Eye on electricity

Strengthening hedge market transparency in the electricity market

- Generation

- Wholesale

Monitoring and reporting on the electricity market are key functions of the Electricity Authority Te Mana Hiko. To strengthen this work, we started publishing monthly hedge market reports in November 2025.

Over the last year, our access to hedge market data has improved because of changes to Hedge Disclosure Obligations. This has allowed us to expand our reporting and provide deeper insights. This also responds to a recommendation from the Frontier Economics Review of Electricity Market Performance.

Our new monthly hedge market summary reports provide a consistent summary of hedge pricing, volume of trades, how much future electricity is hedged, and Australian Securities Exchange market making. The reports are published around the middle of each month on our website.

The new hedge market reports:

- provide greater transparency of pricing, trading volume, and trends in contracting

- provide greater transparency of the markets expectations on future prices

- help participants when negotiating deals as they benefit from that market transparency

- encourage competitive behaviour, as participants know we are closely monitoring hedge activity.

The hedge market is a way for industry participants to manage risk

Since electricity in New Zealand is generated through mostly renewable sources, electricity wholesale spot prices can be very volatile. Market participants such as generators, retailers and those who buy their electricity directly off the spot market, are ‘exposed’ to this volatility through their physical consumption or generation.

Market participants can ‘hedge’ to create some level of price certainty for themselves. Most hedge contracts involve two parties essentially agreeing to trade some volume of electricity at a fixed price for a set period of time in the future. For example, on a particular day in 2025, an industrial electricity consumer might buy 5MW of volume at $200/MWh for the period of Q3 of 2027.

Buying hedges is beneficial to electricity consumers (eg, retailers or industrials) because it reduces the risk of paying a high price for the electricity they need. By entering into hedge contracts, they can lock in a price for a specific period, reducing their exposure to paying a high spot price in some periods.

Selling hedges is beneficial to generators because it reduces the risk of receiving a low price for the electricity they generate. It is one way generators can ensure they have the money to cover the cost of generation (ie, operation, maintenance and fuel costs).

Insights from the latest hedge reporting

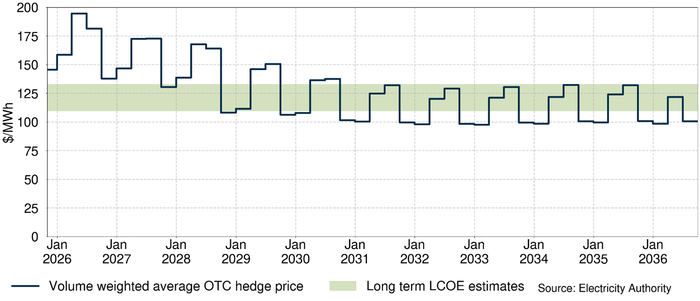

Long-term electricity hedge price estimates are similar to the levelised cost of electricity estimates (Figure 1). This is good because it indicates investment in generation is likely to cover its costs.

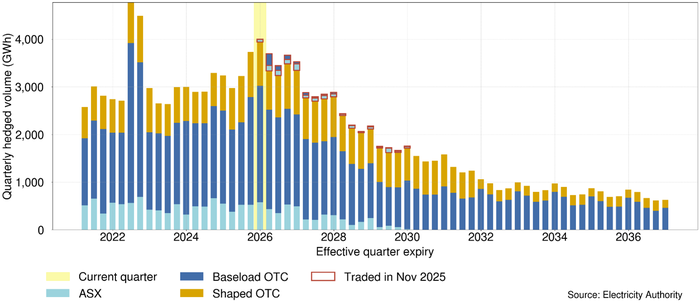

For the coming quarters that include the winter months, approximately 3.4TWh of volume is hedged for Q2 2026 and 3.7TWh for Q3 2026 (Figure 2). For comparison, average total electricity demand for Q2 and Q3 between 2021-24 was 10.4TWh and 11.2TWh respectively. So, about a third of winter 2026’s electricity demand is currently hedged. Some participants will hedge more or trade out of their positions as winter approaches, but the volume hedged is currently similar to last winter.

Related News

Policy changes to strengthen dry year risk management

The Electricity Authority Te Mana Hiko has approved changes to the Security of Supply Forecasting and Information Policy to improve certainty and better suppor…

Electricity Authority launches new consultation on non-discrimination obligations

The Electricity Authority Te Mana Hiko has launched a further consultation on certain aspects of the proposed non-discrimination obligations, which are aimed a…

Are ASX futures prices too high?

In the New Zealand wholesale electricity market, participants can buy and sell hedges as a possible method of managing risk caused by spot price volatility.