Electricity Industry Participation Code 2010

Part 12—Transport

History Notes

Subpart 1—General

12.1

Contents of this Part

- This Part relates to the following aspects of transmission:

- (a) transmission agreements (subpart 2):

- (b) grid reliability and industry information (subpart 3):

- (c) the transmission pricing methodology (subpart 4):

- (d) [Revoked]

- (e) interconnection asset services (subpart 6):

- (f) the Outage Protocol (subpart 7).

Compare: Electricity Governance Rules 2003 rule 1 section I part F

Clause 12.1(d): revoked, on 1 October 2011, by clause 5 of the Electricity Industry Participation (Financial Transmission Rights) Code Amendment 2011.

12.2

Discretion to waive Code requirements

- (1) The Authority may agree to waive Code requirements under this Part if, before the commencement of an amendment to this Part,—

- (a) Transpower or any other participant required to complete actions under this Code has in substance done what it would have been required to do under this Code; and

- (b) the Authority is satisfied that the actions have been completed.

- (2) If the Authority agrees to waive Code requirements under subclause (1), the Authority must publish its decision and reasons for agreeing to waive Code requirements.

Compare: Electricity Governance Rules 2003 rule 2 section I part F

12.3

Interaction between Parts 7 and 8 and this Part

- (1) The principal performance obligations in relation to the real time delivery of common quality and dispatch under Part 7 relate to the functions and obligations of the system operator.

- (2) When it is exercising its functions and powers under this Part, the Authority must have regard to the desirability of Parts 7 and 8 and this Part operating in an integrated and consistent manner.

- (3) The performance or non-performance of a function or obligation of the system operator under Parts 7 or 8, and a claim against the system operator under Parts 7 or 8, is without prejudice to the functions and obligations of Transpower under this Part.

- (4) The performance or non-performance of a function or obligation of Transpower under this Part, and any claim against Transpower under this Part or a transmission agreement, is without prejudice to the functions and obligations of the system operator under Parts 7 or 8.

Compare: Electricity Governance Rules 2003 rule 3 section I part F

Subpart 2—Transmission agreements

12.4

Contents of this subpart

- This subpart deals with transmission agreements, and provides for the following:

- (a) [Revoked]

- (b) the categories of participants that must enter into transmission agreements:

- (c) an obligation on Transpower and designated transmission customers to enter into transmission agreements:

- (d) matters to be included in transmission agreements:

- (e) provisions relating to the default transmission agreement template, which—

- (i) provides the basis for the negotiation of transmission agreements; or

- (ii) provides the basis for a default transmission agreement:

- (f) a process for the Authority to determine a Connection Code that forms part of the default transmission agreement template:

- (g) a process for variations in transmission agreements from the default transmission agreement template:

- (h) a process for resolving disputes arising from the negotiation of transmission agreements and the failure to agree to the terms of default transmission agreements:

- (i) existing agreements.

Compare: Electricity Governance Rules 2003 rule 1 section II part F

Clause 12.4(a): revoked, on 1 October 2023, by clause 5(1) of the Electricity Industry Participation Code Amendment (Default Transmission Agreement) 2023.

Clauses 12.4(e) to 12.4(h): amended, on 1 October 2023, by clause 5(2) of the Electricity Industry Participation Code Amendment (Default Transmission Agreement) 2023.

12.5

[Revoked]

Compare: Electricity Governance Rules 2003 rule 2.1.2 section II part F

Clause 12.5: revoked, on 1 October 2023, by clause 6 of the Electricity Industry Participation Code Amendment (Default Transmission Agreement) 2023.

12.6

[Revoked]

Compare: Electricity Governance Rules 2003 rules 2.1.3 to 2.1.5 section II part F

Clause 12.6(3): amended, on 1 November 2018, by clause 73 of the Electricity Industry Participation Code Amendment (Code Review Programme) 2018.

Clause 12.6: revoked, on 1 October 2023, by clause 7 of the Electricity Industry Participation Code Amendment (Default Transmission Agreement) 2023.

12.7

Categories of participants required to enter into transmission agreements

- (1) The categories of designated transmission customers required to enter into transmission agreements with Transpower under clause 12.8 are as specified in Schedule 12.1.

- (2) The Authority must record in the register whether a registered participant is a designated transmission customer.

- (3) Registration has no effect on a participant’s status as a designated transmission customer.

Compare: Electricity Governance Rules 2003 rule 2.2 section II part F

Transpower and designated transmission customers must enter transmission agreements

12.8

Obligation to enter transmission agreements

- Transpower and designated transmission customers must enter into transmission agreements.

Compare: Electricity Governance Rules 2003 rule 3.1.1 section II part F

12.9

When designated transmission customer must enter into transmission agreement

- A participant who becomes a designated transmission customer must enter into a transmission agreement with Transpower within 2 months after the participant becomes a designated transmission customer.

Compare: Electricity Governance Rules 2003 rule 3.1.2.3 section II part F

12.10

Default transmission agreements

- (1) Subject to clause 12.49 the terms in the default transmission agreement template (other than incomplete terms) apply as a default transmission agreement as soon as a participant becomes a designated transmission customer.

- (1A) Subject to clause 12.49, if, at the expiry of 2 months after a participant becomes a designated transmission customer, the designated transmission customer and Transpower have not entered into a transmission agreement in accordance with clause 12.9, the designated transmission customer and Transpower must comply with the process specified in this clause.

- (2) If this clause applies:

- (a) within 10 business days of the date that is 2 months after the participant became a designated transmission customer, the designated transmission customer must provide Transpower, at the address for service for Transpower registered at the New Zealand Companies Office, with—

- (i) the designated transmission customer’s full name; and

- (ii) the designated transmission customer’s physical address, postal address and electronic address to which notices under the default transmission agreement are to be sent; and

- (iii) the name of the contact person of the designated transmission customer to whom such notices should be addressed:

- (b) by the date 20 business days after the receipt of the designated transmission customer’s details under paragraph (a), Transpower must provide the designated transmission customer with a draft default transmission agreement completed in accordance with the default transmission agreement template, which must include the following:

- (i) the designated transmission customer’s details as provided under paragraph (a):

- (ii) Transpower’s physical address, postal address and electronic address to which notices under the default transmission agreement are to be sent:

- (iii) the contact person to whom notices under the default transmission agreement should be addressed:

- (iv) Transpower’s designated bank account for the purposes of receiving payments under the default transmission agreement:

- (v) draft Schedules 1 and 2, which set out the connection locations, points of service and points of connection of the assets owned or operated by the designated transmission customer to the grid:

