Eye on electricity

Strong inflows push hydro storage above nominal full

- Generation

- Prices

Rainy spring weather and snowmelt have caused national hydro storage in New Zealand to increase beyond ‘nominal full’1 capacity - and to its highest level since June 2023. This article explains how high hydro levels impact wholesale electricity prices and security of supply heading into 2026.

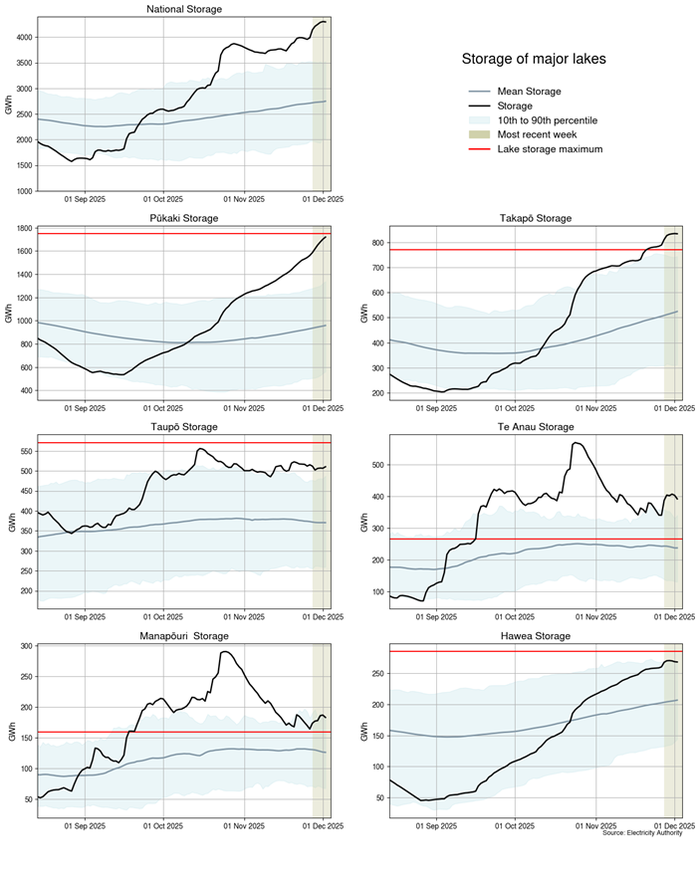

Total controlled national hydro storage is currently well above its historic 90th percentile, at 102% of nominal full and 149% of the historic average for this time of year (as of 2 December 2025). All the major catchment lakes are above or close to their consented maximums (Figure 1).

A number of these lakes have exceeded their storage capacities during spring, including Lake Te Anau, Lake Manapōuri and most recently Lake Takapō.

When hydro storage lakes exceed their maximum consented levels, this excess water must be spilled. Some hydro chains can spill water into head ponds further along in a generation chain, so not all the generation potential is lost.

Lakes Te Anau and Manapōuri have been spilling since mid-September, while Lake Takapō began spilling last week.

The other major catchment lakes are also particularly full for this time of year. Lake Pūkaki is 99% full and is expected to start spilling water this week. Lake Taupō is 89% full, while Lake Hawea is 94% full.

Spring hydro inflows are higher than usual

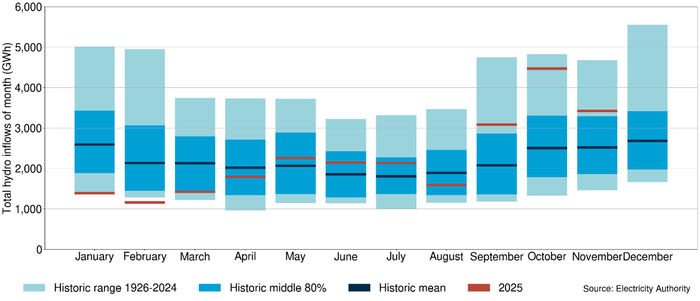

Thanks to rainy spring conditions, hydro inflows have been in the top 10% of historic inflows for the last three months (Figure 2). October, in particular, experienced high levels of inflows at nearly double the historic mean.

