Enabling investment and innovation

Energy Competition Task Force

Investigating actions to strengthen the performance of the electricity market in the short- to medium-term, for the benefit of all consumers.

Overview

The Electricity Authority and Commerce Commission have jointly established the Energy Competition Task Force (Task Force) to investigate ways to improve the performance of the electricity market.

The Task Force was established in response to the fuel shortage and period of sustained high wholesale prices in August 2024, in addition to the immediate steps we, and others, took to manage security of supply and bring prices down.

The Task Force’s work programme focuses on two overarching outcomes:

- enabling new generators and independent retailers to enter, and better compete in, the market

- providing more options for consumers.

These outcomes will encourage more and faster investment in new electricity generation, boost competition, enable homes, businesses and industrials to better manage their own electricity use and costs, and put downward pressure on prices.

The Task Force is considering both new initiatives and some that are already underway but can be accelerated so New Zealanders can benefit from a better performing electricity system sooner.

Representatives from the Ministry of Business, Innovation and Employment will participate on the Task Force as observers.

The Task Force’s recommendations will go to the Authority Board for final decisions. Any options that change market settings or regulations will follow the normal consultation processes.

The Task Force expects its work programme will flex as evidence emerges on the potential impacts of different options, including through engagement. The eight options described below may be modified or augmented with other measures as the work progresses to ensure the best outcomes for consumers.

Decisions

After considering the Task Force’s recommendations, the Authority Board decides on options that change market settings or regulations. Following the consultation processes, the Authority Board then confirms final changes to regulation to achieve the Task Force objectives.

Decisions on changes to give consumers more choices for how they use, buy and sell electricity – and lower their power bills (Initiatives 2A, B and C)

We have confirmed new rules requiring large retailers (those with five per cent or more market share) now have to offer a pricing plan that gives small consumers cheaper rates for off-peak electricity. This means we expect ‘time-of-use’ plans will be available to most New Zealanders by 1 July 2026.

We have also confirmed changes that will reward those households who supply power to the network from small-scale generation systems (such as rooftop solar and batteries) at times when it’s needed most to keep the country powered up. This means we expect plans that offer fair rates for power sold into the network at peak times will be available by 1 July 2026.

In September 2025, we published three guidance documents to support distributors and retailers to implement the new rules.

Open letter: 2026 work programme

We are seeking stakeholders’ views on potential competition-based issues in the electricity sector that could help shape our 2026 work programme.

Your feedback will help us strengthen consumer choice and affordability by fostering market improvements that aim to give households and businesses more ways to manage their energy use and costs, and support a system that delivers sustainable downward pressure on prices.

We have sent an open letter to stakeholders inviting feedback by 30 January 2026.

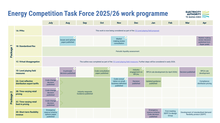

Work programme

Package one

Enable new generators and independent retailers to enter, and better compete in, the market.

This will encourage more and faster investment in new generation, which puts more energy into the system, strengthens resilience against future shortages and puts downward pressure on prices.

1A. Consider requiring gentailers to offer firming for Power Purchase Agreements

This option supports the development of new intermittent generation, such as wind and solar. Access to firming (from flexible generation that can run at any time, such as hydro or gas peakers) enables developers to enter into power purchase agreements (PPAs) with large users and retailers that match their supply of electricity to their customers’ demand profile, and manage the risks of variable generation volume (eg, when the wind does not blow or the sun does not shine).

The Electricity Authority considered requiring gentailers to offer a minimum volume of flexible electricity in the form of long-duration contracts that could be used to firm new generators’ PPAs (an “allocation” approach). Based on feedback from a wide range of stakeholders we now believe that:

- While access to firming is a key issue affecting investment in new power generation projects

- An allocation approach is not the best way to address this issue, because it distorts market signals and incentives.

We instead believe it is more effective to consider improved access to firming via the work on standardised flexibility products, the proposed level playing field measures (particularly the non-discrimination obligations) and complementary initiatives to encourage PPAs which will enable new investment without the risks associated with allocating firming volumes.

1B. Introduce standardised flexibility products

Standardised flexibility products enable retailers to offer stable prices to consumers while managing their exposure to volatile morning and evening peak wholesale prices.

This increases competition in the market, brings more power into the system, provides more choice for consumers, and puts downward pressure on retail prices.

These products are becoming increasingly important as the electricity system becomes more reliant on renewable generation and spot market pricing becomes more volatile.

