Eye on electricity

Electricity hedge prices and conditions for this winter

- Generation

- Prices

The Electricity Authority has analysed information it collected from generators on the winter 2025 hedges they offered to large industrials ie, those where at least one day of the hedge lies between 1 July - 30 September 2025. This data was submitted to the Authority in April 2025.

The main conclusion is that shorter-term hedges — those with durations of five years or less — tend to be within the range of short-term ASX prices. The ASX price itself, especially for shorter-term futures, is influenced by the fuel position. There's more on this below. Larger and/or longer hedges tend to be priced well below the average overlapping ASX curve and instead lie within the range of an estimate for the levelised-cost of energy.

Our conclusions are similar to those from the analysis we completed for winter 2024 and published in this 'Eye on electricity' article.

Data request

Following August 2024, under section 46 of the Electricity Industry Act 2010, the Authority requested details of hedges offered to New Zealand industrial electricity users. The winter 2024 analysis included hedges offered to three large pulp and paper industrials - Oji, Pan Pac and Winstone.

For 2025, we also requested hedges offered to Fonterra, NZ Steel and Daiken. Winstone is not included for 2025 as it has since closed.

This year we also asked for information on hedge shapes. Hedges can either be flat or baseload, where the hedge covers the same load across all periods (say 5MW), or have shape. Usually, shaped hedges follow the generation output, like geothermal or wind. While geothermal generation is quite steady, apart from unexpected or planned outages, wind-backed hedges are subject to high amounts of volatility.

In future data requests, the Authority will collect further information on contract conditions that could suspend these hedges temporarily or permanently. We have heard from some stakeholders that these conditions can affect the value of buying a hedge.

Future contracts traded on the ASX give insight into future wholesale spot prices

Electricity futures trading on the ASX provides a forward price curve. This curve represents the futures market’s aggregate view of the wholesale electricity price at given periods of time in the future.

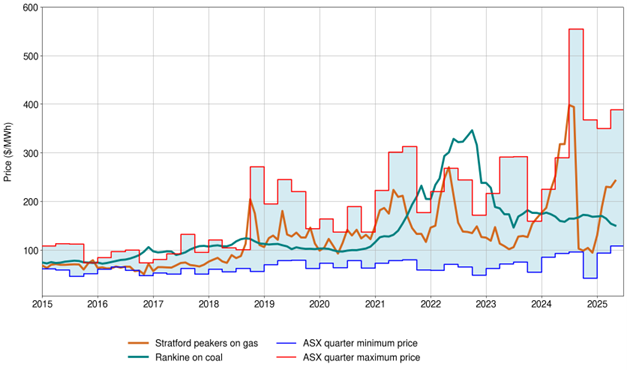

The price of this curve, especially in the near term, is highly influenced by fuel costs – that being water values, gas and coal prices. ASX prices have been influenced by the decline of New Zealand’s largest gas field Pohokura. During times of declining hydro storage, near-term ASX prices have also been elevated. The level of ASX prices and the relationship between ASX and thermal prices is shown in Figure 1.

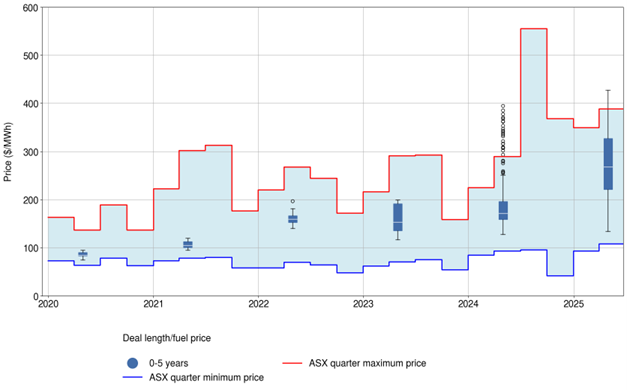

Short duration hedges are priced similarly to the ASX price

Figure 2 shows that shorter hedges are priced closer to the ASX prices at the time the offer was first made. Short hedges will likely be backed with thermal fuels, so their price reflects this. These shorter deals also tend to be smaller, often below 10MW in size. Shorter hedges tend to provide flat or baseload coverage.