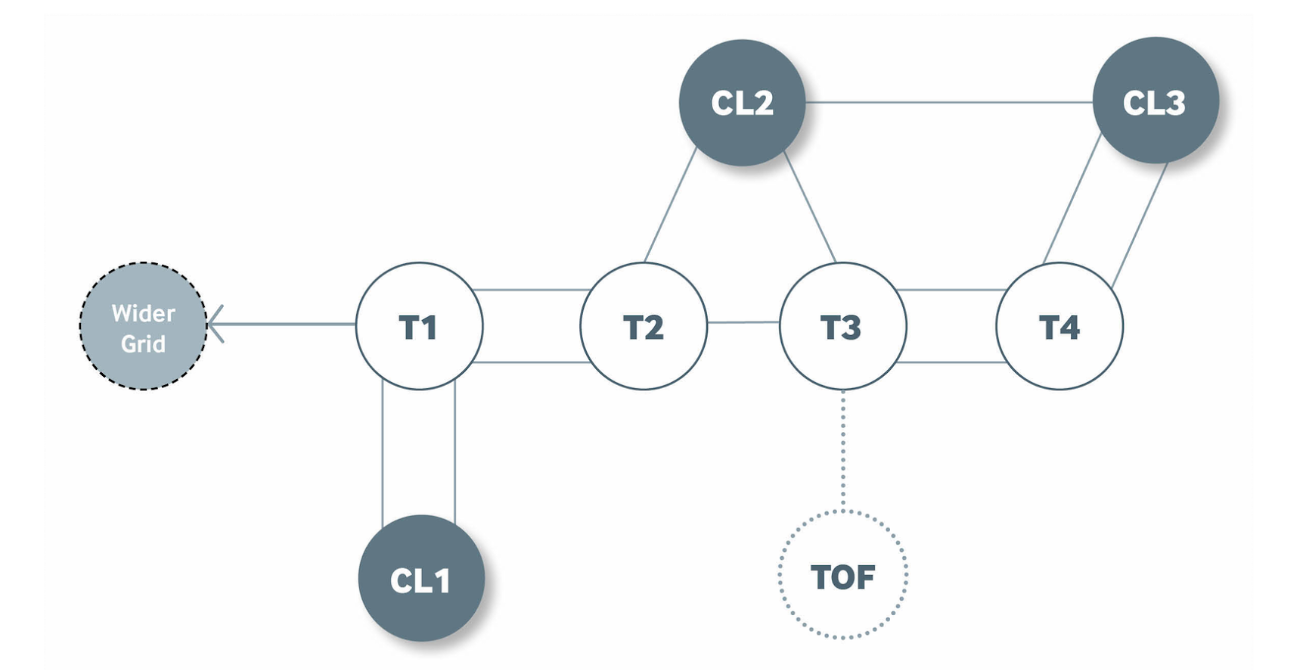

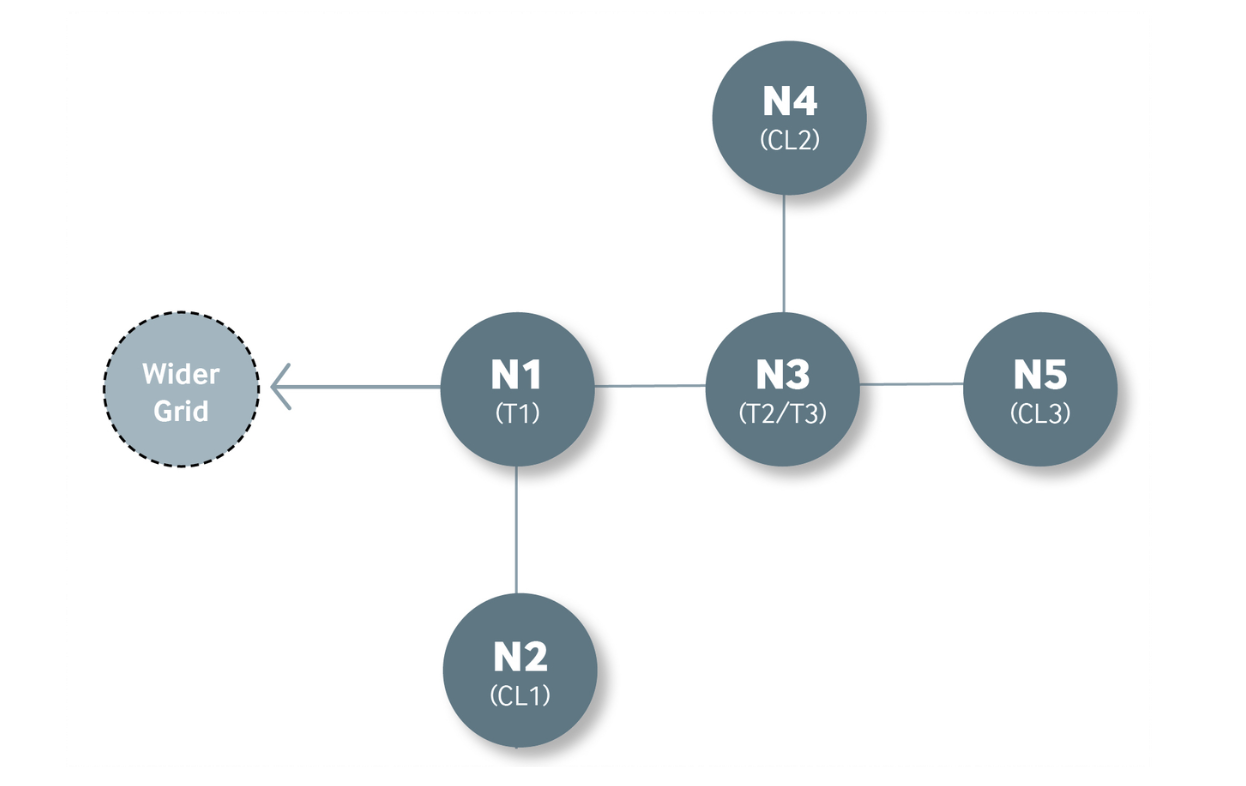

- (vi) a draft Schedule 4 setting out, in the same form as the diagram in Schedule 4 of the default transmission agreement template, the configuration of the connection assets in relation to each connection location listed in Schedule 1:

- (vii) a draft Schedule 5 setting out proposed service levels for each connection location listed in Schedule 1 determined in accordance with subclause (3):

- (viii) if applicable, a draft Schedule 6, including identifying the facilities, facilities area, and land that are to be subject to the access and occupation terms set out in the schedule and the licence charges under the schedule:

- (c) the designated transmission customer and Transpower may discuss the schedules proposed under paragraph (b)(v) to (viii), as a result of which Transpower may amend any of the schedules:

- (d) the designated transmission customer must advise Transpower in writing no later than 20 business days after receiving the draft default transmission agreement under paragraph (b) whether—

- (i) it accepts the schedules as proposed by Transpower under paragraph (b)(v) to (viii); or

- (ii) if Transpower has amended any of those schedules under paragraph (c), it accepts the schedules as amended.

- (a) within 10 business days of the date that is 2 months after the participant became a designated transmission customer, the designated transmission customer must provide Transpower, at the address for service for Transpower registered at the New Zealand Companies Office, with—

- (3) The service levels set out in Schedule 5 of a default transmission agreement must be determined on the following basis:

- (a) the capacity service levels for each branch must be consistent with—

- (i) the capacities of the branch or component assets in the most recent asset capability statement provided by Transpower under clause 2(5) of Technical Code A of Schedule 8.3; or

- (ii) if the relevant information is not contained in the asset capability statement, the manufacturer’s specification for the component assets:

- (b) the service levels for the voltage range specified in the capacity service measures for each branch must be consistent with,—

- (i) for assets of voltages of 50kV or above,—

- (A) the voltage ranges for the component assets specified in the AOPOs, if any; or

- (B) the voltage range specified in any equivalence arrangement approved or any dispensation granted under clauses 8.29 to 8.31 in respect of any asset that does not comply with the voltage range specified in the AOPOs; or

- (ii) for assets of voltages less than 50kV, the normal operating voltage of the component assets:

- (i) for assets of voltages of 50kV or above,—

- (c) Transpower must ensure that each connection asset is included in a branch:

- (d) the availability and reliability service levels must—

- (i) be set at a level equivalent to the average annual availability and reliability at each point of service subject to the default transmission agreement over the 5 year period (being years ending 30 June) immediately before the date that is 2 months after the participant became a designated transmission customer; or

- (ii) if a point of service subject to the default transmission agreement has not been in existence for 5 years (being years ending 30 June) before the date referred to in subparagraph (i), reflect a reasonable estimate of the expected availability and reliability at the point of service having regard to the performance data available for the point of service and average annual availability and reliability of assets similar to the connection assets at the connection location at which the point of service is located:

- (e) the reporting and response service levels must be consistent with Transpower’s practices existing on the date that is 2 months after the participant became a designated transmission customer, including Transpower’s documented policies and procedures, and must not result in changes to the management or operation of the grid that could materially affect Transpower or any other participant or end use customer, or require Transpower to materially alter the level of its normal on-going grid expenditure.

- (a) the capacity service levels for each branch must be consistent with—

- (4) If the designated transmission customer accepts the schedules as proposed by Transpower under subclause (2)(b)(v) to (viii), or as amended by Transpower under subclause (2)(c), the draft default transmission agreement proposed under subclause (2)(b)(v) to (viii), or as amended by Transpower under subclause (2)(c), (as applicable) is deemed to apply as a default transmission agreement from the date the participant became a designated transmission customer.

- (5) If Transpower and a designated transmission customer are unable to agree on the terms of any of the schedules proposed by Transpower under subclause (2)(b)(v) to (viii), or as amended by Transpower under subclause (2)(c), either party may refer the matter to the Rulings Panel for determination under clauses 12.45 to 12.48.

- (6) If a dispute is referred to the Rulings Panel, under subclause (5)—

- (a) the default transmission agreement as determined by the Rulings Panel in accordance with clauses 12.45 to 12.48 is deemed to apply between Transpower and the designated transmission customer from the date the participant became a designated transmission customer; and

- (b) until the Rulings Panel makes a determination, the draft default transmission agreement proposed under subclause (2)(b)(v) to (viii), or as amended by Transpower under subclause (2)(c), (as applicable) is deemed to apply as a default transmission agreement from the date the participant became a designated transmission customer.

Compare: Electricity Governance Rules 2003 rule 3.1.3 section II part F

Clause 12.10 Heading: amended, on 1 October 2023, by clause 8(1) of the Electricity Industry Participation Code Amendment (Default Transmission Agreement) 2023.

Clause 12.10(1): amended, on 16 December 2013, by clause 5 of the Electricity Industry Participation (Revocation of Part 16) Code Amendment 2013.

Clause 12.10(1): amended, on 1 October 2023, by clause 8(2) of the Electricity Industry Participation Code Amendment (Default Transmission Agreement) 2023.

