General news

New standardised super-peak hedge product has improved risk management

- Wholesale

- Prices

In 2024 the Electricity Authority Te Mana Hiko’s risk management review found there was limited volume of a financial tool aimed specifically at price risk during super-peak demand periods. In early 2025 a new super-peak financial product aimed at improving risk management began trading.

This article describes why the super-peak hedge product is important for electricity risk management and explains the effect of its trading so far.

Importance of managing exposure to super-peak prices as renewables increase

New Zealand has a highly renewable electricity system that utilises hydro, geothermal, wind and solar generation. In 2024, over 85% of all electricity generation was from renewable sources. However, high levels of renewable generation can contribute to high volatility in wholesale prices as electricity generation becomes increasingly reliant on short-term weather patterns. Electricity market participants can buy hedges for baseload (all time) hedges and peak (daytime) hedges in the forward market to manage the risk of market volatility.

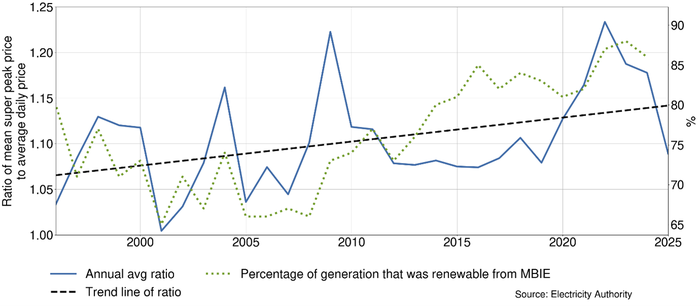

The highest daily prices often occur during super-peak times. This is when demand is particularly high. As the market has become more volatile, the prices at super-peak times have also increased relative to the average price of that day (Figure 1). Participants with shaped load (ie, with higher load at peak times) need access to hedges that are effective specifically during these times.

Increase in volume of super-peak trading

Until 2025, there was no standardised super-peak contract that traded and had pricing published like other standardised contracts on the ASX. This lack of public settlement prices made it difficult for participants to know what a fair price for a super-peak hedge is. Regular trading of standardised products improves price discovery and makes the hedge market more competitive, as hedge buyers and sellers can refer to the published price when negotiating over-the-counter (OTC) contracts for future electricity.

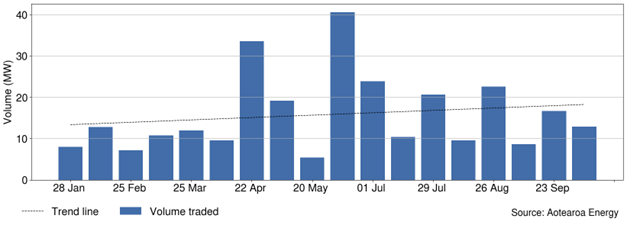

The standardised super-peak product was designed by an industry co-design process and started trading late January 2025 on the Aotearoa Energy trading platform. Trading events take place every fortnight and the anonymised bid, offer and trade details are published after each trading event.

The standardised super-peak product has been trading well in these events, with an overall increase in volume traded between January and September (Figure 2). Participants have also been trading the standardised super-peak product outside the trading events, through direct negotiation with each other, but this data is not shown here.

New product leads to improvement in pricing

To analyse the pricing of OTC hedges we often compare them to their equivalent product traded on the ASX. The simplest comparisons come from comparing OTC contracts to ASX contracts effective over the same period and traded at the same time.

It is expected that a shaped product (ie, which only covers certain periods of the day) like the standardised super-peak product, would be more expensive than a baseload product. However, in a competitive market the expected ratio of the super-peak product prices to their equivalent ASX baseload prices is not too much higher than the ratio of super-peak spot prices to baseload spot-prices (Figure 3).

Before the introduction of the standardised super-peak product, super-peak OTC hedges were priced 1.5 times the equivalent ASX baseload hedges on average. Super-peak hedges traded after the introduction of the standardised-super peak product are priced 1.3 times the equivalent ASX baseload hedges on average. This is a clear improvement in pricing, and the Authority hopes to see further improvement as the standardised super-peak market matures.

It is not expected that super-peak hedge price ratios will match the actual average wholesale electricity spot price ratio as a hedge price includes additional risk premia (uncertainties).

Consistent and frequent pricing available

The trading of baseload hedges on the ASX is supported by mandatory market making to improve market liquidity and price discovery contracts. Market making requires the four large generator-retailers to submit bids and offers for baseload hedges. This ensures there is consistent and frequent pricing available for these hedge products.

This strong price discovery would support participants manage their exposure to price volatility more effectively, encourage the entry of new players, drive competitive pricing for consumers and stimulate investment in new generation. However, market making to the required volume and bid-ask spread can be costly.

In August 2025, the Authority’s issues and options paper ‘Regulating the standardised super-peak hedge contracts’ sought feedback on whether to continue with the voluntary arrangement for trading these contracts. Feedback on that paper provided mixed views on the appropriate market making approach and settings.

After considering stakeholder feedback and conducting additional analysis, the Authority is consulting on proposed changes to market making arrangements. These proposed changes include introducing mandatory market making requirements for the standardised super-peak contracts, reducing the required volume for baseload hedges, extending the horizon of baseload forward price curve, and other adjustments.

The proposed changes seek to balance the cost to market makers with benefits of stronger price discovery to the wider market.

View the strengthening price discovery in the forward electricity markets consultation

We welcome submissions by 23 December.

Related News

Super-peak hedge contract data collection proposal

We're seeking feedback on a proposal to use clause 2.16 of the Code to formalise the collection of standardised super-peak hedge contract trading information.

Consumer insights helping to shape the Electricity Authority’s work

The Electricity Authority's 2025 Consumer Perceptions and Sentiment Survey shows that affordability remains a pressing concern for New Zealanders and reinforce…

Electricity Authority proposes reining in high up-front charges to connect to electricity networks

We’re seeking feedback on our proposal to rein in excessively high connection costs, which are a known problem in some parts of the country.