Eye on electricity

Exchange traded electricity futures margins update

- Distribution

- Retail

- Wholesale

In June 2022, the Australian Securities Exchange (ASX) released the latest margin requirements for exchange traded New Zealand electricity futures. This latest update remains consistent with the changes to margin requirements adopted in September 2021.

In September 2021 margin percentages changed with the majority of ASX New Zealand electricity base load and peak futures experiencing increases. For some products such as near-term Otahuhu Base Quarter Futures, the initial margin for New Zealand base load electricity futures can be at 45% of the total contract value. This has primarily been a reflection of higher energy prices and greater volatility in the global energy markets.

Whenever a futures contract is traded, an end-user will be required to post an initial margin with their Clearing Participant, who pay margins to ASX Clear (Futures) (the clearing house). A margin is held by the clearing house to cover the risk to the exchange if a Clearing Participant were to default. As well as initial margins, additional margin may be required to cover for changes in the market value of the contract, these additional margins are known as variation margin.

New Zealand electricity futures can be traded on the ASX platform with margins calculated by ASX Clear (Futures) and collected from each Clearing Participant. To access the ASX platform, end-users may need to use a Trading Participant, who has access to a Clearing Participant. A Clearing Participant may impose different margin requirements to ASX Clear (Futures).

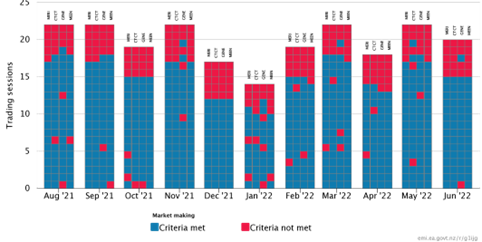

The Authority recently made changes to market-making services that will go live on 1 September 2022 and will improve the ability for end-users to operate in the futures market. The Authority anticipates that these changes will result in fewer periods where all market makers are absent from the futures market. This will reduce price uncertainty because there will be more trading days with market makers and improved liquidity in the form of volume depth in the futures market. The greater liquidity at the end of a calendar month will provide end-users with more volume to trade into and will likely assist them in the management of their futures inventory.

The Authority acknowledges a robust futures market is critical for end-users in the New Zealand electricity market. The futures market plays an important role towards the Authority’s statutory objective (competition, reliability, and efficiency) for the long-term benefit of consumers.

Related News

Deadline extended for non-discrimination obligations consultation

On 26 February, the Energy Competition Task Force launched a consultation on certain aspects of the proposed non-discrimination obligations, which are aimed at…

Workshop held on reactive power and voltage coordination

The Electricity Authority Te Mana Hiko held a workshop on reactive power flows and voltage coordination across grid exit points on 26 February 2026 in Wellingt…

Watch the space weather webinar and register for the Industry Exercise

Transpower have published the recording of our joint webinar on space weather and its potential impacts on Aotearoa’s power system. This webinar is part of our…