General news

New Zealand’s electricity retail market: retail gross margins

- Retail

The Electricity Authority Te Mana Hiko has released the retail gross margin for each retailer subject to disclosure1.

The retail gross margin represents the revenue2 received by a retailer after electricity, metering, levies, and distribution costs2. The margin therefore includes both the cost of service related to the retail business and any retail profits. Our analysis of 2022 retail gross margins found that the cost breakdowns of gentailers and retailers without a generation portfolio were similar, suggesting a competitive market. However, high spot and hedge prices compared to previous years meant that new entrants to the retail market likely struggled to compete with incumbents in 2022.

New Zealand’s retail market is made up of five large gentailers and many smaller retailers

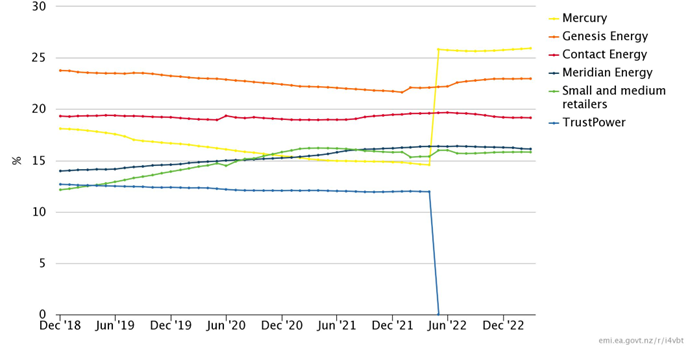

New Zealand’s retail market is currently made up of 39 retailers, of which five (four as of May 2022) are large gentailers, who both sell and buy electricity. Figure 1 shows that the large gentailers, Genesis, Contact, Meridian, Mercury and TrustPower, each have between 12% and 26% of the retail market share. The remaining retailers each have less than 5% of the market share, with a combined total of 16% as at the end of 2022. Some industry participants and commentators have expressed concern that the large gentailers have an advantage over small and medium retailers without generation portfolios and an advantage over new retailers.

Note that for the 2022 report, TrustPower has been treated as a separate retailer. However, in May 2022 the TrustPower retail business was sold to Mercury, increasing Mercury’s market share from 15% to 26%.

The retail gross margin was similar between gentailers and retailers without generation portfolios

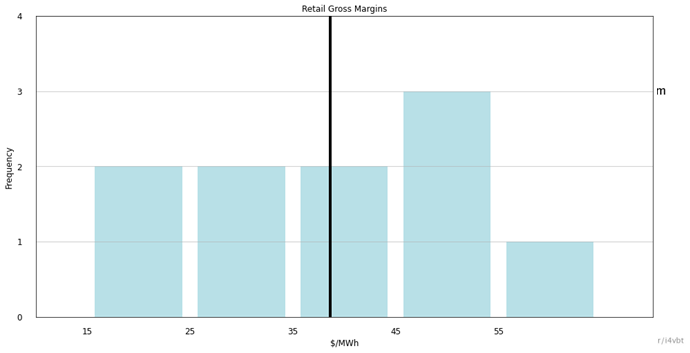

Figure 2 shows the retail gross margin by frequency of retailers in each value range, with retailers spread between $19.50/MWh to $56.57/MWh, and a mean of $38.63/MWh. There was no noticeable pattern in the size of margins between the gentailers and the retailers without generation portfolios, with both the largest and smallest retail gross margin reported by gentailers.

Retailer costs varied from $226/MWh to $281/MWh, which was predominantly made up of the cost of electricity, between $92/MWh and $111/MWh, and lines costs of between $84/MWh and $105/MWh. Lines costs are largely determined by the pricing plans of Transpower and electricity distribution businesses and so depend primarily on the type and location of customers. Metering costs were between $9/MWh and $15/MWh and levy3 costs were usually close to $1.10/MWh.

The spot price of electricity is the price paid for electricity on the wholesale market, calculated on a half hourly basis and varying according to location, total usage, and available generation and fuel. Residential consumers use more electricity during peak periods4 when prices are often highest compared to commercial users, and electricity prices in the North Island are usually higher than in the South Island where most hydrogeneration is located. Therefore, we expect retailers’ cost of electricity to vary depending on their customer base.

