Eye on electricity

How marginal electricity spot pricing reflects cost

- Generation

- Prices

In the New Zealand wholesale electricity market, the price paid to dispatched generators is the nodal ‘spot price’, which is priced to reflect the ‘marginal’ generation needed to meet demand. This design ensures the New Zealand electricity system delivers efficiently and at the lowest cost.

This article explains how the spot price is determined, how its design ensures electricity supply reflects cost and how this encourages investment in new generation.

How half-hourly wholesale prices work

The ‘marginal generator’ is the generator dispatched (required to generate) to meet the next MW of supply each time the electricity system is redispatched.

The electricity sector works on half-hourly periods, called trading periods. Within these periods there are usually six redispatches of the system (roughly every five minutes), as electricity demand constantly fluctuates.

Each redispatch creates a new ‘marginal generator’ (though it may be the same unit as before or a different unit) and there can be multiple marginal units in each period, for example one in each island. The prices in these periods are referred to as the five-minute spot price.

The half-hourly ‘spot price’ is a time weighted average of all the five-minute prices. This change was introduced in 2022 under real-time pricing and allows the spot price to better reflect the market conditions throughout the trading period.

Prices across the country differ slightly through the nodal pricing system which sets different prices at the ~285 electricity nodes (or grid points). These prices usually reflect how far electricity needs to travel from its source, with higher prices typically further away from generation.

Hydro or thermal generation is marginal most of the time

As wind, solar and geothermal generation have virtually no fuel cost, they are nearly always dispatched in each five-minute period1 when there is wind or sun available.

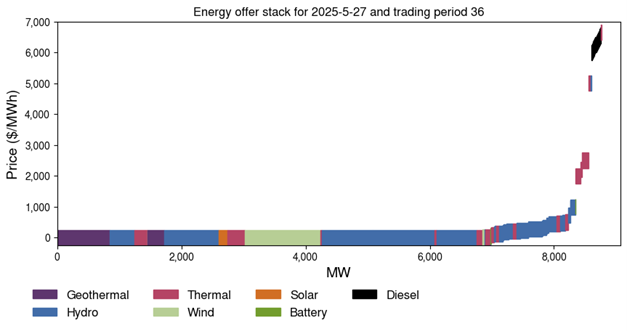

Figure 1 shows an example of a generation stack, which represents all offers available in the market for a half-hour trading period in May 2025. Wind, solar and geothermal are priced near zero. Hydro and thermal generation are also priced low to cover existing contracts to meet minimum load or meet resource constraints.

Since all low-cost electricity is usually used first, this often leaves only hydro or thermal higher in the offer stack and these generation types are often marginal and set the five-minute price.

When hydro generators set their offer prices, they face a choice between saving the water for later and generating now. If they generate now, then they forgo the opportunity to store the water and use it later. This is called the opportunity cost of water.

The cost for a thermal generator is the cost of acquiring coal or gas. Batteries are also increasing in the electricity market and costs are related to charging costs.

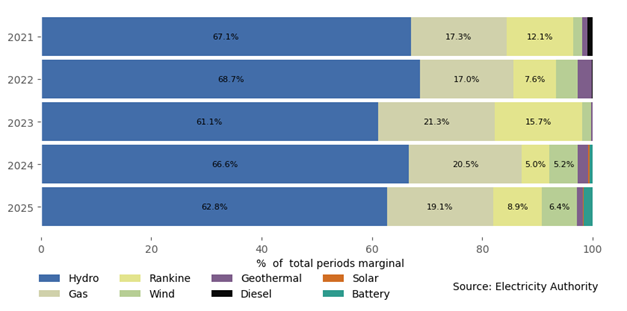

Figure 2 shows the proportion of time each technology types was marginal going back to 2021 (2025 values only up to 30 November).

Hydro and thermal generation, including gas fired and Rankine separately (as Rankines can run on coal or gas) and diesel, were marginal 97% of the time in 2021, 93% in 2022, 98% in 2023, 92% in 2024 and 91% in 2025 (up to 30 November).

