Eye on electricity

Retail power prices and power supply security

- Consumers

- Retail

On 1 April 2025 most New Zealanders’ electricity bills would have increased. These increases are to recover costs for power transmission and distribution and will be invested in developing and maintaining the national and local power grids. Much of our electricity network is over 60 years old and needs renewing to remain reliable and resilient.

As retail prices increase, storage in our power system is declining because of historically low rainfall (needed for our hydro-power lakes) and low wind generation. This stress on our power system is similar to what we saw in winter 2024.

This article explains the different costs which are recovered via household power bills and where the recent price increases are coming from. It also explains why the current low hydro lake levels are not the main driving force behind these price increases.

Your power bill includes several different services

Retail power bills in New Zealand cover the range of different services which deliver power supply to households and businesses. The main parts of an average power bill include the cost of generation, transmission, distribution, retailer operation and GST.

The largest portions of the bill are for generation, transmission and distribution. The generation part covers the cost of generating electricity and reflects the wholesale electricity spot market, where electricity is bought and sold.

Transmission and distribution costs are like the ‘shipping’ costs you pay when buying regular goods.

The transmission part covers the cost of transporting electricity between regions. This includes maintaining and improving transmission towers, power lines and the inter-island HVDC cable that shares electricity between the motu (North and South islands).

The distribution part covers transmission on a more local level, making sure the electricity gets from the power grid to your home or business.

In New Zealand, the electricity ‘shipping’ costs are high because we have high electricity demand in the upper North Island, far away from the South Island, where most of our electricity is generated.

What’s causing retail price increases?

Most New Zealanders' electricity bills will have increased on 1 April 2025. These increases are to recover costs for power transmission and distribution and will be invested in developing and maintaining the national and local power grids.

These charges are regulated by the Commerce Commission (the Commission). The Commission has approved an increase for the next five years to cover increasing costs, higher interest rates and rising levels of investment needed in the electricity network. This investment supports electrification of our economy and ensures reliable power supply for New Zealanders.

As ‘low user plans’ are being gradually phased out, retailers can increase the fixed charges for low users by $30c/day (or about $9/month) from 1 April. This will help retailers more fairly recover increased transmission and distribution costs from their customers.

The remaining power price increase covers the other costs – generation, retail, metering and market governance/services. The size of these increases will depend on where you live, who your retailer is and what electricity plan you are on.

It is worth shopping around to make sure you are getting the best deal for your household or business - Powerswitch is a free and independent tool you can use to help get the best deal for your power.

Do wholesale electricity prices matter to consumers?

Households and smaller businesses do not pay the wholesale electricity spot price. Instead, they buy power from an electricity retailer. Retailers buy at the spot price or through contracts with generators and offer electricity to consumers using their pricing plans.

In this way, retailers absorb risk from New Zealand’s volatile electricity market, in a similar way to companies providing house or car insurance.

Some larger businesses choose to buy their electricity from the spot market instead. Companies buying from the spot market, including retailers, have the option to buy large amounts of electricity in advance (called hedges) at a fixed price on the electricity hedge market. This helps them manage the business risks that come from being exposed to changing spot prices.

While most consumers are protected from high wholesale spot prices, if spot prices stay higher over a longer period, retailers and generators selling hedges will choose a higher fixed price to balance their risk. This can lead to higher retail prices for consumers.

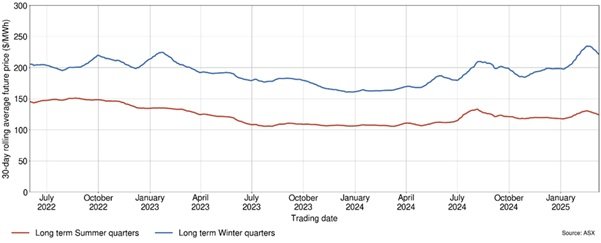

The ASX future electricity market, where hedges can be bought and sold, is a good indicator of whether future electricity prices are expected to stay higher or lower over time. Figure 1 shows that long-term future electricity prices are not trending up, and that long-term future electricity spot price expectations have not changed much in the last few years.