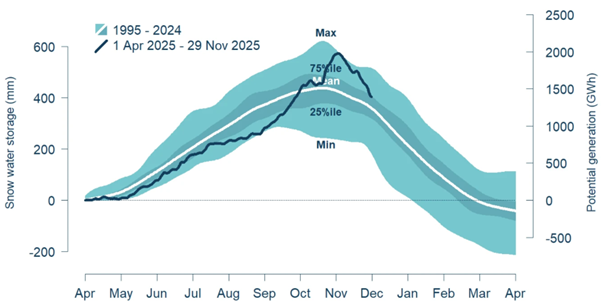

Snow storage is another important component of hydro inflows alongside rain, as water from snowmelt is captured by storage lakes. November saw high levels of snowmelt, with snow storage declining steeply over the course of the month (Figure 3).

Snow storage is still currently above mean, which means further inflows from snowmelt are expected. However, if snow melts into already full lakes, this water may spill.

Drop in average spot prices as storage increases

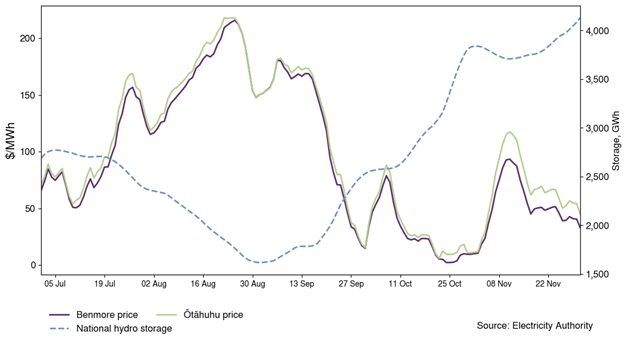

Since 1 July, New Zealand’s average wholesale electricity prices peaked in August when hydro storage was declining. However, since early September, storage has been improving. Prices were extremely low in late October when a very high proportion of generation was from renewables (Figure 4).

There were increased geothermal outages in November which meant more thermal baseload was needed. Daily average prices have remined below $100/MWh since 11 November, with one exception on 18 November, when wind generation was below forecast.

With plenty of water in the power system, New Zealand is well placed going into potentially drier summer conditions. High levels of hydro storage should mean there is less need for hydro generators to conserve water, resulting in higher hydro generation and lower spot prices in the short-term. However, if inflows decline over the summer and autumn, generators may begin conserving water ahead of winter 2026.

Monitoring the market

The Trading Conduct rule ensures wholesale electricity prices reflect underlying market conditions.

The Electricity Authority Te Mana Hiko monitors the market and the activity of industry participants to ensure wholesale prices reflect the underlying supply and demand conditions in the market.

We publish weekly trading conduct reports. If we identify suspected non-compliance with the trading conduct rule, we mark these cases for further analysis. This often involves requesting more information from industry participants. Cases may be passed to the Authority’s compliance team, and escalated to the Rulings Panel, if there is a potential Code breach.

1. Some lakes have exceeded their maximum consented range and others are still below, but the current combined hydro storage has exceeded all lake consented capacities combined.

Related News

Next steps in our network pricing reform work

The Electricity Authority welcomes Transpower’s consultation for its operational review of the Transmission Pricing Methodology. Efficient network pricing is e…

Policy changes to strengthen dry year risk management

The Electricity Authority Te Mana Hiko has approved changes to the Security of Supply Forecasting and Information Policy to improve certainty and better suppor…

Electricity Authority launches new consultation on non-discrimination obligations

The Electricity Authority Te Mana Hiko has launched a further consultation on certain aspects of the proposed non-discrimination obligations, which are aimed a…