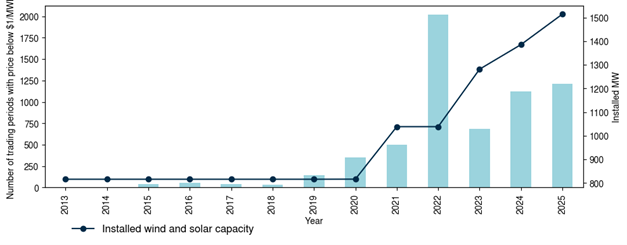

This decline has occurred as more periods where wind, geothermal or solar generation has been marginal, which only occurs during times of very low prices. Figure 3 shows that the frequency of prices below $1/MWh has increased since 2019 as wind and solar capacity has grown.

Marginal hydro generator prices have changed with storage

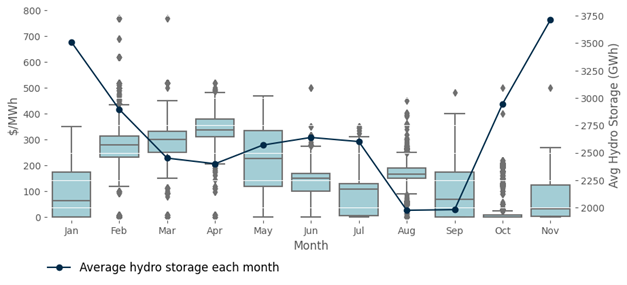

Figure 4 shows how five-minute prices set by marginal hydro generators have changed during 2025 compared to the monthly average hydro storage. This figure clearly demonstrates the relationship between storage and five-minute prices set by marginal hydro generators. When storage is higher (the opportunity cost of stored water is lower), hydro generation is offered at a lower price than when storage is low.

Figure 4 also shows how seasonality impacts the opportunity cost of water. These five-minute prices were highest in April when hydro storage had declined. This was also before winter, when electricity demand will be highest in New Zealand, so hydro generators had a stronger incentive to store water for later use - in other words the opportunity cost is high. In contrast, when hydro storage was lower in August at the end of winter, the water was less valuable, with more hydro inflows expected in spring.

In October when many hydro schemes approached being full and some were spilling, these marginal prices were the lowest of the year thus far.

Prices set by thermal operators reflect changing thermal cost

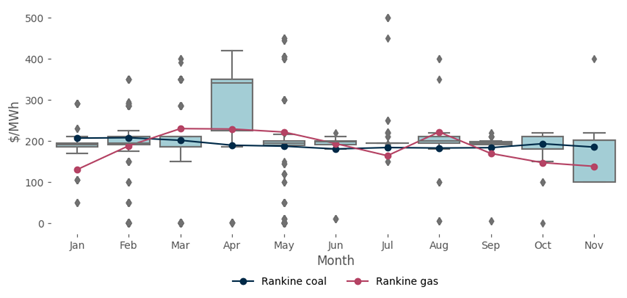

When analysing thermal operator marginal price setting, Genesis’s Rankines are separated out as they can use both coal and natural gas as fuel.

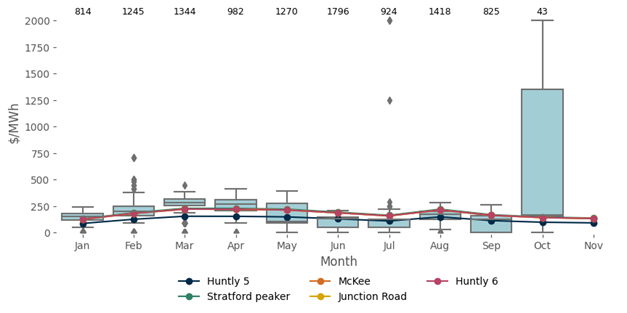

Figure 5 examines how gas fired generation (excluding Rankines) have been marginal for five-minute prices over 2025. Most of these prices have been in the $150-$250/MWh range which is broadly in line with the Authority’s short run marginal cost approximations for gas and have fluctuated slightly as gas prices have changed.

