Eye on electricity

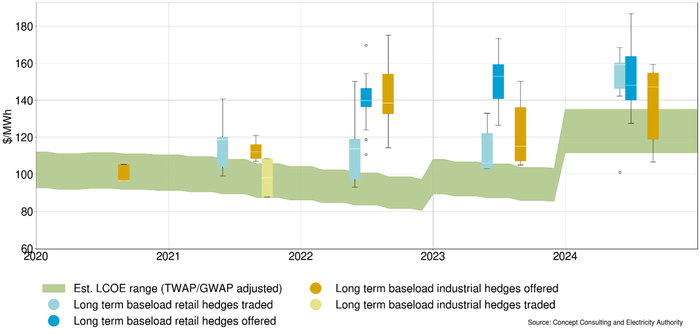

Electricity hedge prices compared to new estimate of the LCOE

- Generation

- Wholesale

In an 'Eye on electricity' article in June, we compared the prices of long and short hedges to estimates of the levelised cost of electricity (LCOE) and short run marginal cost (SRMC) of thermal generator fuels. The main conclusion of that article was that shorter-term hedges — those with durations of five years or less — tend to be within the range of short-term ASX prices. Larger and/or longer hedges tend to be priced well below the average overlapping ASX curve and instead are closer to the LCOE.

We have updated this analysis to include a new LCOE estimate. We use LCOE data from energy sector specialist Concept Consulting for dates before 2024, and a new LCOE estimate based on disclosures from completed new generation from 2024. Our analysis shows the LCOE in the near term has risen1. Offered hedges mostly lie in and above the adjusted LCOE range for 2024.

This analysis also now includes hedges offered to electricity retailers, where the contract length was between five and 15 years.

By providing hedge price and LCOE price information to the wider market, market participants can be confident in the competitiveness of the hedge market.

How hedging is used to manage the risk of high electricity prices

Electricity consumers, including industrial users and electricity retailers, can use the hedge market to manage their exposure to high wholesale electricity prices. All market participants make decisions around their hedging position over time. The Authority requires participants to use a standardised series of stress tests to assist them in doing this.

Market participants also make decisions on their level of exposure to spot prices, and for managing that exposure on an ongoing basis. While there are advantages to being under-hedged, including being able to take advantage of low prices, there are downsides when spot prices are high.

How the LCOE is estimated

The Authority calculated its own estimated LCOE for 2024 onwards by collecting information from new generation projects. The LCOE calculations result from two wind farms, two solar farms and one geothermal site.

The following information was collected:

- capacity in megawatts (MW)

- the capacity factor

- the expected annual energy output in MWh

- the expected lifetime of the asset in years

- the capital cost (capex) of the project in $NZ

- the expected annual cost (opex) in $NZ.

From this information, the LCOE was estimated for each project with the details posted at the end of this article. These LCOEs have then been adjusted to be equivalent to baseload at Ōtāhuhu, by multiplying the ratio of the time weighted average price estimate (TWAP2) and generation weighted average price (GWAP). Because wind and solar are intermittent, this adjustment alters the price to what it would be if the hedge were ‘flat’. For solar and wind, this increases the LCOE price as other generation must be ‘priced in’ to these hedges to smooth them out.

Figure 1 shows how the estimated LCOE from both Concept Consulting (pre-2024) and the Authority LCOE estimate (2024) compared to the price of long-duration (greater than five years) industrial and retail baseload3 hedges.

The retail hedges exclude ‘winter only’ hedges. Retail hedges have been split into traded, (where the hedge was bought by a retailer), and offered (where a hedge offer was declined). Offered hedges include early-stage indicative offers, which may not represent the final price of these hedges if they had progressed further into negotiations. Data for 2025 is not included as it is incomplete. Please note this data was submitted on a ‘best endeavours’ basis and may include all hedges available in previous years.

Industrial hedges have been split into traded and non-traded, however, traded hedges have only been plotted in years where there is enough data to do so.

Not all hedges will have been offered with consistent contract terms and conditions. The variation in this may explain some of the variation in hedge prices, so hedge offers can’t always be directly compared to each other.

For 2021 hedges, data submitted to the Authority only included retail traded hedges (light blue), and these were generally priced below $120/MWh and close to the LCOE. Retail traded hedges in 2022 and in 2023 were generally lower than retail offered hedges during that same year, with most priced below $120/MWh. In 2024 the price of traded retail prices increased, as did the LCOE estimate.

Industrial hedges sat close to the estimated LCOE in 2021, and several offered hedges were accepted. However, price ranges increased in 2022-23. There were some accepted offers, but these are not shown due to their small number. Similar to offers made to retailers, the offer prices made to industrials increased from 2023 to 2024, alongside an increase in estimated LCOE.

Increasing information around hedges and the LCOE

Competitive hedge prices are important for the electricity sector. They allow both hedge buyers and sellers to manage their exposure to high and low spot prices over the short and long term. The Authority is increasing its monitoring of both the hedge market and the LCOE.

By collecting information from new generation sites, which is published through our generation investment pipeline dashboard, an estimated LCOE can be calculated annually.

The Authority has also consulted on a proposed clause 2.16 information notice to improve monitoring and transparency of the over-the-counter4 (OTC) market. This information can be used to compare hedge offer prices to an estimated LCOE and ASX baseload prices.

Details of the calculation

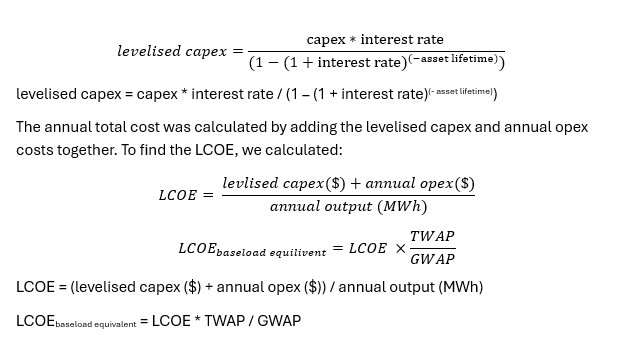

An interest rate level over the lifetime of the asset was assumed to be 10%. Then a levelised capex has been calculated using capex, interest rate and asset lifetime.

The annual total cost was calculated by adding the levelised capex and annual opex costs together. To find the LCOE we calculated:

1. Based on a discount rate of 10%.

2. The GWAP/TWAP ratio indicates the proportion of the baseload ie, TWAP price captured by a generation type. It has been estimated from historical data.

3. We have also included hedges which span 6am-12pm.

4. All hedges traded outside the ASX ie, peer-to-peer trading.

Related News

Tracking efforts to maximise local electricity generation

A new tracker shows the progress of distributors voluntarily increasing their default export limit for residential connections to 10kW or more. The tracker s…

Quarterly update: progress on MDAG recommendations strengthens the security and resilience of the electricity system

This is the Authority’s latest quarterly update on how we are implementing the recommendations in the Market Development Advisory Group’s final report. It cove…

How accurate wind and solar forecasts and the new forecasting arrangement are crucial

Last year, the Authority introduced a hybrid forecasting arrangement and awarded DNV Services a contract to provide centralised wind and solar forecasting …