Clause 12.10(1A): inserted, on 1 October 2023, by clause 8(2) of the Electricity Industry Participation Code Amendment (Default Transmission Agreement) 2023.

Clause 12.10(2)(a)(ii) and (b)(ii): amended, on 5 October 2017, by clause 287 of the Electricity Industry Participation Code Amendment (Code Review Programme) 2017.

Clause 12.10(2): amended, on 1 October 2023, by clause 8(3) of the Electricity Industry Participation Code Amendment (Default Transmission Agreement) 2023.

Clause 12.10(3): amended, on 1 October 2023, by clause 8(3) of the Electricity Industry Participation Code Amendment (Default Transmission Agreement) 2023.

Clause 12.10(4): amended, on 1 October 2023, by clause 8(4) of the Electricity Industry Participation Code Amendment (Default Transmission Agreement) 2023.

Clause 12.10(4): amended, on 1 March 2024, by clause 55(1) of the Electricity Industry Participation Code Amendment (Code Review Programme) 2024.

Clause 12.10(5): amended, on 1 October 2023, by clause 8(5) of the Electricity Industry Participation Code Amendment (Default Transmission Agreement) 2023.

Clause 12.10(6)(a): amended, on 1 October 2023, by clause 8(6) of the Electricity Industry Participation Code Amendment (Default Transmission Agreement) 2023.

Clause 12.10(6)(b): amended, on 1 October 2023, by clause 8(7) of the Electricity Industry Participation Code Amendment (Default Transmission Agreement) 2023.

Clause 12.10(6): replaced, on 1 March 2024, by clause 55(2) of the Electricity Industry Participation Code Amendment (Code Review Programme) 2024.

12.11

Subsequent transmission agreements

- If a default transmission agreement applies, it may be superseded by a subsequent transmission agreement entered into by Transpower and the designated transmission customer.

Compare: Electricity Governance Rules 2003 rule 3.1.4 section II part F

Clause 12.11: amended, on 1 October 2023, by clause 9 of the Electricity Industry Participation Code Amendment (Default Transmission Agreement) 2023.

12.12

Changes to connection assets under default transmission agreements

- (1) If Transpower reconfigures, replaces, enhances, or permanently removes a connection asset from service in accordance with the provisions of a default transmission agreement—

- (a) within 20 business days, to the extent necessary, Transpower must provide the designated transmission customer who is a party to that agreement with a revised Schedules 1 and 2, a revised Schedule 4, and a revised Schedule 5, and a revised Schedule 6 for that agreement, reflecting any changes to the description of the connection locations, points of service, or points of connection in Schedules 1 and 2, the diagram in Schedule 4, the service levels specified in Schedule 5, or the information in Schedule 6 resulting from the replacement or enhancement of the connection asset; and

- (b) the designated transmission customer and Transpower may discuss the revised schedules, as a result of which Transpower may amend any of the revised schedules; and

- (c) the designated transmission customer must advise Transpower within 20 business days of receiving the revised schedules under paragraph (a) whether—

- (i) it accepts the revised schedules as proposed by Transpower under paragraph (a); or

- (ii) if Transpower has amended any of those revised schedules under paragraph (b), it accepts the revised schedules as amended; and

- (d) the revised schedules apply under the default transmission agreement from the date that acceptance is received by Transpower under paragraph (c).

- (2) If the designated transmission customer does not accept the revised schedules under subclause (1)(c), either party may refer the matter to the Rulings Panel for determination under clauses 12.45 to 12.48.

- (3) If a dispute is referred to the Rulings Panel in accordance with subclause (2)—

- (a) the revised schedules proposed by Transpower under subclause (1)(a) apply from the date on which Transpower provides the designated transmission customer with the revised schedules under subclause (1)(a) until the date on which the Rulings Panel makes its determination or the determination comes into effect; and

- (b) the revised schedules as determined by the Rulings Panel under clauses 12.45 to 12.48 apply under the default transmission agreement from the date determined by the Rulings Panel.

Compare: Electricity Governance Rules 2003 rule 3.1.5 section II part F

Clause 12.12: amended, on 1 October 2023, by clause 10(1) of the Electricity Industry Participation Code Amendment (Default Transmission Agreement) 2023.

Clause 12.12(1) and (1)(a): amended, on 1 October 2023, by clause 10(2) and 10(3) of the Electricity Industry Participation Code Amendment (Default Transmission Agreement) 2023.

12.13

Expiry or termination of transmission agreements

- If a participant and Transpower are party to an existing transmission agreement or written agreement to which clause 12.49 applies, and do not enter into a new transmission agreement before the existing agreement expires or terminates, upon expiry or termination of the existing agreement the provisions in clause 12.10 apply with all necessary modifications.

Compare: Electricity Governance Rules 2003 rule 3.1.6 section II part F

Clause 12.13: amended, on 1 October 2023, by clause 11(1) and 11(2) of the Electricity Industry Participation Code Amendment (Default Transmission Agreement) 2023.

Clause 12.13(a)(ii) and (b)(ii): amended, on 5 October 2017, by clause 288 of the Electricity Industry Participation Code Amendment (Code Review Programme) 2017.

Clause 12.13(b)(v): amended, on 1 October 2023, by clause 11(3) of the Electricity Industry Participation Code Amendment (Default Transmission Agreement) 2023.

Clause 12.13(e): amended, on 1 October 2023, by clause 11(4) of the Electricity Industry Participation Code Amendment (Default Transmission Agreement) 2023.

Clause 12.13(g)(i): amended, on 1 October 2023, by clause 11(5) of the Electricity Industry Participation Code Amendment (Default Transmission Agreement) 2023.

Clause 12.13(g)(ii): amended, on 1 October 2023, by clause 11(6) of the Electricity Industry Participation Code Amendment (Default Transmission Agreement) 2023.

Clause 12.13: replaced, on 1 March 2024, by clause 56 of the Electricity Industry Participation Code Amendment (Code Review Programme) 2024.

Content of transmission agreements

12.14

Transmission agreements to be consistent with default transmission agreement template and grid reliability standards

- Subject to clauses 12.35 to 12.38, a transmission agreement entered into between Transpower and a designated transmission customer under clause 12.8 must be consistent in all material respects with—

- (a) the default transmission agreement template; and

- (b) the grid reliability standards,—

- as at the date the transmission agreement is entered into.

Compare: Electricity Governance Rules 2003 rule 3.2.1 section II part F

Clause 12.14 Heading: amended, on 1 October 2023, by clause 12(1) of the Electricity Industry Participation Code Amendment (Default Transmission Agreement) 2023.

Clause 12.14(a): amended, on 1 October 2023, by clause 12(2) of the Electricity Industry Participation Code Amendment (Default Transmission Agreement) 2023.

12.15

Transpower to publish information about transmission agreements and provide them on request

- (1) Transpower must publish and update annually a list of all transmission agreements it has with designated transmission customers that includes, in respect of each transmission agreement contained in the list, the following information:

- (a) the full name of the designated transmission customer that is a party to the transmission agreement; and

- (b) the date on which the transmission agreement was executed; and

- (c) whether the transmission agreement includes any material variations from the default transmission agreement; and

- (d) if the transmission agreement includes any material variations from the default transmission agreement; a description of the variations; and

- (e) if any schedule to the transmission agreement has been revised in accordance with clause 12.12, the date from which the revised schedule began to apply.

- (2) A person may request from Transpower a copy of a transmission agreement that Transpower has with a designated transmission customer, and Transpower must provide a copy to the person as soon as practicable after receiving the request.

- (3) Despite subclause (2), Transpower may refuse to provide information from a transmission agreement if it considers that there would be grounds for withholding the information under the Official Information Act 1982.

Compare: Electricity Governance Rules 2003 rule 3.2.2 section II part F

Clause 12.15: substituted, on 1 February 2016, by clause 46 of the Electricity Industry Participation Code Amendment (Code Review Programme) 2015.

Clause 12.15(1): amended, on 1 October 2023, by clause 13 of the Electricity Industry Participation Code Amendment (Default Transmission Agreement) 2023.

Connection Code

12.16

[Revoked]

Clause 12.16: revoked, on 1 October 2023, by clause 14 of the Electricity Industry Participation Code Amendment (Default Transmission Agreement) 2023.

12.17

Purpose of Connection Code

- The purpose of the Connection Code is to set out the technical requirements and standards that designated transmission customers must meet in order to be connected to the grid and that Transpower and designated transmission customers must comply with under transmission agreements.

Compare: Electricity Governance Rules 2003 rule 3.3.1 section II part F

Clause 12.17: amended, on 23 February 2015, by clause 75 of the Electricity Industry Participation Code Amendment (Distributed Generation) 2014.

Clause 12.17: amended, on 5 October 2017, by clause 289 of the Electricity Industry Participation Code Amendment (Code Review Programme) 2017.