The boxplot for October has a much larger 75th percentile than other months. This was due to the running of gas fired generation in this month.

The number of times gas units were marginal is shown along the top of the plot. In October there were only 43 such occasions compared to the hundreds of times in previous months, as less thermal generation was needed due to high renewable generation. However, there were five instances of gas fired generation setting prices near $2,000/MWh in October2. Hence, these values distort the boxplot. But the median value remains near $250/MWh. In November gas fired (Rankine excluded) generation was never marginal.

Figure 6 shows prices set by marginal Rankine generation over 2025. The median for each month hovers closely to $200/MWh apart from April. During April there was heightened uncertainty around gas availability for winter, and the coal stockpile reach a low of 431 kilotonnes. Once gas availability had been increased following the May Methanex gas swap and coal imports resumed, the May and June marginal prices again sank back to around $200/MWh.

Grid scale batteries are entering the electricity market

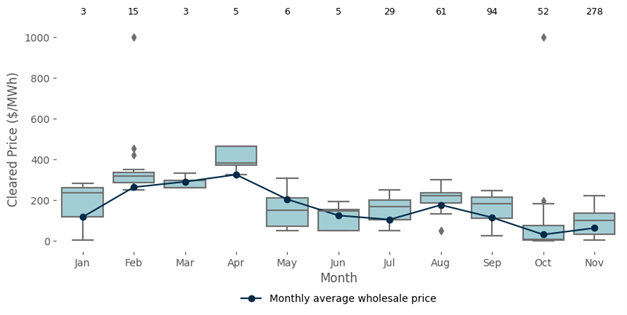

The five-minute prices set by grid scale batteries is shown in Figure 7. Since grid scale batteries ‘fuel up’ by charging off the grid, their fuel cost is the electricity price they pay for that charging. There is a clear relationship between average monthly wholesale price, which is used as a proxy for battery charging costs, and the marginal price batteries set in the market.

The only battery operating before July was the 35MW Wel Network battery near Huntly. Meridian’s 100MW Ruakākā Battery was commissioned in May. Following some initial outages, it began offering both energy and reserve into the market consistently in late July. Since then, the frequency a battery has been marginal has increased from roughly 1-10 times a month to 278 times in November.

Marginal spot pricing encourages investment

Wholesale electricity prices that are based on the marginal generator ensure that cost of supply electricity is reflected in the price. When renewable generation is very high, the cost of producing the next MW of electricity is typically lower and wholesale prices fall, as happened in October 2025. However, if wholesale prices are sustained at a high value, this reflects some scarcity in the market.

In the long term, high average wholesale prices act as a signal to investors that more generation is needed to meet demand. Many developers have already reacted to recent wholesale price trends, and more renewable generation is being built to meet future demand. This investment pipeline can be viewed on the Electricity Authority’s investment dashboard. The priority is that this investment comes to market as quickly as is practicable.

The Authority has also updated its battery energy storage systems roadmap which outlines our batteries-related work programme for the next two years. This work will improve regulatory settings that promote investment in standalone batteries and batteries paired with intermittent generation (eg, solar generation).

1. Sometimes intermittent generation is constrained off

2. These prices were caused by a combination of factors including forecasting errors, generation tripping and high reserve prices, read more in that week’s trading conduct report

Related News

Tracking efforts to maximise local electricity generation

A new tracker shows the progress of distributors voluntarily increasing their default export limit for residential connections to 10kW or more. The tracker s…

How accurate wind and solar forecasts and the new forecasting arrangement are crucial

Last year, the Authority introduced a hybrid forecasting arrangement and awarded DNV Services a contract to provide centralised wind and solar forecasting …

Deadline extended for feedback on Task Force work programme

On 15 December the Energy Competition Task Force published an open letter to stakeholders. Seeking feedback on potential competition-based issues in the electr…