In 2024 we established an industry co-design group to develop a new standardised flexibility product. The group recommended a super peak product which will provide buyers with protection against high prices in morning and evening peaks.

See the product specification sheet for details.

Voluntary trading in the super-peak product began in January 2025.

Aotearoa Energy is facilitating voluntary trading in the products by running fortnightly trading events.

The Electricity Authority is actively monitoring trading and publishing auction results.

Our flexibility hedge products dashboard shows prices and traded volumes of key types of flexibility products to help industry make operational and investment decisions.

While voluntary trading of the new super-peak product has already improved availability and pricing, the market remains shallow, with limited seller diversity and low trading volumes.

To address this, we are proposing to set clear expectations for robust participation in voluntary trading by the gentailers. The gentailers own over 95% of flexible generation, which backs shaped hedge contracts.

Regulation may follow if trading does not improve, and we are ready to intervene with urgent regulation if there is a sudden material reduction in the supply of shaped hedges.

We are now seeking feedback on options for regulation to apply if voluntary trading fails to deliver sufficient competition. This includes seeking feedback on market making on the over the counter (OTC) market as our preferred approach.

Feedback closes at 5pm, Tuesday 30 September 2025.

View the consultation: Regulating the standardised super-peak hedge product

1C. Prepare for virtual disaggregation of the flexible generation base

This option would design rules to require gentailers to offer a minimum volume of their flexible generation base to buyers in the form of risk management contracts. This option will be considered as a backstop if previous measures aimed at increasing the supply of firming contracts in the market don’t produce the intended uplift in competition. This is consistent with the Market Development Advisory Group’s recommendation 13. Although this is a backstop measure, designing the rules now will advance the work so it can be implemented quickly if needed.

1D. Investigate level playing field measures such as non-discrimination rules as a regulatory backstop

The Task Force considered the pros and cons of various measures to ensure a level playing field between gentailers and independent retailers.

We consulted on a proposal to introduce a new electricity industry rule called ‘mandatory non-discrimination obligations’ that the four large gentailers - Genesis, Contact, Meridian and Mercury – would have to follow.

This new rule would prevent the gentailers from giving preferential treatment to their retail arms for hedge contracts. Instead, they would have to make these contracts available to all industry participants on effectively the same terms as they use when trading internally. This would ‘level the playing field’ so independent retailers and generators can better compete with the gentailers.

We are now consulting on Code changes necessary to introduce mandatory non-discrimination obligations.

View level playing field Code change consultation

View level playing field measures (February 2025) consultation

Package two

Provide more options for consumers. Initiatives 2A, 2B and 2C, as described below, have been updated to reflect recent decisions. Package Two initiatives are:

2A. Requiring distributors to pay a rebate when consumers supply electricity at peak times

In July 2025 we introduced a requirement that, from 1 April 2026, electricity distribution businesses will need to pay rebates (negative charges) to households and small businesses supplying power to the network at peak times. View Guidance.

However, distributors told us that applying the definition of “small business consumer” (defined in the Electricity Industry Act 2010 as those using less than 40,000 kWh per year) was not workable because they generally work with connection capacity (kVA), not annual consumption.

In November 2025 we consulted on a proposal to clarify the definition of “small business consumers”, and on 22 December 2025 we announced our decision that, from 1 April 2026, distributors will be required to pay rebates to small businesses that have a network connection size of up to 45kVA and that export up to 45kW of electricity back to the network at peak times.

The full decision paper was published on 20 January 2026.

We consider these changes will make the policy clearer and easier to apply, ensuring that the rebates apply to small business consumers we intended to target, while avoiding an unintended extension of the policy to larger-scale generators.

Importantly, this decision means all consumers in price categories that target households and target small businesses with a connection capacity of up to 45kVA, and that export up to 45kW will be eligible. The rebates will also apply to those with higher generation potential so long as they adjust their inverters to limit injection to 45kW.

This decision is part of a progressive and staged approach the Authority is taking to ensure consumers are rewarded for the benefits their export provides. It anticipates a future where there is increasing participation in the electricity system from homes and business consumers.

2B. Requiring more retailers to offer time-of-use pricing

We have confirmed new rules that large retailers (those with 5% or more market share) now have to offer a pricing plan that gives consumers cheaper rates for off-peak electricity. This means we expect ‘time-of-use’ plans will be available to most New Zealanders by 1 July 2026.