Clause 12.17: amended, on 1 October 2023, by clause 15 of the Electricity Industry Participation Code Amendment (Default Transmission Agreement) 2023.

12.18

Review of Connection Code

- (1) The Authority may review the Connection Code at any time.

- (2) Clauses 12.19 to 12.25 apply to any such review.

Compare: Electricity Governance Rules 2003 rule 3.3.10 section II part F

12.19

Transpower to submit Connection Code

- (1) Transpower must submit a proposed Connection Code to the Authority within 90 days (or such longer period as the Authority may allow) of receipt of a written request from the Authority. The Authority may issue such a request at any time. The proposed Connection Code must provide for the matters set out in clause 12.20 and give effect to the principles set out in clause 12.21.

- (2) With its proposed Connection Code, Transpower must submit to the Authority an explanation of the proposed Connection Code and a statement of proposal for the proposed Connection Code.

Compare: Electricity Governance Rules 2003 rule 3.3.2 section II part F

12.20

Required content of Connection Code

- The Connection Code must provide for the following matters:

- (a) connection requirements for designated transmission customers:

- (b) technical requirements for assets, including assets owned by Transpower, and for other equipment and plant that is connected to a local network or an embedded network or that forms part of an embedded network or embedded generating station if the operation of that equipment and plant could affect the grid assets:

- (c) operating standards for equipment that is owned by a designated transmission customer, used in relation to the conveyance of electricity, and that is situated on land owned by Transpower:

- (d) information requirements to be met by designated transmission customers before equipment is connected to the grid and before changes are made to the equipment:

- (e) an obligation on Transpower to provide a 10 year forecast of the expected maximum fault level of each point of service to designated transmission customers set out in the transmission agreement between Transpower and each designated transmission customer.

Compare: Electricity Governance Rules 2003 rule 3.3.3 section II part F

Clause 12.20: amended, on 23 February 2015, by clause 75 of the Electricity Industry Participation Code Amendment (Distributed Generation) 2014.

Clause 12.20(a): amended, on 5 October 2017, by clause 290(1) of the Electricity Industry Participation Code Amendment (Code Review Programme) 2017.

Clause 12.20(b) and (d): amended, on 5 October 2017, by clause 290(2) of the Electricity Industry Participation Code Amendment (Code Review Programme) 2017.

Clause 12.20(c): amended, on 5 October 2017, by clause 290(3) of the Electricity Industry Participation Code Amendment (Code Review Programme) 2017.

Clause 12.20(e): amended, on 5 October 2017, by clause 290(4) of the Electricity Industry Participation Code Amendment (Code Review Programme) 2017.

12.21

Principles for developing Connection Code

- The Connection Code must give effect to the following principles:

- (a) the principles of the default transmission agreement template in clause 12.30:

- (b) the desirability of the Connection Code and Part 8 operating in an integrated and consistent manner, if possible:

- (c) the need to ensure that the grid owner can meet all obligations placed on it by the system operator for the purpose of meeting common security and power quality requirements under Part 8:

- (d) the need to ensure that the safety of all personnel is maintained:

- (e) the need to ensure that the safety and integrity of equipment is maintained.

Compare: Electricity Governance Rules 2003 rule 3.3.4 section II part F

Clause 12.21: amended, on 1 October 2023, by clause 16 of the Electricity Industry Participation Code Amendment (Default Transmission Agreement) 2023.

12.22

Authority may initially approve proposed Connection Code or refer back to Transpower

- (1) After consideration of Transpower’s proposed Connection Code, and accompanying explanation and statement of proposal, the Authority may—

- (a) provisionally approve the proposed Connection Code having regard to the matters set out in clause 12.20 and the principles in clause 12.21; or

- (b) refer the proposed Connection Code and accompanying explanation and statement of proposal back to Transpower if, in the Authority’s view,—

- (i) the proposed Connection Code does not contain the matters set out in clause 12.20; or

- (ii) the proposed Connection Code does not adequately provide for the principles in clause 12.21; or

- (iii) the explanation or statement of proposal provided with the proposed Connection Code in accordance with clause 12.19(2) is inadequate.

- (2) Transpower may, no later than 20 business days (or such longer period as the Authority may allow) after the Authority advises Transpower of its decision under subclause (1), consider the Authority’s concerns and resubmit its proposed Connection Code and accompanying explanation and statement of proposal for consideration by the Authority.

Compare: Electricity Governance Rules 2003 rule 3.3.5 section II part F

Clause 12.22(2): amended, on 1 November 2018, by clause 74 of the Electricity Industry Participation Code Amendment (Code Review Programme) 2018.

12.23

Amendment of proposed Connection Code by Authority

- If the Authority considers that the Connection Code resubmitted by Transpower under clause 12.22(b) does not adequately provide for the matters set out in clause 12.20 or adequately give effect to the principles in clause 12.21, the Authority may make any amendments to the proposed Connection Code it considers necessary.

Compare: Electricity Governance Rules 2003 rule 3.3.6 section II part F

12.24

Authority must consult on proposed Connection Code

- (1) The Authority must publish the proposed Connection Code, either as provisionally approved by the Authority or as amended by the Authority, as soon as practicable, for consultation with any person that the Authority thinks is likely to be materially affected by the proposed Connection Code.

- (2) As well as the consultation required under subclause (1), the Authority may undertake any other consultation it considers necessary.

Compare: Electricity Governance Rules 2003 rules 3.3.7 and 3.3.8 section II part F

12.25

Decision on Connection Code

- When the Authority has completed its consultation on the proposed Connection Code it must decide whether to amend the Connection Code.

Compare: Electricity Governance Rules 2003 rule 3.3.9 section II part F

Clause 12.25(2): amended, on 1 August 2023, by clause 41 of the Electricity Industry Participation Code Amendment (System Operation Documents) 2023.

Clause 12.25(1) and 12.25(2): amended, on 1 October 2023, by clause 17 of the Electricity Industry Participation Code Amendment (Default Transmission Agreement) 2023.

12.26

[Revoked]

Clause 12.26(1): amended, on 5 October 2017, by clause 291 of the Electricity Industry Participation Code Amendment (Code Review Programme) 2017.

Clause 12.26(1): amended, on 1 August 2023, by clause 42(1) of the Electricity Industry Participation Code Amendment (System Operation Documents) 2023.

Clause 12.26(2): revoked, on 1 August 2023, by clause 42(2) of the Electricity Industry Participation Code Amendment (System Operation Documents) 2023.

Clause 12.26: revoked, on 1 October 2023, by clause 18 of the Electricity Industry Participation Code Amendment (Default Transmission Agreement) 2023.

Default transmission agreement template

Cross heading: amended, on 1 October 2023, by clause 19 of the Electricity Industry Participation Code Amendment (Default Transmission Agreement) 2023.

12.27

[Revoked]

Clause 12.27(1)(e): amended, on 1 February 2016, by clause 47 of the Electricity Industry Participation Code Amendment (Code Review Programme) 2015.

Clause 12.27: revoked, on 1 October 2023, by clause 20 of the Electricity Industry Participation Code Amendment (Default Transmission Agreement) 2023.

12.28

[Revoked]

Compare: Electricity Governance Rules 2003 rule 7 section II part F

Clause 12.28: revoked, on 1 October 2023, by clause 20 of the Electricity Industry Participation Code Amendment (Default Transmission Agreement) 2023.

12.29

Purpose of default transmission agreement template

- The purpose of default transmission agreement template is to—

- (a) facilitate commercial arrangements between Transpower and designated transmission customers by providing a basis for negotiating transmission agreements required under clause 12.8 that meet the particular requirements of Transpower and designated transmission customers; and

- (b) provide the basis for default transmission agreements

Compare: Electricity Governance Rules 2003 rule 4.1 section II part F

Clause 12.29 heading and clause: amended, on 1 October 2023, by clause 21(1) and (2) of the Electricity Industry Participation Code Amendment (Default Transmission Agreement) 2023.

Clause 12.29(b): amended, on 1 October 2023, by clause 21(3) of the Electricity Industry Participation Code Amendment (Default Transmission Agreement) 2023.

12.30

Principles for default transmission agreement template

- The default transmission agreement template should—

- (a) reflect a fair and reasonable balance between the requirements of designated transmission customers and the legitimate interests of Transpower as asset owner; and

- (b) reflect the interests of end use customers; and

- (c) reflect the reasonable requirements of designated transmission customers at the grid injection points and grid exit points, and the ability of Transpower to meet those requirements; and

- (d) reflect the differing needs of different classes of designated transmission customers; and

- (e) be appropriate to the technical requirements of services provided at the point of connection to the grid, but not duplicate requirements that are more appropriately included in the grid reliability standards; and

- (f) establish common standards for a common configuration based on factors such as size of connection and voltage level; and

- (g) encourage efficient and effective processes for enforcement of obligations and dispute resolution.

