Eye on electricity

Wholesale prices plummet as the proportion of renewables increases

- Generation

- Prices

Wholesale electricity prices dropped dramatically in just two months - from over $280/MWh in late August 2025 to an average of $30/MWh in October. This steep decrease is down to a natural reduction in electricity demand with warmer spring weather, in combination with consistently windy conditions and increased hydro generation. All these factors boosted the proportion of electricity supplied by renewables in September and October 2025.

This article explains how New Zealand's electricity system is designed to react to changes in supply and how it responds to high amounts of renewable generation. This is important due to the increased renewable generation that is being built.

Low prices driven by high renewable generation

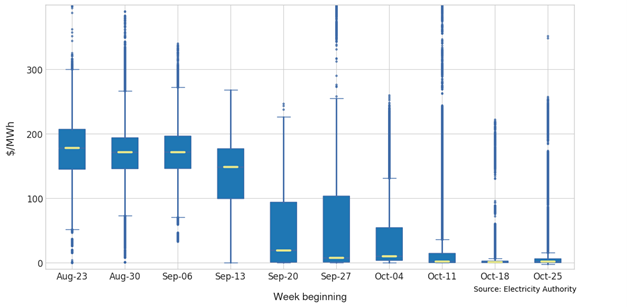

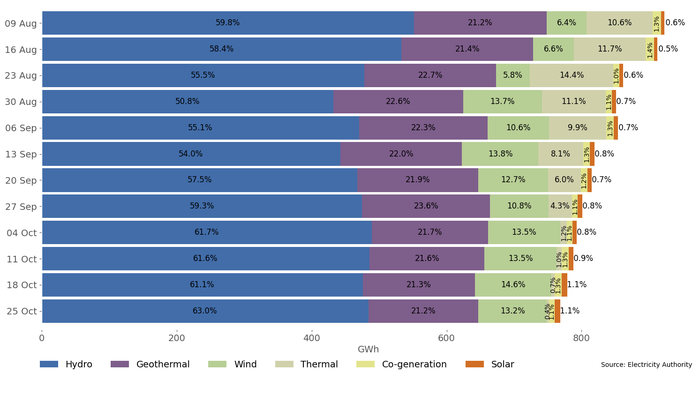

In August 2025 demand for electricity was high due to the bitter winter weather and declining hydro storage which increased the need for thermal generation. Through September, electricity demand declined as spring kicked in while hydro and wind generation increased, leading to less thermal generation and lower wholesale prices (Figure 1). In the final week of October, grid-connected solar contributed electricity more than thermal generation (Figure 2). This last occurred during Christmas 2024.

The ability of the New Zealand electricity system to react quickly to changes in electricity demand or supply helps ensure the system runs efficiently. The system always uses the lowest cost fuels first, which changes as hydro storage changes, leaving expensive fuels to be stockpiled for future use.

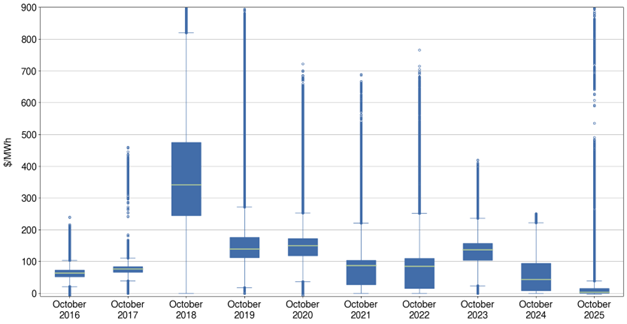

October 2025 prices were the lowest in a decade

Wholesale electricity prices tend to decline as winter moves into spring and electricity demand falls while rainfall lifts hydro lakes. But this isn’t always the case.

Figure 3 shows how the distribution of October prices over the last 10 years, adjusted for inflation. In October 2018 hydro storage reached a low of 1,290 gigawatt hours which is lower than the point reached in August 2024. At the same time, the Pohokura gas field had begun to decline and wholesale prices averaged $380/MWh.

However, October 2025 has seen the highest proportion of renewables for that month in the last 10 years, and subsequently the lowest average October wholesale prices, but there were still some occasions with high half-hourly prices.

Price spikes can occur even when renewable generation is high

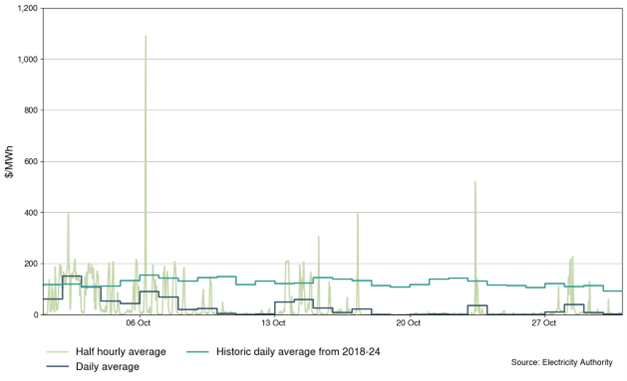

While wholesale prices were low in October, price spikes still occurred (Figure 4). Some of these were related to the storm which hit much of the country on 23 October.

Most other high prices were related to a combination of low wind generation, overforecast wind generation (and increasingly larger errors in solar generation as its capacity grows) and errors in demand forecasts. During these times more expensive hydro or thermal generation is dispatched.

During the final week of October, no efficient thermal baseload generation ran, and only less efficient thermal generators were able to fill these forecasting gaps (along with hydro).

Helping the industry adjust

October 2025 serves as a peek into the future of the industry. Periods of high renewable electricity generation are set to increase as more renewable generation is built, and the Electricity Authority is helping industry adjust to these changes.

Key initiatives include:

- In January 2025, the Authority and the Energy Competition Task Force announced the trading of new standardised flexibility product to help participants cover the risk of high prices in peak demand times.

- To improve the visibility of thermal fuel stockpiles, in March 2025, the Authority published a Clause 2.16 notice requiring thermal generators to provide information on their thermal fuels. Key information gathered under this notice is presented in our thermal fuel dashboard.

- To highlight new generation investment, in July 2025, the Authority published a new generation investment pipeline dashboard showing the planned generation projects in Aotearoa New Zealand.

The Authority also implemented a new hybrid forecasting arrangement to improve the accuracy of wind and solar generation forecasts which took effect from 31 July 2025.

Related News

Hedge market summary report for January 2026

Each month the Electricity Authority publishes a hedge market summary report for the previous calendar month. The January 2026 report is available to view.

Grid-connected solar is having its time in the sun

New Zealand’s electricity system is rapidly building more grid scale solar generation. This generation is beginning to show up in the weekly generation mix and…

Tracking efforts to maximise local electricity generation

A new tracker shows the progress of distributors voluntarily increasing their default export limit for residential connections to 10kW or more. The tracker s…