Gentailers reported their costs of electricity to be between $99/MWh and $111/MWh, while retailers without a generation portfolio reported electricity costs between $92/MWh and $111/MWh indicating costs of electricity were similar for gentailers and retailers who do not own generation.

Retailers use hedge contracts to reduce risk of price shock in the wholesale spot market

Retailers buy electricity on the spot market which has volatile prices; this creates risk for retailers as shortages, such as during a dry year, can result in high spot prices. Retailers can manage this risk by owning generation, or by agreeing in advance to pay a set price for electricity, either through a power purchasing agreement, by purchasing hedges on the Australian Securities Exchange (ASX) or through an over-the-counter agreement usually with an electricity generator.

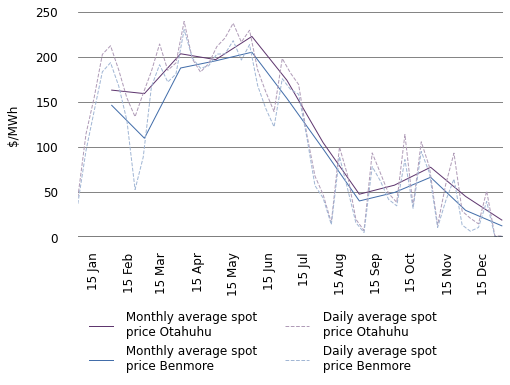

Figure 3 shows the 2022 monthly and daily spot prices, with the mean spot price of $141/MWh at Otahuhu and $126/MWh at Benmore. This is significantly higher than the retailers’ reported cost of electricity of between $92/MWh and $111/MWh, indicating that retailers used other risk management tools, such as hedging, to reduce the risk of high spot prices.

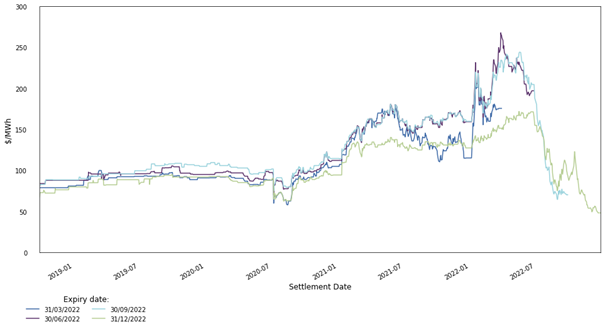

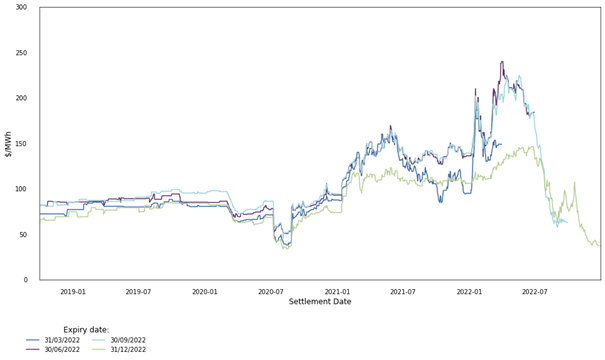

Hedge prices increased from 2021, reflecting local and global supply risks

Figure 4 shows the hedge prices for the 2022 quarters at Otahuhu and Benmore between 2019 and 2022. Hedge prices indicate expected spot prices in the future, factoring in the risk of high prices due to shortages. A purchaser can lock-in this expected price by buying the hedge contracts. During 2019 and 2020 prices varied between $58/MWh and $115/MWh at Otahuhu and between $33/MWh and $105/MWh at Benmore. In early 2021, future prices for 2022 rose dramatically to above $130/MWh and eventually reached a high of $265/MWh at Otahuhu for the June quarter in March 2022. Higher prices were driven by periods of low hydro inflows and an increase in the price of thermal fuels.

The analysis shows that most retailers’ electricity costs in 2022 were close to the long-term average of the ASX hedge price. This indicates there is no significant retail profit advantage for companies which also own generation assets. The analysis suggests most retailers without a generation portfolio used a long-term hedging strategy, or similar risk management strategy.