Compare: Electricity Governance Rules 2003 rule 4.2 section II part F

Clause 12.30(f): amended, on 23 February 2015, by clause 75 of the Electricity Industry Participation Code Amendment (Distributed Generation) 2014.

Clause 12.30(f): amended, on 5 October 2017, by clause 292 of the Electricity Industry Participation Code Amendment (Code Review Programme) 2017.

Clause 12.30 heading and clause: amended, on 1 October 2023, by clause 22(1) and (2) of the Electricity Industry Participation Code Amendment (Default Transmission Agreement) 2023.

12.31

Contents of default transmission agreement template

- (1) The default transmission agreement template must include—

- (a) an obligation on the parties to design, construct, maintain and operate all relevant plant and equipment in accordance with—

- (i) relevant laws; and

- (ii) the requirements of this Code (including obligations on designated transmission customers to provide information to facilitate system planning, as set out in clause 12.54); and

- (iii) good electricity industry practice and applicable New Zealand technical and safety standards; and

- (b) an obligation on designated transmission customers to comply with Transpower’s reasonable technical connection and safety requirements; and

- (c) an obligation on designated transmission customers to pay prices calculated in accordance with the transmission pricing methodology approved by the Authority under subpart 4; and

- (d) arbitration or mediation processes for resolving disputes; and

- (e) service definitions, service levels, and service measures to the extent practicable for transmission services, other than the services to which the clauses in subpart 6 apply; and

- (f) the charging of a fee by Transpower to recover its settlement residue processing costs from designated transmission customers; and

- (g) the recovery of any negative settlement residue by Transpower from designated transmission customers.

- (a) an obligation on the parties to design, construct, maintain and operate all relevant plant and equipment in accordance with—

- (2) The default transmission agreement template must be consistent in all material respects with the grid reliability standards.

Compare: Electricity Governance Rules 2003 rule 4.3 section II part F

Clause 12.31(1)(b): amended, on 23 February 2015, by clause 75 of the Electricity Industry Participation Code Amendment (Distributed Generation) 2014.

Clause 12.31(1)(b): amended, on 5 October 2017, by clause 293 of the Electricity Industry Participation Code Amendment (Code Review Programme) 2017.

Clause 12.31 heading: amended, on 1 October 2023, by clause 23(1) of the Electricity Industry Participation Code Amendment (Default Transmission Agreement) 2023.

Clause 12.31(1) and (1)(e): amended, on 1 October 2023, by clause 23(2) and (3) of the Electricity Industry Participation Code Amendment (Default Transmission Agreement) 2023.

Clause 12.31(1)(f) and (g): inserted, on 1 October 2023, by clause 23(4) of the Electricity Industry Participation Code Amendment (Default Transmission Agreement) 2023.

Clause 12.31(2): amended, on 1 October 2023, by clause 23(5) of the Electricity Industry Participation Code Amendment (Default Transmission Agreement) 2023.

12.32

[Revoked]

Compare: Electricity Governance Rules 2003 rules 4.4 and 4.5 section II part F

Clause 12.32(2): amended, on 1 November 2018, by clause 75 of the Electricity Industry Participation Code Amendment (Code Review Programme) 2018.

Clause 12.32: revoked, on 1 October 2023, by clause 24 of the Electricity Industry Participation Code Amendment (Default Transmission Agreement) 2023.

12.33

[Revoked]

Compare: Electricity Governance Rules 2003 rule 4.6 section II part F

Clause 12.33(2): amended, on 1 August 2023, by clause 43 of the Electricity Industry Participation Code Amendment (System Operation Documents) 2023.

Clause 12.33: revoked, on 1 October 2023, by clause 24 of the Electricity Industry Participation Code Amendment (Default Transmission Agreement) 2023.

12.34

[Revoked]

Clause 12.34(1): amended, on 5 October 2017, by clause 294 of the Electricity Industry Participation Code Amendment (Code Review Programme) 2017.

Clause 12.34(1): amended, on 1 August 2023, by clause 44(1) of the Electricity Industry Participation Code Amendment (System Operation Documents) 2023.

Clause 12.34(2): revoked, on 1 August 2023, by clause 44(2) of the Electricity Industry Participation Code Amendment (System Operation Documents) 2023.

Clause 12.34: revoked, on 1 October 2023, by clause 24 of the Electricity Industry Participation Code Amendment (Default Transmission Agreement) 2023.

Variations from default transmission agreement template and grid reliability standards and enhancement and removal of connection assets

Cross heading: amended, on 1 October 2023, by clause 25 of the Electricity Industry Participation Code Amendment (Default Transmission Agreement) 2023.

12.35

Increased service levels and reliability

- (1) This clause applies if—

- (a) a proposed transmission agreement is not consistent in all material respects with the default transmission agreement template because it increases the service levels above those in the template; or

- (b) subject to clause 12.39, a proposed transmission agreement or other agreement between Transpower and a designated transmission customer increases the level of reliability above the grid reliability standards for a particular grid injection point or grid exit point.

- (2) If this clause applies, the parties to the proposed transmission agreement must confirm in writing to the Authority that—

- (a) they have consulted with affected end use customers in relation to—

- (i) the proposed service levels or the proposed increase in reliability; and

- (ii) any resulting price implications; and

- (b) there are no material unresolved issues affecting the interests of those end use customers.

- (a) they have consulted with affected end use customers in relation to—

Compare: Electricity Governance Rules 2003 rule 5.1 section II part F

Clause 12.35 Heading: amended, on 15 May 2014, by clause 32(a) of the Electricity Industry Participation (Minor Code Amendments) Code Amendment 2014.

Clause 12.35(1)(a): amended, on 15 May 2014, by clause 32(b) of the Electricity Industry Participation (Minor Code Amendments) Code Amendment 2014.

Clause 12.35(1)(a): amended, on 1 October 2023, by clause 26 of the Electricity Industry Participation Code Amendment (Default Transmission Agreement) 2023.

Clause 12.35(2): replaced, on 5 October 2017, by clause 295 of the Electricity Industry Participation Code Amendment (Code Review Programme) 2017.

12.36

Decreased service levels and reliability

- (1) This clause applies if—

- (a) a proposed transmission agreement is not consistent in all material respects with the default transmission agreement template because it decreases the service levels below those in the template; or

- (b) subject to clause 12.39, a proposed transmission agreement or other agreement between Transpower and a designated transmission customer decreases the level of reliability below the grid reliability standards for a particular grid injection point or grid exit point.

- (2) If this clause applies, the parties must obtain the Authority's approval of the proposed service levels or the lower level of reliability.

- (3) The parties must satisfy the Authority that the Authority should grant an approval under subclause (2), having regard to any potential material adverse impacts of the proposed service levels or the lower level of reliability on—

- (a) current and future service levels or reliability for any affected designated transmission customer or end use customer; and

- (b) the price paid for transmission or distribution services, or electricity, by any affected designated transmission customer or end use customer.

Compare: Electricity Governance Rules 2003 rule 5.2 section II part F

Clause 12.36 Heading: amended, on 15 May 2014, by clause 33(a) of the Electricity Industry Participation (Minor Code Amendments) Code Amendment 2014.

Clause 12.36(1)(a): amended, on 15 May 2014, by clause 33(b) of the Electricity Industry Participation (Minor Code Amendments) Code Amendment 2014.

Clause 12.36(1)(a): amended, on 1 October 2023, by clause 27 of the Electricity Industry Participation Code Amendment (Default Transmission Agreement) 2023.

12.37

Variations that may increase or decrease reliability

- If it is uncertain whether, subject to clause 12.39, a proposed transmission agreement or other agreement increases or decreases the service levels from those that would apply if the default transmission agreement template applied, or whether a proposed transmission agreement or other agreement increases or decreases the level of reliability above or below the grid reliability standards, for a particular grid injection point or grid exit point, the parties must obtain the Authority’s approval described in clause 12.36(2).

Compare: Electricity Governance Rules 2003 rule 5.3 section II part F

Clause 12.37: amended, on 1 October 2023, by clause 28 of the Electricity Industry Participation Code Amendment (Default Transmission Agreement) 2023.

12.38

Other variations from terms of default transmission agreement template

- (1) This clause applies if a proposed transmission agreement to be entered into by Transpower and a designated transmission customer under clause 12.8 is not consistent in all material aspects with the default transmission agreement template , other than a situation to which clauses 12.35 to 12.37 apply.

- (2) If this clause applies, the parties must obtain the Authority’s approval to the proposed variation from the default transmission agreement template. The parties to the proposed transmission agreement must satisfy the Authority that they have consulted with any affected end use customers and designated transmission customers in relation to the proposed variation, and there are no material unresolved issues affecting the interests of those persons.