Secure supply is essential to a reliable power system

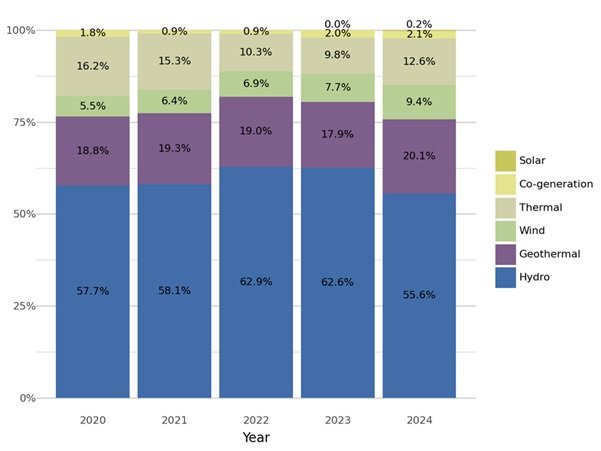

The ability of power supply to meet demand over time is referred to as ‘security of supply’. Our challenge in New Zealand is to have enough generation capacity to meet peak demand and enough fuel to generate electricity over the long term. Hydro, gas, coal, geothermal, wind and sun are used to generate electricity in New Zealand (Figure 2).

Hydro generation is the largest proportion of these fuels and also has the largest amount of storage as water can be stored in the lakes and released when it’s needed. Hydro provides between 4,412GWh-4,562GWh of power storage, depending on seasonal environmental consents. For context, 4,500GWh of generation would cover all of New Zealand’s electricity for about six weeks. This means our long-term security of supply relies on:

- how full our hydro storage lakes are

- how much rain is expected to fall into those lakes, and

- how much thermal fuel the generators have stockpiled to use when the lakes are not full enough.

Security of supply in recent years

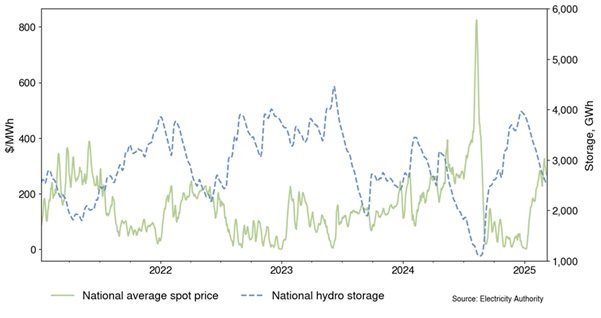

Figure 3 shows how periods of high inflows into the hydro lakes and hydro storage tend to result in lower wholesale spot prices, and vice versa.

Wholesale spot prices were high in August 2024 but were balanced out by very low prices when hydro inflows were high from October to December. Since January 2025, hydro inflows have been low, and the spot price has been increasing to reflect low levels of stored water.

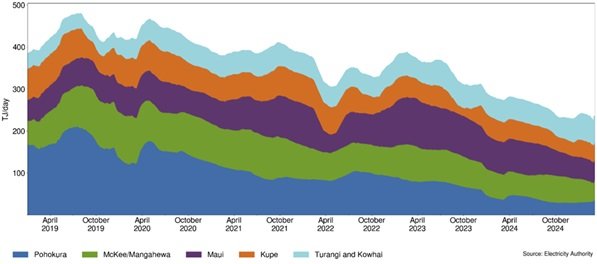

Gas supply also contributed to high spot prices in 2024. As Figure 2 shows, thermal generation often increases in years when hydro generation decreases. Total gas production in New Zealand has been declining over the last five years (Figure 4). This has led to higher gas prices.

When gas availability was limited in August 2024, Methanex, a major industrial gas consumer, shut their operations down to provide more gas for the electricity sector. This enabled an increase in gas-fuelled generation, which, alongside increased hydro generation, helped decrease wholesale electricity prices in August and September.

Securing New Zealand's power supply for the future

Gas supply will continue to influence future electricity prices as gas production may continue to decline. However, the Methanex deal is a good example of how industry can act to help ensure our electricity supply remains secure in times of market stress.