We encourage all large retailers to read the guidance document below to ensure they meet the new time-of-use pricing plan requirements.

Time-varying price plan requirements – retailer guidance

Distributors are encouraged to read this guidance to ensure they meet the new Code requirements for assigning time-varying tariffs to customers with smart meters and billing retailers using more accurate consumption data.

Charging based on time-varying distribution charges – distributor guidance

2C. Requiring large retailers to better reward consumers for supplying power

We have confirmed changes that will reward those households who supply power to the network from small-scale generation systems (such as rooftop solar and batteries) at times when it’s needed most to keep the country powered up. This means plans that offer fair rates for power sold into the network at peak times will be available by 1 July 2026.

We encourage all retailers to read the guidance document below to ensure they meet the new requirements to offer buy-back rates for customers who supply power when it’s needed.

2D. Reward industrial consumers for providing short-term demand flexibility

Our electricity system must ensure supply can always meet demand, including at peak times. Some industrial consumers can make a meaningful contribution by shifting the timing of their demand, ie, using less electricity when it’s scarce and expensive, or by generating more and supplying it to the network.

The Task Force is considering measures that would enable industrials to be appropriately rewarded for the benefit their flexibility brings to the system.

We received broad industry support for our consultation in August 2025 on Establishing an Emergency Reserve Scheme and for our November 2025 consultation on the Emergency Reserve Scheme Code amendment required for it to be established.

On 13 January 2026 we announced our decision to proceed with the Emergency Reserve Scheme. Transpower, as System Operator, will work with industry to develop and implement the scheme which should be in place towards the end of 2026.

Timeline

-

-

-

3 November - 24 November 2025

Consultation —Requiring distributors to pay a rebate when consumers supply electricity at peak times: definition of a small businessView consultation -

17 October 2025 - 14 November 2025

Consultation —Emergency Reserve Scheme Code amendment proposalView consultation -

14 October - 2 December 2025

Consultation —Level playing field proposed Code amendmentsView consultation -

November 2025

Consultation —Consult on a review of market making (Electricity Authority initiative)

-

12 September 2025

News — -

19 August 2025 - 30 September 2025

Consultation —1B: Regulating the standardised super-peak hedge contractView consultation -

-

-

-

-

-

28 May 2025

Update —Enabling new generation entry

-

-

-

-

-

28 March - 11 April 2025

Cross-submissions —New ways to empower electricity consumersView consultation -

24-27 March 2025

Level playing field measures in-person events — -

-

-

-

-

18 February 2025

Event — -

12 February 2025

Press release — -

12 February - 26 March 2025

Consultation —New ways to empower electricity consumersView consultation -

-

-

12 February 2025

Consultation —Package Two initiatives 2A, 2B and 2C

-

-

17 January - 28 February 2025

Consultation —Entrant generators – context, headwinds and options for power purchase agreementsView consultation -

-

-

12 December 2024

News — -

9 December 2024

Package One D —Early stakeholder input published on level playing field work - see 1D above

-

-

-

-

-

-

-

-

FAQs

Question?

Read our frequently asked questions or get in touch!

Project background

New Zealand experienced a fuel shortage in August 2024 due to unexpected lower gas reserves, low hydro storage and rainfall, and low wind. The shortage led to very high wholesale prices, which affected those industrial business whose electricity costs were tied to the wholesale spot price.

Regulators, the Government and industry took action to manage security of supply and help bring wholesale prices down. Households were generally not affected by the price spike as they pay retail prices set by their electricity retailer.

The interventions and increased hydro storage caused wholesale prices to drop significantly by the end of the month. Although the event was rare, it highlighted the need to improve the electricity market’s performance and better bolster security of supply.

The Authority is now working with the Commerce Commission to investigate ways to adjust regulatory settings to strengthen the electricity market.

The Energy Competition Task Force, co-led by the Authority’s Chair Anna Kominik and the Commission’s Chair Dr John Small, brings together a number of sector and regulatory experts from both regulators. Representatives from the Ministry of Business, Innovation and Employment attend as observers.

Other projects in Enabling investment and innovation

View all projectsEvolving multiple trading and switching

Introducing multiple traders at a property and an operational review of industry switching processes.

Code amendment omnibus

Consulting on amendments to the Electricity Industry Participation Code.

Distribution connection pricing reform

Improving connection pricing methodologies so they’re more efficient with greater consistency across distributors.