Compare: Electricity Governance Rules 2003 rule 5.4 section II part F

Clause 12.38 heading: amended, on 1 October 2023, by clause 29(1) of the Electricity Industry Participation Code Amendment (Default Transmission Agreement) 2023.

Clause 12.38: amended, on 1 October 2023, by clause 29(2) of the Electricity Industry Participation Code Amendment (Default Transmission Agreement) 2023.

12.39

Customer specific value of expected unserved energy

- (1) [Revoked]

- (2) Transpower or a designated transmission customer may apply to the Authority—

- (a) if permitted under a transmission agreement, for provisional approval to use a different value of expected unserved energy than the value specified in clause 4 of Schedule 12.2 for the purposes of determining whether to replace or enhance connection assets as provided for under that transmission agreement; or

- (b) for approval to use a different value of expected unserved energy than the value specified in clause 4 of Schedule 12.2 for the purposes of applying the grid reliability standards under clauses 12.35 to 12.37 for a grid injection point or grid exit point, regardless of whether Transpower or the designated transmission customer has applied for the Authority's provisional approval under subclause (4).

- (3) An application under subclause (2) must be made in writing to the Authority—

- (a) in the case of an application under subclause (2)(a), within 20 business days of the designated transmission customer proposing that different value to Transpower under the transmission agreement; and

- (b) in the case of an application under subclause (2)(b), within 20 business days of the designated transmission customer reaching an agreement with Transpower to which clauses 12.35 to 12.37 apply.

- (4) If Transpower or a designated transmission customer applies for approval of a different value of expected unserved energy under subclause (2)(a), the Authority may provisionally approve that value if the Authority considers that the value is a reasonable estimate of the value of expected unserved energy in respect of the grid injection point or grid exit point for the designated transmission customer concerned.

- (5) If Transpower or a designated transmission customer applies for approval of a different value of expected unserved energy under subclause (2)(b) the Authority—

- (a) may approve that value if the Authority considers that the value is a reasonable estimate of the value of expected unserved energy in respect of the grid injection point or grid exit point for the designated transmission customer concerned; and

- (b) may decline to approve that value despite having provisionally approved that value under subclause (4).

- (6) If the Authority approves the value of expected unserved energy proposed by Transpower or the designated transmission customer under subclause (2)(b), that value of expected unserved energy applies for the purposes of applying the grid reliability standards under clauses 12.35 to 12.37 for the grid injection point or grid exit point instead of the value of expected unserved energy specified under clause 4 of Schedule 12.2.

- (7) If the Authority does not approve the value of expected unserved energy proposed by Transpower or the designated transmission customer under subclause (2)(b), the value of expected unserved energy under clause 4 of Schedule 12.2 applies for the purposes of applying the grid reliability standards under clauses 12.35 to 12.37 for the grid injection point or grid exit point.

Compare: Electricity Governance Rules 2003 rule 5.5 section II part F

Clause 12.39 Heading: amended, on 1 February 2016, by clause 48(1) of the Electricity Industry Participation Code Amendment (Code Review Programme) 2015.

Clause 12.39: amended, on 1 February 2016, by clause 48(3) of the Electricity Industry Participation Code Amendment (Code Review Programme) 2015.

Clause 12.39(1): revoked, on 1 February 2016, by clause 48(2) of the Electricity Industry Participation Code Amendment (Code Review Programme) 2015.

Clause 12.39(2)(b): amended, on 1 February 2016, by clause 48(4) of the Electricity Industry Participation Code Amendment (Code Review Programme) 2015.

Clause 12.39(4): amended, on 1 February 2016, by clause 48(5) of the Electricity Industry Participation Code Amendment (Code Review Programme) 2015.

Clause 12.39(6): amended, on 1 February 2016, by clause 48(6) and (7) of the Electricity Industry Participation Code Amendment (Code Review Programme) 2015.

Clause 12.39(7): amended, on 1 February 2016, by clause 48(8) of the Electricity Industry Participation Code Amendment (Code Review Programme) 2015.

12.40

Replacement and enhancement of shared connection assets

- (1) If 2 or more designated transmission customers are connected to a point of connection and Transpower has advised those designated transmission customers, in accordance with the provisions of a transmission agreement between Transpower and each of the designated transmission customers, that a grid reliability report published by Transpower in accordance with clause 12.76 sets out that the power system is not reasonably expected to meet the N-1 criterion at all times over the next 5 years because of a connection asset related to that point of connection, Transpower must—

- (a) as soon as practicable after advising the designated transmission customers, investigate whether the connection asset meets the grid reliability standards; and

- (b) if it finds that the connection asset does not meet the grid reliability standards, develop proposals for investment in the grid to ensure that the connection asset meets the grid reliability standards and propose them to the designated transmission customers as soon as reasonably possible after publication of the grid reliability report.

- (2) Transpower and the designated transmission customers advised under subclause (1) must attempt in good faith, within 6 months of the date on which Transpower makes its proposals to the designated transmission customers under subclause (1)(b), or such longer period as the Authority may allow, to reach an agreement for an investment or other solution that will have the effect of—

- (a) maintaining the level of reliability for the connection asset at the level of reliability in the grid reliability standards; or

- (b) increasing or decreasing the level of reliability for the connection asset above or below the grid reliability standards, so long as Transpower and the designated transmission customers have complied with clauses 12.35 to 12.37 and 12.39.

- (3) Transpower may undertake an investment proposed under subclause (2) only—

- (a) if the designated transmission customers unanimously agree with the proposal in accordance with subclause (2); or

- (b) if the designated transmission customers do not unanimously agree or none of the designated transmission customers agree with the proposed investment, if—

- (i) the proposal has been approved under a grid upgrade plan requested by the Electricity Commission in accordance with rule 5.10 of section II of part F of the rules before this Code came into force; or

- (ii) the proposal is approved by the Commerce Commission under an investment proposal requested by the Commerce Commission in accordance with clause 12.44(1); or

- (iii) the proposal is permitted under an input methodology determined by the Commerce Commission under section 54S of the Commerce Act 1986.

Compare: Electricity Governance Rules 2003 rule 5.6 section II part F

Clause 12.40(1): amended, on 23 February 2015, by clause 75 of the Electricity Industry Participation Code Amendment (Distributed Generation) 2014.

Clause 12.40(1): amended, on 5 October 2017, by clause 296 of the Electricity Industry Participation Code Amendment (Code Review Programme) 2017.

Clause 12.40(1) and (2): amended, on 1 November 2018, by clause 76(a) and (b) of the Electricity Industry Participation Code Amendment (Code Review Programme) 2018.

12.41

Removal of shared connection assets from service

- (1) If 2 or more designated transmission customers are connected to a point of connection, and Transpower is required by a transmission agreement between Transpower and each of those designated transmission customers to provide the connection assets at the point of connection, Transpower may decommission a connection asset at that point of connection from service only—

- (a) if the designated transmission customers unanimously agree with the decommissioning and clauses 12.35 to 12.37 (if applicable) are complied with; or

- (b) if the designated transmission customers do not unanimously agree, or none of the designated transmission customers agree, with the decommissioning, if the decommissioning results in a net benefit, as calculated under the test set out in clause 12.43.

- (2) To avoid doubt, this clause applies only if Transpower proposes to remove a connection asset from service and not replace the asset with another connection asset.

Compare: Electricity Governance Rules 2003 rule 5.7 section II part F

Clause 12.41(1): amended, on 23 February 2015, by clause 75 of the Electricity Industry Participation Code Amendment (Distributed Generation) 2014.

Clause 12.41(1): amended, on 5 October 2017, by clause 297 of the Electricity Industry Participation Code Amendment (Code Review Programme) 2017.

12.42

Reconfiguration of shared connection assets

- If 2 or more designated transmission customers are connected to a point of connection, and Transpower is required by a transmission agreement between Transpower and each of those designated transmission customers to provide the connection assets in the configuration specified in each of those transmission agreements, Transpower may only change that configuration—

- (a) if the designated transmission customers unanimously agree with the reconfiguration and clauses 12.35 to 12.37 (if applicable) are complied with; or

- (b) if the designated transmission customers do not unanimously agree, or none of the designated transmission customers agree with the reconfiguration, if the reconfiguration results in a net benefit, as calculated under the test set out in clause 12.43.

Compare: Electricity Governance Rules 2003 rule 5.8 section II part F

Clause 12.42: amended, on 23 February 2015, by clause 75 of the Electricity Industry Participation Code Amendment (Distributed Generation) 2014.

Clause 12.42: amended, on 5 October 2017, by clause 298 of the Electricity Industry Participation Code Amendment (Code Review Programme) 2017.