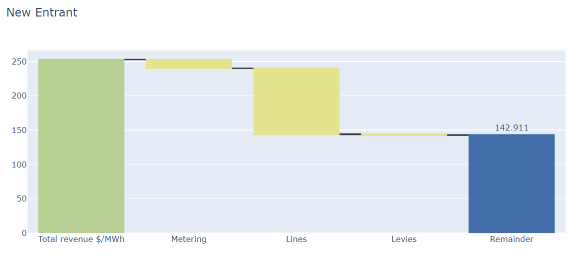

New entrants to the market in 2021 and 2022 faced higher hedge prices than incumbents who bought hedge contracts prior to 2021

A new entrant to the retail market is expected to face similar metering, distribution, and levy costs to existing retailers, at least for a given customer, and they would need to price competitively to gain new customers. Figure 5 uses the mean revenue and metering, distribution, and levy costs for incumbent retailers to estimate plausible revenue and costs for a theoretical new entrant, with the remainder of $143/MWh estimating the highest they could pay for both electricity and cost of service without making a loss. A new entrant entering the retail market in 2021 faced hedge prices for 2022 of between $130/MWh and $180/MWh for Otahuhu, with prices about $20/MWh lower at Benmore. Therefore, the new entrant could not buy hedges at the prices incumbent retailers reported (between $92/MWh and $111/MWh). The hedge prices sold in 2021 for the 2022 calendar year were also frequently above the estimated maximum of $143/MWh they could pay for electricity, indicating a new retailer would have struggled to buy hedges for 2022 at a price low enough to maintain a sufficient retail margin to cover cost of service.

In the first half of 2022 the hedge prices for the March, June and September 2022 quarters were usually above $180/MWh, and spot prices were above $180/MWh between March and June, meaning a new entrant in early 2022 would likely have made a loss during its first year unless it had built forward cover before entering the market.

Hedge prices are currently declining, creating more favourable conditions for new entrants

A new entrant entering the market in early 2023 would have faced higher prices for ASX hedges for 2023 and 2024 compared to incumbent retailers who were in the market before 2022. However, future prices for 2023 and 2024 have recently decreased, especially for the June and September quarters. When future prices drop below the long-term average price paid by incumbent retailers, new entrants have an advantage against incumbent retailers as they are can take advantage of lower hedge prices to offer better deals to consumers.

The timing of entry into the retail market is crucial to the success of a new entrant, given current price volatility in both the spot and hedge market. A retailer who entered the market and bought hedges during 2019 or 2020 would probably have had a cost advantage over incumbents due to the low forward prices at the time. The opposite is true for a retailer entering in 2022.

Overall, we found the retail gross margin for 2022 ranged between $19.50/MWh to $56.57/MWh. There was no noticeable difference in the margins between gentailers and retailers without generation portfolios, with energy costs ranging between $92/MWh and $111/MWh, close to the long-term average of ASX prices. However, a new entrant entering the market in 2021 or 2022 faced high hedge prices and would likely have struggled to remain competitive against incumbent retailers while maintaining a positive retail margin.

1. All retailers with at least 1% of ICPS are required by the Code clause 13.259 to provide their Retail Gross Margin Report for the financial year to the Electricity Authority no later than 90 calendar days from the end of their financial year.

2. Associated with the sale of electricity sold to mass market customers.

3. The levy is paid by industry participants to the Electricity Authority to fund our work to regulate the wholesale market and fund market operations service provides, such as Transpower.

4. Mornings from 6 to 9am and evenings from 5 to 9pm typically have the highest residential load, especially during winter.

Related News

Information session for retailers on new mandatory reporting under the Retail Market Monitoring notice

We invite retailers to our information session where we will answer your questions ahead of the first report which is due on 31 August 2025.

Highlighting retailers’ obligations to protect medically dependent consumers

Under the Consumer Care Obligations retailers must not disconnect registered medically-dependent consumers, and must notify the Authority as soon as they becom…

Submissions published on over-the-counter information notice

We have published submissions on our proposal to require all retailers and large industrials to regularly provide us with their over-the-counter requests for b…