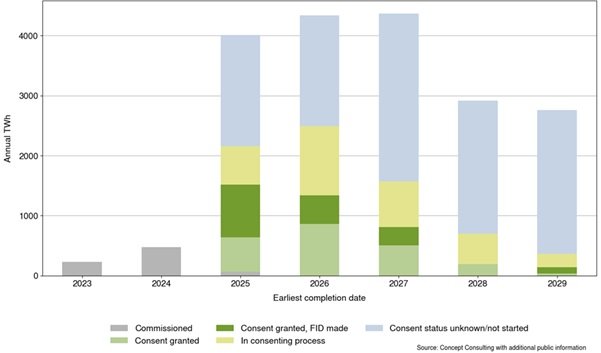

More renewable generation is being built to ensure there is enough capacity in our system to meet growing electricity demand. Figure 5 shows the expected capacity growth up to 2029.

What we are doing to support New Zealanders

The Authority has several policy initiatives designed to empower New Zealanders as electricity consumers and put downward pressure on retail prices.

A new hub to support smart power use and retail choices

Firstly, we are developing a new, more comprehensive service to help New Zealanders compare and switch power plan or provider, and to find information about how to actively manage their power use and costs.

This is a key initiative to ensure consumers are equipped with the information and tools they need to take full advantage of a dynamic and competitive electricity market.

New consumer rights

On 1 April 2025, the Authority’s new Consumer Care Obligations became binding for all retailers. Power companies must follow these obligations to help households stay connected and manage their power bills. Some of the most important rules are to help prevent homes from being disconnected. Power companies must have a consumer care policy that explains how they will meet these obligations and publish it on their website in a place that is easy to find.

Supporting competition in the market

The Authority is currently consulting on a proposal to level the playing field between the gentailers - Genesis, Contact, Meridian and Mercury – and independent companies. We are proposing to introduce a new rule called mandatory non-discrimination obligations that would prevent the gentailers from giving preferential treatment to their retail arms for hedge contracts. This would increase competition in the retail electricity market, giving households and businesses more choices and better power prices over the long term.

Shining a light on power retailers and consumer choices

We are also improving our retail market monitoring, to increase transparency and accountability. This will enable us to identify potential issues, publish more insights and make well-informed policy decisions that will benefit consumers.

Keeping the lights on

We are also working on other changes to ensure the lights stay on, even through a dry winter.

In winter 2024 we saw how important contingency arrangements are for managing supply risks. The demand response agreement between New Zealand Aluminium Smelters Ltd (NZAS) and Meridian is a good example. It was used early in the winter and benefited the electricity market by reducing the smelter’s power use. Later in the winter power generators purchased gas from Methanex to use in generation. This deal was done after prices peaked in early August and soon after prices dropped. If there had been the increase in gas availability prior to the start of winter, this may have helped lower wholesale prices. We have encouraged and monitored contingent contracting and as a result our system is in a better position than in 2024, even without the largest tranche of demand response being available from NZAS.

We have also completed an urgent Code amendment that gives Transpower (as the system operator) enhanced information gathering powers so it can more effectively manage security of supply risks.

The Authority introduced a second Code change to update the ‘scarcity pricing settings’. This took effect on 17 April 2025 and will ensure the correct pricing signals are set in the wholesale market to incentivise immediate responses, if a shortage situation emerges. It will also encourage investment in demand side flexibility, batteries and fast-start generation.

We are introducing new requirements for the provision of thermal fuels information. Thermal generators will be required to provide information on their fuel availability weekly, through the Authority’s information provision platform. As we head into winter each year, knowing how much thermal fuel is available to support the electricity system is critical for understanding security of supply. Publishing more information will help participants to make informed decisions about risk-management for winter 2025 and beyond.

Related News

Watch the space weather webinar and register for the Industry Exercise

Transpower have published the recording of our joint webinar on space weather and its potential impacts on Aotearoa’s power system. This webinar is part of our…

Consultation opens on how retailers will provide consistent information about their power plans

The Electricity Authority Te Mana Hiko has opened consultation on a proposed format for the prescribed Electricity Information Exchange Protocol 14A – Re…

New rules for power companies to improve bills, reduce bill shock and introduce product information standards

The Electricity Authority Te Mana Hiko has announced new rules to protect consumers by improving electricity bills, preventing large back bills and requiring p…