12.43

Net benefits test

- (1) When Transpower is required to apply a net benefit test, Transpower must—

- (a) estimate the following costs:

- (i) any additional fuel costs incurred by a generator in respect of any generating units that will be dispatched or are likely to be dispatched during or after the removal of the connection asset or the reconfiguration of the connection assets, arising as a result of the removal or reconfiguration:

- (ii) any direct labour and material costs that will be incurred by Transpower and the designated transmission customers undertaking the removal of the connection asset or the reconfiguration of the connection assets:

- (iii) any increase in the estimate of expected unserved energy in MWh multiplied by the value per MWh of that expected unserved energy, arising as a result of the removal of the connection asset or the reconfiguration of the connection assets:

- (iv) any of the following costs, if the cost is to a person that produces, transmits, retails, or consumes electricity in New Zealand:

- (A) changes in fuel costs of existing assets, committed projects and modelled projects:

- (B) changes in the value of involuntary demand curtailment:

- (C) changes in the costs of demand-side management:

- (D) changes in costs resulting from deferral of capital expenditure on modelled projects:

- (E) changes in costs resulting from differences in the amount of capital expenditure on modelled projects:

- (F) changes in costs resulting from differences in operations and maintenance expenditure on existing assets, committed projects, and modelled projects:

- (G) changes in costs for ancillary services:

- (H) changes in losses, including local losses:

- (I) subsidies or other benefits provided under or arising pursuant to all applicable laws, regulations and administrative determinations:

- (J) the value of the expected change in economic surplus due to a change in competition among participants arising as a result of the removal of the connection asset or the reconfiguration of the connection assets, excluding any expected change in economic surplus due to a change in another cost in this net benefit test:

- (v) any other relevant cost to a person that produces, transmits, retails or consumes electricity in New Zealand; and

- (b) estimate the following benefits:

- (i) any reduction in maintenance costs arising as a result of the removal of the connection asset or the reconfiguration of the connection assets (including Transpower’s and any designated transmission customer’s costs):

- (ii) any reduction in fuel costs incurred by a generator in respect of any generating units, arising or likely to arise during or after the removal of the connection asset or the reconfiguration of the connection assets, as a result of the removal or reconfiguration:

- (iii) any decrease in the estimate of expected unserved energy in MWh multiplied by the value per MWh of that expected unserved energy, arising as a result of the removal of the connection asset or the reconfiguration of the connection assets:

- (iv) any of the following benefits, if the benefit is to a person that produces, transmits, retails or consumes electricity in New Zealand:

- (A) changes in fuel costs of existing assets, committed projects and modelled projects:

- (B) changes in the value of involuntary demand curtailment:

- (C) changes in the costs of demand-side management:

- (D) changes in costs resulting from the deferral of capital expenditure on modelled projects:

- (E) changes in costs resulting from differences in the amount of capital expenditure on modelled projects:

- (F) changes in costs resulting from differences in operations and maintenance expenditure on existing assets, committed projects, and modelled projects:

- (G) changes in costs for ancillary services:

- (H) changes in losses, including local losses:

- (I) subsidies or other benefits provided under or arising pursuant to all applicable laws, regulations and administrative determinations:

- (J) the value of the expected change in economic surplus due to a change in competition among participants arising as a result of the removal of the connection asset or the reconfiguration of the connection assets, excluding any expected change in economic surplus due to a change in another benefit in this net benefit test:

- (v) any other relevant benefit to a person that produces, transmits, retails or consumes electricity in New Zealand; and

- (c) deduct the costs estimated under paragraph (a) from the benefits estimated under paragraph (b) to determine the net benefit of the proposed removal of the connection asset or the reconfiguration of the connection assets.

- (a) estimate the following costs:

- (2) Transpower may apply the test under this clause at differing levels of rigour in different circumstances, which may include taking into account the number of assets to be removed or reconfigured, the value of the assets involved, and the size of the load served by the assets.

- (3) Transpower is only required to—

- (a) make a reasonable estimate of the costs and benefits identified in subclause (1), based on information reasonably available to it at the time it undertakes the test, and taking into account the proposed number of assets to be removed or reconfigured, the value of the assets involved, and the size of the load served by the assets; and

- (b) take account of events that can be reasonably foreseen.

- (4) Transpower’s estimate of fuel costs under subclause (1) must—

- (a) in relation to thermal generating stations, be a reasonable estimate of the fuel costs, based on the economic value of the fuel required for the relevant thermal generating station, and justified by Transpower with reference to opinions on the economic value of the fuel, provided by 1 or more independent and suitably qualified persons; and

- (b) in relation to hydroelectric generating stations—

- (i) be a reasonable estimate of the fuel costs, based on the economic value of the water stored at a hydroelectric generating station, provided by a suitably qualified person other than—

- (A) Transpower; or

- (B) an employee of Transpower; and

- (ii) be published, as provided for in the Outage Protocol.

- (i) be a reasonable estimate of the fuel costs, based on the economic value of the water stored at a hydroelectric generating station, provided by a suitably qualified person other than—

- (5) The direct labour costs of Transpower and designated transmission customers under subclause (1)(a) may include any amounts paid to contractors, but must not include any apportionment of the overheads or office costs of Transpower or designated transmission customers.

- (6) The material costs of Transpower and designated transmission customers under subclause (1)(a) are the costs of the materials used in carrying out the work during the removal of the connection asset or the reconfiguration of the connection assets.

- (7) In assessing costs and benefits under subclause (1), Transpower must consider any reasonably expected operating conditions, forecasts in the system security forecast, likely fuel costs, and any other reasonable assumptions.

- (8) The estimate of expected unserved energy in MWh multiplied by the value per MWh of that expected unserved energy under subclause (1) must be based on—

- (a) the estimated amount and value of the expected unserved energy as agreed between Transpower and each affected designated transmission customer; or

- (b) if Transpower and a designated transmission customer cannot agree on the amount and value of the expected unserved energy under paragraph (a), the value of expected unserved energy in clause 4 of Schedule 12.2 and Transpower’s estimate of the expected unserved energy in respect of each affected designated transmission customer and end use customer.

Compare: Electricity Governance Rules 2003 rule 5.9 section II part F

Clause 12.43: substituted, on 16 December 2013, by clause 5 of the Electricity Industry Participation (Urgent Temporary Grid Reconfiguration) Code Amendment 2013.

Clause 12.43(8)(b): amended, on 1 February 2016, by clause 49 of the Electricity Industry Participation Code Amendment (Code Review Programme) 2015.

Clause 12.43(8)(b): amended, on 1 November 2018, by clause 77 of the Electricity Industry Participation Code Amendment (Code Review Programme) 2018.

12.44

Request to the Commerce Commission to request an investment proposal be submitted

- (1) Transpower may request in writing that the Commerce Commission request that Transpower submit an investment proposal to the Commerce Commission—

- (a) for the purposes of clause 12.40(3); or

- (b) if permitted by a transmission agreement.

- (2) Unless requested to do so by the Commerce Commission, Transpower must not submit an investment proposal to the Commerce Commission for approval in respect of an investment that has been proposed by Transpower in accordance with a transmission agreement or clause 12.40(3).

Compare: Electricity Governance Rules 2003 rules 5.10 section II, and 12.2.2 section III part F

Resolutions of disputes

12.45

Certain disputes relating to transmission agreements may be referred to Rulings Panel

- If a dispute between Transpower and a designated transmission customer concerning—

- (a) the customer specific terms of a transmission agreement being negotiated between those parties; or

- (b) a requested variation of any of the terms of a default transmission agreement (other than a variation under clause 12.12) that applies between Transpower and the designated transmission customer in accordance with clauses 12.10 to 12.13 (including a requested variation from the services described in the default transmission agreement); or

- (c) the schedules proposed by Transpower under clauses 12.10(2)(b)(v) to (viii), or as amended by Transpower under clause 12.10(2)(c) or

- (d) any revision to Schedule 4 or Schedule 5 of a default transmission agreement proposed by Transpower under clause 12.12; or

- (e) the schedules proposed or amended by Transpower under clause 12.13 on the expiry or termination of a transmission agreement—

- is not resolved within a reasonable time, either party may refer the matter to the Rulings Panel for determination.

Compare: Electricity Governance Rules 2003 rule 6.1 section II part F

Clause 12.45(b), (c), and (d): amended, on 1 October 2023, by clause 30(1) of the Electricity Industry Participation Code Amendment (Default Transmission Agreement) 2023.

Clause 12.45(c): amended, on 1 October 2023, by clause 30(2) of the Electricity Industry Participation Code Amendment (Default Transmission Agreement) 2023.

Clause 12.45(e): amended, on 1 October 2023, by clause 30(3) of the Electricity Industry Participation Code Amendment (Default Transmission Agreement) 2023.

12.46

Rulings Panel has discretion to determine dispute

- (1) The Rulings Panel may, in its discretion, decide whether or not to undertake the determination of a dispute under clause 12.45(a) or (b).

- (2) If the Rulings Panel decides not to undertake the determination of the dispute, the Rulings Panel must inform Transpower or the designated transmission customer—

- (a) that the Rulings Panel intends to do no more in relation to the matter; and

- (b) of the reasons for that intention.

