Eye on electricity

An explanation of ASX forward prices

- Wholesale

- Prices

In 2022, we published an article that looked into how the ASX forward electricity market works and the factors that affect these prices. This article looks at some of the current market conditions and provides our views on the recent high prices in the ASX forward electricity market.

Forward prices, or electricity futures, allow participants to buy and sell electricity contracts at fixed costs which cover a period in the future. This is one of several ways industry participants can control their balance sheet.

The ASX forward electricity market provides prices at two base nodes - Ōtāhuhu in the North Island and Benmore in the South Island. These prices are a good indicator of what market participants think spot prices may be over certain future months and quarters, providing those participants with a consensus. For more details see Energy derivatives - market maker arrangements.

Trading on the ASX forward electricity market does not guarantee low prices. If the contract price ends up much higher than the actual spot price when the future period comes around, the contract buyer will be worse off. Conversely, the seller will make money on this difference. Over time, with fluctuations in the market and the length of contracts available on the ASX, we would expect participants to win as much as they lose.

Near-term contracts react strongly to current market conditions

Short-term future prices (futures for the closest approaching quarters) will react to current market conditions.

When hydro storage is low, there is higher thermal generation commitment which means the cost to produce electricity increases. The hydro generation itself is also priced higher due to water scarcity. If weather outlooks are indicating sustained dry periods this also shows in the forward market, as it typically takes time for hydro storage to increase and bring prices back down.

The cost of running thermal generation depends on carbon costs and the cost of the fuel needed to run them. In New Zealand we have gas, coal and diesel fired thermal generators. Most of the coal used for the Huntly Power Station Rankine generators is sourced internationally, so international events can impact the cost of coal.

New Zealand has its own gas supply, however as we addressed in a previous article, gas fields are in decline. Declining gas provisions can also put pressure on prices due to uncertainty around supply. Without gas supply, many of the thermal generation units we rely on cannot run, and this increases the risk of insufficient generation.

Longer term future prices may also move slightly with short-term futures

ASX long-term contracts are those purchased a minimum of one year ahead of the quarter being purchased. However, longer term prices tend to be affected more by factors such as related markets (gas, aluminium, hydrogen) and renewable generation project timelines. Government policy changes or any large contingent contracts like the various industrial demand response contracts that are in place, can also have an impact on longer outlooks.

Winter 2025 forward prices have dropped

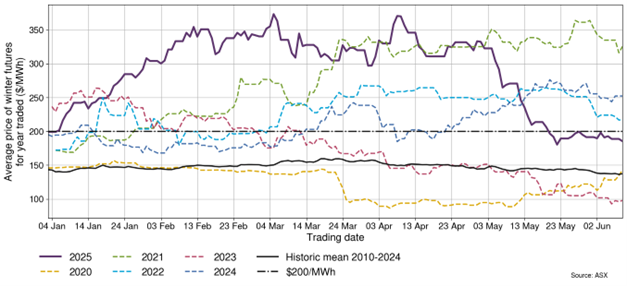

Figure 1 shows how the average price of short-term winter futures change in the lead-up to winter.

Since last winter, when hydro storage reached record lows, there have been some consistently high prices in the forward electricity market. The supply of thermal fuels, both gas availability and the coal stockpile at the time, exacerbated this.

From July 2024 the coal stockpile has increased which eased some of the pressure on the forward curve. However, extended periods of low inflows in the first quarter of 2025 resulted in the forward prices for this winter remaining mostly above $250/MWh.

During May rainfall levels brought hydro storage back to near 70% nominally full. Contact and Genesis also made deals with Methanex to secure gas early in the month. Looking at settlement prices around the time of these announcements, nearer term future contracts drop below $250/MWh (Figure 1).

Looking to the future as the market evolves

Figure 2 shows the 30-day rolling average future price of long-term contracts. As noted above, the price of long-term futures is affected by many factors. The electricity sector is in a transition phase with the introduction of more intermittent renewable generation as well as some older thermal generation reaching the end of its life.

Although winter long-term outlooks are resulting in prices rising above $200/MWh, we expect this will change as the market adapts to new forms of generation as they come online, and various innovations and initiatives emerge.

Authority working to encourage investment in new generation to ease the transition

To support the influx of wind and solar generation, we are developing a new hybrid forecasting arrangement to support better generation forecasting. To encourage more households to invest in their own distributed generation resources, the Energy Competition Task Force is considering how best to incentivise households exporting electricity.

Over the past year we have also enhanced regulatory support for new innovation in the energy sector via the Power Innovation Pathway. We will soon release an updated version of our investment pipeline dashboard1 based on our new data collection, where you can keep an eye on the status of generation investment.

1 Link to Investment Pipeline Dashboard based on the 2023 generation investment survey

Related News

Hedge market summary report for January 2026

Each month the Electricity Authority publishes a hedge market summary report for the previous calendar month. The January 2026 report is available to view.

Proposals invited from OTC platform providers

The Electricity Authority Te Mana Hiko, on behalf of the Industry Selection Panel, is inviting proposals for an over-the-counter trading platform to support vo…

Stress test disclosures due by 25 March 2026

The stress testing regime requires certain participants in the wholesale electricity market to test their exposure to changes in spot electricity prices and re…