This is a similar pattern to the analysis done for winter 2024. When fuel (water, gas, coal) is scarce or expensive, the ASX price can be quite variable, especially when both gas and water are in shorter supply than usual. Thermal fuel price volatility has increased in the 2020s with fluctuations in gas and coal supply. This has meant that short-term deals have been similarly volatile in price.

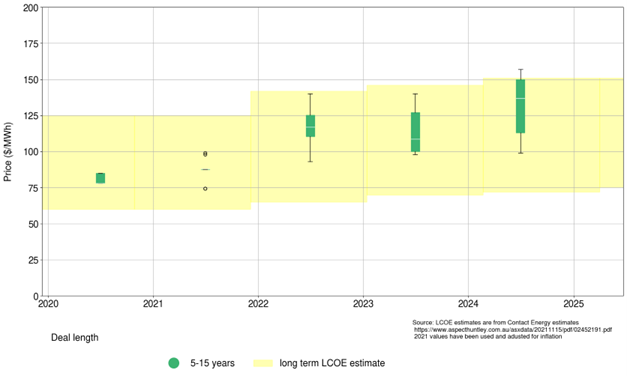

Longer hedges more closely reflect the levelised cost of energy

Long-term hedges – those 5-15 years long – are more comparable to the estimated levelised cost of electricity (LCOE). See Figure 3. Longer deals also tend to be larger and are often greater than 10MW. There were fewer hedges of this type offered to industrials when compared to shorter deals.

The price of long-term hedges reflects the input electricity cost behind these hedges and the value of certainty of demand; generators can use these long-term agreements to finance new generation.

Some of the longer hedges include forms of price escalation, mostly to adjust the price of the hedge for inflation. Additionally, some of the largest hedges are generation following, which means that buyers face the risk of variation in generation output.

Benefits and downsides

While not shown in the plots, our analysis found that most industrials accepted a mixture of long- and short-term hedges.

Some businesses see benefits in holding short-dated hedges, others opt for longer hedges. Some may have both. If a participant holds a hedge, and reduces consumption, they can sell that hedge on without being exposed to the spot price.

Market participants also make decisions on their level of exposure to spot prices, and for managing that exposure on an ongoing basis. There are advantages to being under-hedged, including being able to take advantage of very low prices, however, there are also downsides when spot prices are high.

The Authority’s recent review and decisions on the stress test regime (effective from 15 May 2025) led to enhancements such as extending the stress test horizon to include both the immediate next quarter and the 11 following quarters. This should give participants’ governing boards an indication of longer-term risk positions.

The new regime also requires participants to submit their actual hedge cover ratios for the previous quarter to the Registrar. And it asks the Registrar to send out benchmarking reports to participants, so they can consider their relative risk cover against others in their sector.

Cost differences driving investment

Hedge length is closely linked to the estimated cost of generation to supply that hedge. Short-term hedges are more influenced by the fuel situation. Long-term hedges are less influenced by near-term fuel availability, and more likely to underwrite new generation build. Long-term deals are a way for purchasers to access more competitive pricing.

The difference between the LCOE and ASX prices has been driving investment in new generation, as shown in Figure 4. This is because the long-term cost of building new generation is lower than the current price of supply.

Over time, new generation will drive prices towards the LCOE as generators have incentives to keep investing until the long- and short-term costs they face are nearly equal.

Related News

Tracking efforts to maximise local electricity generation

A new tracker shows the progress of distributors voluntarily increasing their default export limit for residential connections to 10kW or more. The tracker s…

How accurate wind and solar forecasts and the new forecasting arrangement are crucial

Last year, the Authority introduced a hybrid forecasting arrangement and awarded DNV Services a contract to provide centralised wind and solar forecasting …

Deadline extended for feedback on Task Force work programme

On 15 December the Energy Competition Task Force published an open letter to stakeholders. Seeking feedback on potential competition-based issues in the electr…