, and their timing, are linked to both relevant disclosures and increased anticipation of tight supply, in addition to the Tiwai announcement.

Related News

Information session for retailers on new mandatory reporting under the Retail Market Monitoring notice

We invite retailers to our information session where we will answer your questions ahead of the first report which is due on 31 August 2025.

Consultation open on distribution system operation models

We are consulting on three alternative models for distribution system operation as part of the Future System Operations project.

Highlighting retailers’ obligations to protect medically dependent consumers

Under the Consumer Care Obligations retailers must not disconnect registered medically-dependent consumers, and must notify the Authority as soon as they becom…