Eye on electricity

Generation investment pipeline: updates and insights

- Generation

In July 2025, the Electricity Authority Te Mana Hiko (Authority) published a new generation investment pipeline dashboard showing the planned generation projects in Aotearoa New Zealand. At launch, the dashboard included details about where projects were located, their size, status and expected commissioning as a static view only. We have now expanded the dashboard to include previous months’ data, and data on load projects.

The dashboard is updated monthly using data collected by Transpower, as required by the Authority. It’s important that developers provide Transpower with updates on projects as soon as possible to ensure that the dashboard stays up to date.

New features

Viewers can now compare data from different months to see how the generation pipeline has changed over time. We have also added a graphic to show changes in project statuses between any two months. For example, the dashboard currently shows that 958MW moved from the ‘other’ to ‘actively pursued’ stage between June and August 2025.

The dashboard now includes the option to filter data, to provide additional insights. Filtering by expected commissioning year and project status reveals that, as of August 2025, most ‘other’ and ‘actively pursued’ capacity is expected to be commissioned in 2031 due to several planned offshore wind projects. The second most common commissioning year for actively pursued projects is 2027 with over 500MW of planned solar generation.

Information on load projects

The dashboard now includes insights into new load projects, which provides a more complete picture of future national electricity supply and demand, helping developers make informed investment decisions. The load summary view shows 31 load projects in the August 2025 pipeline, with a combined capacity of 1,780MW. 64% of these projects by capacity are data centres.

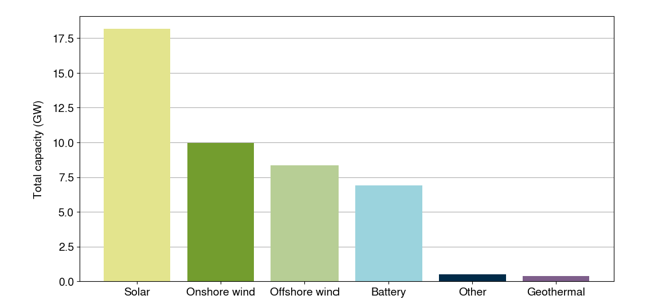

Solar and wind projects make up the majority of the pipeline, with battery projects increasing

There are 289 new generation projects in the pipeline as at 31 August 2025, with a combined total capacity of 44.29GW. This comes from nine different types of generation which can be grouped into two categories: intermittent (eg, solar and wind), where power output fluctuates depending on weather conditions, and firming (eg, battery and geothermal), which can generate at any time. Batteries can discharge if they have enough charge.

Currently, 82% of pipeline capacity comes from intermittent renewable projects. Increasing renewable generation is key to decarbonising New Zealand’s economy and can help lower wholesale prices when wind and solar generation are high, as discussed in a previous Eye on electricity article.

However, if the wind stops blowing or the sun goes behind a cloud, there must be enough firming generation to meet demand. This could be provided by existing generation capacity, most of which is capable of firming, as well as new firming generation projects.

Of the 160 new solar projects, 30 are being built with batteries. Batteries can be charged when there is plenty of sunshine and demand for electricity is low, usually in the middle of the day. That power can then be supplied back to the grid when it is needed most. Three new battery projects have been added to the pipeline since June.

Not every project in the pipeline will be built

With the current national generation capacity of ~10.6GW and demand at ~41.5TWh in 2024, it may be uneconomical to build all 44.3GW of projects in the pipeline, even with retirement of the current thermal generators and the signalled increased load entering the system.

New generation plants are significant investments for developers, and the complexity of these projects means it can take a long time to decide on feasibility before construction can begin. Early-stage projects can therefore drop out of the pipeline if they are not viable.

Before the end of June, Transpower marked projects in its connection queue as ‘cancelled’ if they had not heard back from the developer after multiple contact attempts. Since the end of June until August 2025 no further projects have been cancelled. One project has changed ownership.

More new generation planned for the Waikato than any other region

The data includes the locations of projects so we can see where investment in new generation is taking place. We currently know the locations of 268 projects and encourage developers to provide Transpower with this information.

Of projects with known locations, 66% of planned capacity is in the North Island, with more in the Waikato (7.2GW) than any other region. Currently there is higher electricity demand in the North Island, but most generation capacity is in the South Island. A small amount of electricity is lost in transmission, and this amount increases the further it needs to travel, so it is more efficient to build generation close to where demand is highest.

New insights will be available monthly

This dashboard will be updated monthly to provide the most up-to-date information available*. New features will also be added as the data evolves, so watch this space!

View the generation investment pipeline dashboard

*This information is published on a best-endeavours basis. It should not be considered as definitive and is subject to change. The Electricity Authority takes no responsibility for the completeness, accuracy or reliability of this information.

Related News

Tracking efforts to maximise local electricity generation

A new tracker shows the progress of distributors voluntarily increasing their default export limit for residential connections to 10kW or more. The tracker s…

How accurate wind and solar forecasts and the new forecasting arrangement are crucial

Last year, the Authority introduced a hybrid forecasting arrangement and awarded DNV Services a contract to provide centralised wind and solar forecasting …

Deadline extended for feedback on Task Force work programme

On 15 December the Energy Competition Task Force published an open letter to stakeholders. Seeking feedback on potential competition-based issues in the electr…