Compare: Electricity Governance Rules 2003 rule 6.2 section II part F

12.47

Determinations by Rulings Panel

- (1) In determining a dispute under this clause, the Rulings Panel must take into account—

- (a) the principles for the default transmission agreement template in clause 12.30; and

- (b) the desirability of consistent treatment of designated transmission customers except if special circumstances justify a departure; and

- (c) the potential impact of a decision on the contents of other transmission agreements or existing agreements as described in clauses 12.49 and 12.50.

- (2) The Rulings Panel must not determine disputes relating to the interpretation or enforcement of a transmission agreement.

- (3) The Rulings Panel must give notice to the parties of its determination, as soon as reasonably practicable.

Compare: Electricity Governance Rules 2003 rules 6.3 and 6.4 section II part F

Clause 12.47(1)(c): amended, on 16 December 2013, by clause 6 of the Electricity Industry Participation (Revocation of Part 16) Code Amendment 2013.

Clause 12.47(1)(a): amended, on 1 October 2023, by clause 31(1) of the Electricity Industry Participation Code Amendment (Default Transmission Agreement) 2023.

Clause 12.47(2): amended, on 1 October 2023, by clause 31(2) of the Electricity Industry Participation Code Amendment (Default Transmission Agreement) 2023.

12.48

Status of default transmission agreement while Rulings Panel determining dispute

- Nothing in clauses 12.45 to 12.47 overrides the application of a default transmission agreement pending a determination of the Rulings Panel.

Compare: Electricity Governance Rules 2003 rule 6.5 section II part F

Clause 12.48: amended, on 1 October 2023, by clause 32 of the Electricity Industry Participation Code Amendment (Default Transmission Agreement) 2023.

Existing agreements not affected

12.49

Existing agreements

- (1) Except as provided for by clauses 12.50B and 12.95, this Part does not apply to or affect the rights, powers or obligations of a participant or Transpower under a written agreement entered into between that participant and Transpower for connection to and/or use of the grid that is—

- (a) entered into before 29 October 2003; or

- (b) based on Transpower’s standard connection contract and entered into before 28 June 2007.

- (2) The exceptions from this Part in subclause (1) do not apply to a right, power or obligation of a participant that arises because of the variation of an agreement described in subclause (1).

- (3) To avoid doubt, the posted terms and conditions of Transpower do not constitute a written agreement.

Compare: Electricity Governance Rules 2003 rule 8.1 section II part F

Clause 12.49(1): amended, on 23 February 2015, by clause 75 of the Electricity Industry Participation Code Amendment (Distributed Generation) 2014.

Clause 12.49(1): amended, on 5 October 2017, by clause 299 of the Electricity Industry Participation Code Amendment (Code Review Programme) 2017.

Clause 12.49(1): amended, on 1 October 2023, by clause 33(1) of the Electricity Industry Participation Code Amendment (Default Transmission Agreement) 2023.

Clause 12.49(2): amended, on 1 October 2023, by clause 33(2) of the Electricity Industry Participation Code Amendment (Default Transmission Agreement) 2023.

12.50

Copies of other agreements to be provided to Authority

- If requested to do so by the Authority, Transpower or a participant must provide a copy of any written agreement for connection to and/or use of the grid that Transpower or the participant is a party to and that was entered into before 28 June 2007, including any amendments.

Compare: Electricity Governance Rules 2003 rule 8.2 section II part F

Clause 12.50(1): amended, on 23 February 2015, by clause 75 of the Electricity Industry Participation Code Amendment (Distributed Generation) 2014.

Clause 12.50(1): amended, on 5 October 2017, by clause 300 of the Electricity Industry Participation Code Amendment (Code Review Programme) 2017.

Clause 12.50: amended, on 1 October 2023, by clause 34 of the Electricity Industry Participation Code Amendment (Default Transmission Agreement) 2023.

12.50A

Amending default transmission agreement template

- (1) An amendment of the default transmission agreement template must have regard to the purpose, principles, and content of the default transmission agreement template in clause 12.29 to 12.31.

- (2) An amendment of the Connection Code must be carried out in accordance with clause 12.18.

- (3) For the purpose of this clause and clause 12.50B an amendment of the default transmission agreement template includes a replacement of the agreement.

Clause 12.50A: inserted, on 1 October 2023, by clause 35 of the Electricity Industry Participation Code Amendment (Default Transmission Agreement) 2023.

12.50B

Effect of amendment of default transmission agreement template on existing agreements

- (1) This clause applies when the Authority amends the default transmission agreement template.

- (2) Subject to subclause (3), all transmission agreements and agreements referred to in clause 12.49(1) are deemed to be amended to the extent necessary to make them consistent with an amendment to the default transmission agreement template, from the date of the amendment.

- (3) Subclause (2) applies except where an amendment to the default transmission agreement template provides otherwise.

Clause 12.50B: inserted, on 1 October 2023, by clause 35 of the Electricity Industry Participation Code Amendment (Default Transmission Agreement) 2023.

12.50C

Effect of first default transmission agreement template

- Despite anything else in this Code, agreements referred to in clause 12.49(1) are deemed to be amended in respect of the first default transmission agreement template inserted into this Code, only to the extent necessary to make them consistent with Part D of that template.

Clause 12.50C: inserted, on 1 October 2023, by clause 35 of the Electricity Industry Participation Code Amendment (Default Transmission Agreement) 2023

12.51

[Revoked]

Compare: Electricity Governance Rules 2003 rule 8.3 section II part F

Clause 12.51: revoked, on 16 December 2013, by clause 7 of the Electricity Industry Participation (Revocation of Part 16) Code Amendment 2013.

Subpart 3—Grid reliability and industry information

12.52

Contents of this subpart

- This subpart relates to—

- (a) grid reliability standards; and

- (b) investment contracts; and

- (c) [Revoked]

- (d) grid reliability reporting.

Compare: Electricity Governance Rules 2003 rule 1 section III part F

Clause 12.52(c): revoked, on 1 February 2016, by clause 50 of the Electricity Industry Participation Code Amendment (Code Review Programme) 2015.

12.53

Purpose of the reliability and industry information clauses

- The purposes of this subpart are to—

- (a) facilitate Transpower’s ability to develop and implement long term plans (including timely securing of land access and resource consents) for investment in the grid; and

- (b) assist participants to identify and evaluate investments in transmission alternatives; and

- (c) facilitate efficient investment in generation; and

- (d) facilitate any processes pursuant to Part 4 of the Commerce Act 1986.

Compare: Electricity Governance Rules 2003 rule 2 section III part F

12.54

Obligations to provide information

- (1) Each participant must provide information reasonably required by the Authority for the purposes of this subpart and respond to requests from the Authority under this subpart promptly and accurately.

- (2) Each participant must use reasonable endeavours to provide accurate information.

- (3) The Authority is not liable for the accuracy of information provided by a participant.

- (4) Subject to the Official Information Act 1982, the Authority may at its discretion, or on the application of an affected party, withhold publication of confidential aspects of the information provided by a participant to the Authority if the Authority reasonably considers that there is good reason for withholding it.

Compare: Electricity Governance Rules 2003 rule 3 section III part F

Grid reliability standards

12.55

Authority determines grid reliability standards

- (1) The Authority must determine the most appropriate grid reliability standards.

- (2) The Authority must consider and determine grid reliability standards, having regard to the purposes set out in clause 12.56 and the principles set out in clause 12.57.

- (3) The grid reliability standards that apply at the commencement of this Code are the grid reliability standards in Schedule 12.2.

Compare: Electricity Governance Rules 2003 rule 4.1 section III part F

12.56

Purpose of grid reliability standards

- The purpose of the grid reliability standards is to provide a basis for Transpower and other parties to appraise opportunities for transmission investments and transmission alternatives.

Compare: Electricity Governance Rules 2003 rule 4.2 section III part F

12.57

Principles of grid reliability standards

- The grid reliability standards should—

- (a) take into account that transmission investments are long-lived assets and require a long-term planning perspective; and

- (b) reflect the public interest in reasonable stability in planning, having regard to the long term nature of investment in transmission assets; and

- (c) be consistent with good electricity industry practice; and

- (d) provide flexibility to allow the form of the standards to evolve over time, reflecting any changes in good electricity industry practice.

Compare: Electricity Governance Rules 2003 rule 4.3 section III part F

12.58

Content of grid reliability standards

- (1) The grid reliability standards must contain 1 or more standards for reliability of the grid, which may include without limitation a primary reliability standard and other reliability standards.

- (2) The reliability standards set out in the grid reliability standards may differ to reflect differing circumstances in different regions supplied by the grid.

- (3) The grid reliability standards may include 1 or more standards for reliability of the core grid.